Market Data

July 1, 2015

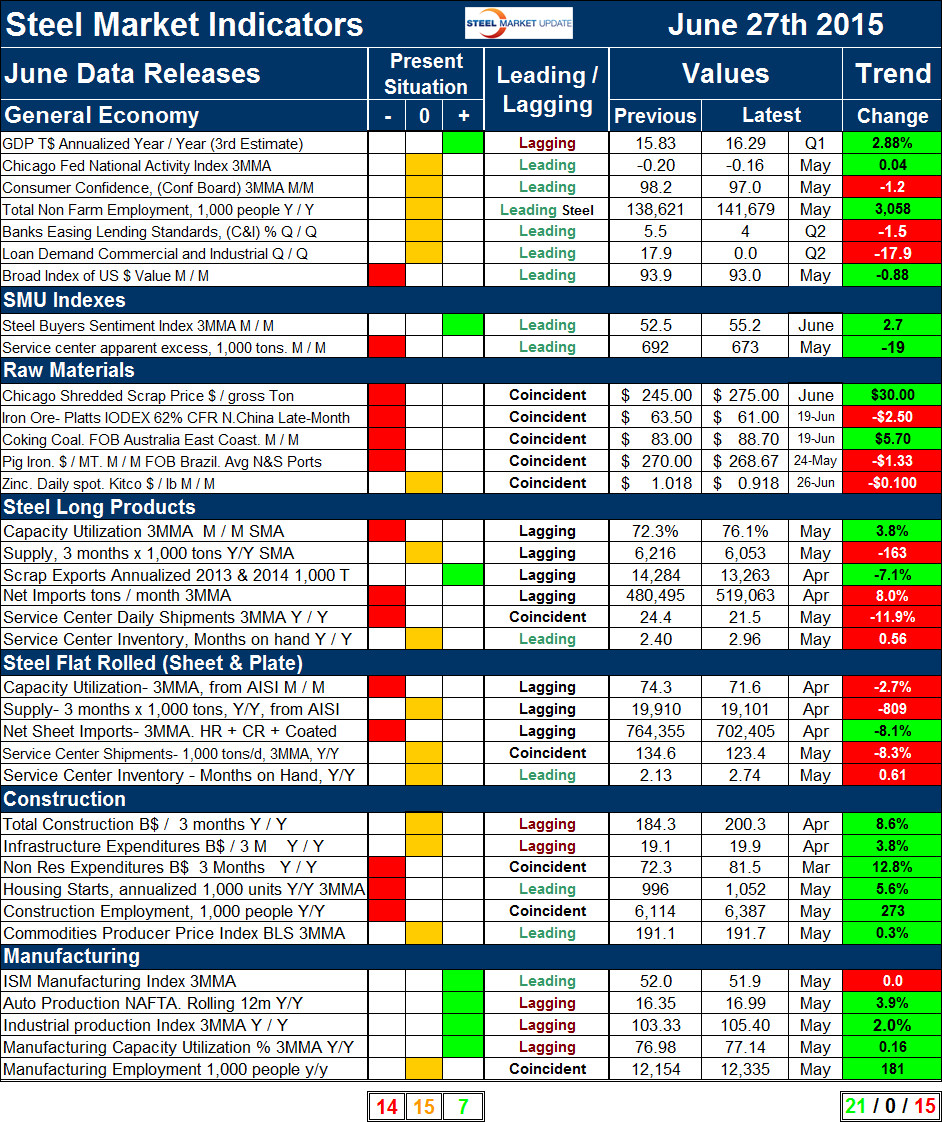

Key Market Indicators - June 27, 2015

Written by Peter Wright

An explanation of the Key Indicators concept is given at the end of this piece for those readers who are unfamiliar with it.

The total number of indicators considered in this analysis is currently 36.

![]()

Please refer to Table 1 for the view of the present situation and the quantitative measure of trends. Readers should regard the color codes in the present situation column as a quick look at the current market condition. This is a subjective analysis based on our opinion of the level of each indicator. The “Trend” columns of Table 1, are also by their color codes designed to give a quick visual appreciation of the direction in which the market is headed. However the quantitative analysis of the value and direction of each indicator over time are the latest “facts” available. There is nothing subjective about the trends section which is designed for those readers who want to dig deeper. All data included in this table was released in June, the month or specific date to which the data refers is shown in the second column from the far right and all data is the latest available as of June 27th.

Present Situation: There was a decrease of two in the positive column and an increase of two in the neutral column. There was no change in the number of indicators classified as negative at this time. Changes that occurred in the month of June were as follows. The price of Zinc (Kitco 24 hour spot) fell below $1.00/lb. on the 26th of June and was re-classified from positive to neutral. The price on May 28th was $1.018/lb. The apparent supply of total flat rolled products was also re-classified from positive to neutral. We regard this as a proxy for market demand, data is through April from the AISI and Department of Commerce. In 3 months through April supply fell to 19.101 million tons down by 809,000 tons from the same period last year.

There was no change in our perception of any other indicators in the June data. A quick visual appraisal of the present situation shows that the general economy is basically neutral. Readers might wonder why we have the growth of GDP as positive after this week’s negative report for Q1 2015. Our reasoning is that on a trailing 12 months basis GDP is up by 2.88 percent which we regard as positive and which is in line with long term expectations. Steelmaking raw materials are historically weak through June’s data. The present situation of the flat rolled steel sector is similar to that for long products. The only difference between these two steel sectors is that for long products service center daily shipments are negative and for flat rolled are neutral.

Construction continues to be weak to neutral and manufacturing continues to be neutral to strong. Both nonresidential and residential construction starts are rated historically negative as is the total number of people employed in construction. No indicators are currently rated positive in the construction category. None of the manufacturing indicators on a present situation basis are currently negative. Four are positive and one, manufacturing employment is neutral.

Trends: Twenty one of thirty six indicators are trending positive which was an increase of one from the May 31st data. Fifteen are trending negative which was a decrease of one, no indicator trends were unchanged.

Changes in the individual sectors are described below. Please note in most cases this is not June data but data that was released in June for previous months.

There were no changes in the direction of trends in the general economy. The Commerce Department released the 3rd of GDP for the 1st Q of 2015 on Wednesday as an annualized growth rate of negative 0.17 percent. The Bureau of Economic Analysis is currently under pressure to revise its procedure for seasonal adjustment which is believed to penalize results in the first quarter. This is why at SMU we prefer to report year over year results in all our data to remove seasonality and on this basis the growth of GDP is historically OK. Not terrific but not depressing either. In Table 1 we report GDP in trillions of dollars with the year over year growth rate which we believe is more indicative of the real situation.

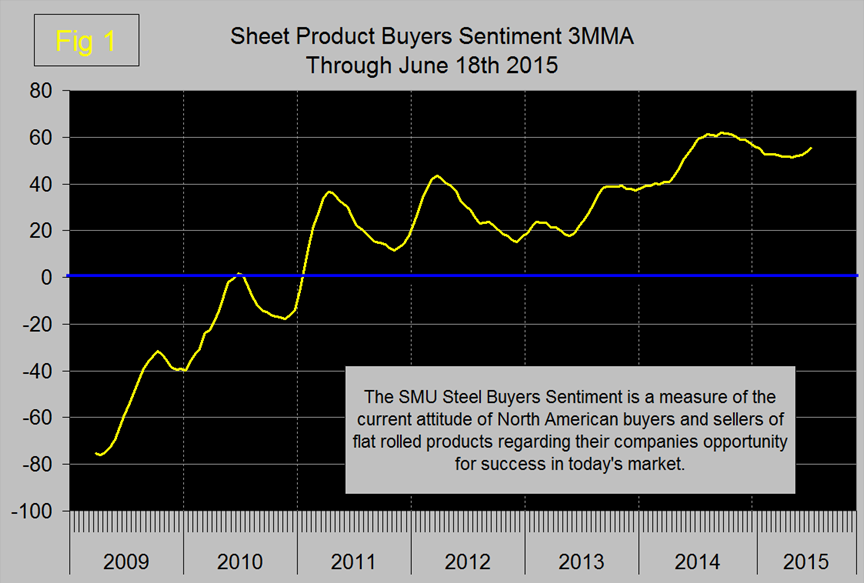

The trend of the two SMU proprietary indexes remained unchanged in the latest data. The steel buyer’s sentiment index (Figure 1) is a measure of the current attitude of North American buyers and sellers of flat rolled products regarding their company’s opportunity for success in today’s market.

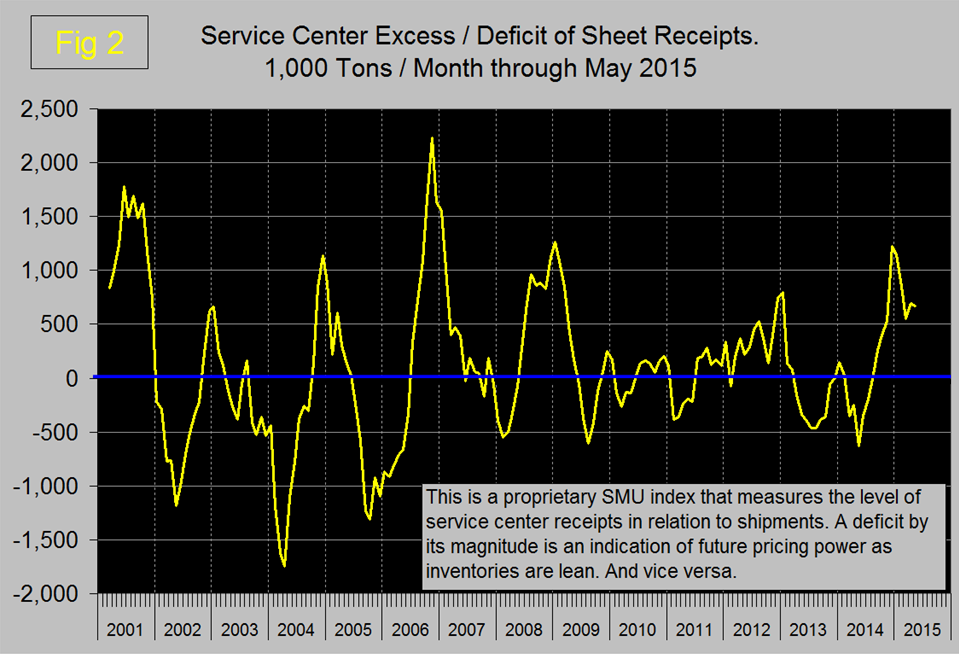

Sentiment had been declining since its all-time high on September 15th, it eked out a small gain in the February 12th result, slid slightly in March and April then once again trended positive in May and June. This index is still historically strong. The service center excess (Figure 2) declined in February and March, increased in April and was little changed in May.

This indicator was developed by SMU for sheet products and when in surplus as it is today indicates excess inventories and weak pricing power. SMU is forecasting an excess of 381,000 tons in September which is as far out as we look in this context.

In the raw materials section there were two trend reversals. The price of iron ore trended negative with the Platts IODEX standing at $61.00/dmt on June 19th. According to Goldman Sachs, the recent rally in iron ore prices is unusual, as the market outlook remains unchanged. Iron Ore supplies will continue to expand as more new mines become operational and existing ones become more efficient. To squeeze out the supply required to balance the Iron Ore market, Goldman Sachs said prices must fall below USD 50/mt CFR in the medium term – the cash cost of marginal producers. However, the investment bank acknowledged that new Iron Ore capacity – from the 55 M mt/y Roy Hill mine in Australia and Vale’s 90 M mt/y S11D growth project – is about to enter the market later this year and next year. In addition, some mines previously flagged for closure have restarted operations due to the recent rebound in spot prices. In the short term then, Goldman Sachs expects Iron Ore prices to continue upwards, as modest export volumes in recent weeks do not seem enough to replenish low inventory levels in China. Coking coal moved in the opposite direction to iron ore and in June trended positive month over month with an increase of $5.70 through June 19th. Scrap prices moved ahead strongly in early June but this was a continuation of a trend that began in May. The price of zinc trended negative in both May and June.

In the long products section, apparent supply which had trended positive for three months went into reverse with a decline of 163,000 tons in three months through May year over year. On a month/month basis capacity utilization improved for the third straight month. For the second consecutive month service center shipments declined and month end inventories increased, the worst of both worlds.

In the flat rolled section (total of sheet and plate), capacity utilization trended down for the sixth straight month. Note that capacity utilization and supply of long products are one month more current that for flat rolled because the SMA gets their data out faster than does the AISI. Apparent supply in April (latest month for which data is available from the AISI) reversed course and trended negative. Net imports which had trended negative in March reversed direction in April which is the latest trade data available at this level of detail. At the service center level we see the same situation for flat rolled as described for longs. Shipments continued to decline as inventories increased.

In the construction section there was one trend reversal as the producer price of commodities began to trend positive. We regard this indicator as a driver of industrial construction starts which are strongly driven by energy projects. Nonresidential and residential construction starts continue to improve but as we have reported elsewhere they both have a long way to go. On a year over year basis, the growth of employment in construction now exceeds that for manufacturing.

In the manufacturing sector trends have been unchanged for seven straight months. In this period the ISM index has trended negative every month and the other four indexes have all trended positive. In May the 3MMA of the ISM index stood at 51.9 which still signifies growth but the trend is disturbing.

The key indicators analysis is still generally positive. SMU has several benchmark analyses that show steel demand has recovered more slowly than the general economy and is still not where it should be at this stage of a recovery.

We believe a continued examination of both the present situation and direction is a valuable tool for corporate business planning.

Explanation: The point of this analysis is to give both a quick visual appreciation of the market situation and a detailed description for those who want to dig deeper. It describes where we are now and the direction in which the market is headed and is designed to give a snapshot of the market on a specific date. The chart is stacked vertically to separate the primary indicators of the general economy, of proprietary Steel Market Update indices, of raw material prices, of both flat rolled and long product market indicators and finally of construction and manufacturing indicators. The indicators are classified as leading, coincident or lagging as shown in the third column.

Columns in the chart are designed to differentiate between where the market is today and the direction in which it is headed. It is quite possible for the present situation to be predominantly red and trends to be predominantly green and vice versa depending on the overall direction of the market. The present situation is sub-divided into, below the historical norm (-) (OK), and above the historical norm (+). The “Values” section of the chart is a quantitative definition of the market’s direction. In most cases values are three month moving averages to eliminate noise. In cases where seasonality is an issue, the evaluation of market direction is made on a year over year comparison to eliminate this effect. Where seasonality is not an issue concurrent periods are compared. The date of the latest data is identified in the third values column. Values will always be current as of the date of publication. Finally the far right column quantifies the trend as a percentage or numerical change with color code classification to indicate positive or negative direction.