Prices

July 16, 2015

Hot Rolled Futures: Not So Fast

Written by Andre Marshall

The following article on the hot rolled coil (HRC), busheling scrap (BUS), iron ore and financial futures markets was written by Andre Marshall, CEO of Crunch Risk LLC and our Managing Price Risk I & II instructor. Here is how Andre saw trading over the past week:

Financial Markets:

No Grexit worries are going to derail this market. Shrugging off Greece and the beginning of the potential unwinding of the Euro as a catch all pan, European currency is no match for our Teflon, 401 K driven, steel clad, U.S. Equities market. We didn’t even breach the 200 day moving average on this last scare/dip, which has very bullish implications. We are last 2117 area on the September future and we put in today a 2118.50 high which is right on the resistance line formed from the May 20th and June 22nd highs at 2125 and 2122 respectively. On this last dip we set a low of 2035 on July 7th and we have rallied since. On July 14th to July 15th we rallied hard with both the new Greece deal and the much maligned Iran nuke deal being announced whereby the market shot up precipitously. We are headed higher no doubt, but there is clearly some short cover moves in the July 15th spring and the market may want to bounce of this resistance and find it footing before ripping higher, Or just rip higher. Strange for me this market where we do nothing but go up and yet the China de-leverage is clearly in full swing. The latter will eventually catch up with the former just a question of when.

Steel:

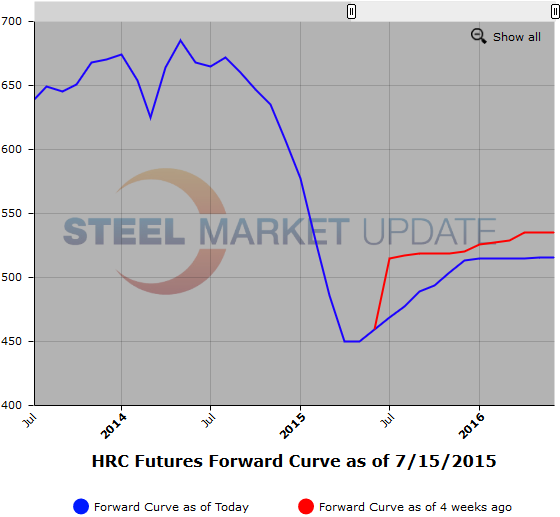

A good week this week in steel futures with 1818 lots or 36,360 ST trading. Most of that was done Tuesday when we traded 24,600 ST for Q4, Dec. and Q1. So in the week we have moderated up slightly from $1-4/ST counting today’s trades which were lower than mid week. In the Calendar ’16 months, it is clearly a case of higher as the selling from imports has died down and sellers are there, but not looking to hit a bid against a transaction. We are approximately $515 avg. on Cal ’16 v. $508 avg. a week back. Meanwhile the CRU has done another about face as the steel markets says “not so fast”. Lots of head fakes as a lot of bearishness in sentiment, but some needs to order units nonetheless. Behind the scenes inventory is dropping with aplomb, and the import lever has not been a threat because most buyers are too bearish to book what they consider forward metal with potential trade case headaches. Mills will be seeing replenishment orders soon if they haven’t already.

Below is a graphic of the HRC Futures Forward Curve. The interactive capabilities of the graph can only be used in Steel Market Update website here. If you have any issues logging in or navigating the website please contact us at info@steelmarketupdate.com or (800) 432 3475.

Iron Ore:

A big “not so fast” in Iron Ore as well. Vale was reported to be cutting 25 million tons of capacity only to state the next day that their forecast had not changed. So Iron Ore enjoyed a brief blip up of about $2/MT only to fall back down the next day, and then some. We are last right around $50/MT on the index with decent backwardation to $43.00/MT zone for Cal 16. We are linearly discounted on the curve from spot. Some are calling for even lower prices as producers refuse to yield to their competitors, but I would only remind the market that we are at the lows and the highs were $120-150/MT, so risk is clearly to the upside for those with exposures. Let’s call August either side of $47.00, Sepember either side of $45.75, October either side of $44.75, and Q4 either side of $44.25 and Q1 either side of $43.50.

Scrap:

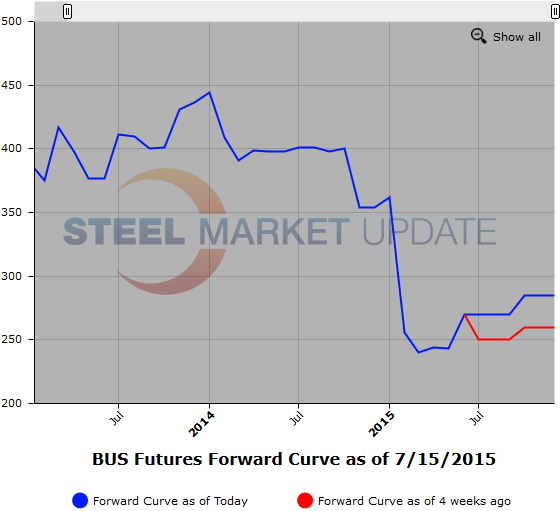

Wow CFR Turkey has taken a hit, dropping precipitously from its recent $280 plus high to its current $227/MT print. The Turks are simply not running their pots, instead going with the flow and buying the flood of Chinese billet for their raw material. So this is material for us in that the Coasts, particularly the East Coast do not have a bid to speak of and the flows out of Philly and New England will need to flow to the Midwest. That said the price staying in the depressed $250-270 prime/shred zone means flows continue to stink on obsolete, and will factor into the balance. This month we were essentially flat on the Midwest BUS, but more like $10/GT on average across Shred and Primes depending on region with the South either side of $10-20 down depending type and region. Most calling for down again August. I still think the steel inventory decline, and thus order books for mills will improve enough that the market will hold and climb into the early fall. So, I will fade that.

Another graphic is below, to use it’s interactive features you must visit this page on our website.