Analysis

May 31, 2015

Trader's View on Threat of Anti-Dumping Suit on Light Flat Rolled

Written by John Packard

Last month, Alfred (Al) Plummer, Sales Manager for Hanwa American Corporation, made a presentation about the steel industry at a regional meeting of the Association of Steel Distributors (ASD). Over the past few days Mr. Plummer has been communicating with Steel Market Update and we thought that the items being discussed should be of interest to our readers with the goal being to open a two-sided conversation about foreign steel imports and the changes in pricing seen over the past 12 to 18 months. Mr. Plummer sent Steel Market Update a letter to the editor and we have included the vast majority of the content in the article below:

“China is not the sole problem facing the Domestic Steel Industry. In addition, when you consider that a large percentage of Chinese ships to the West Coast, there really is only a modest impact to the Midwest mills who are screaming the loudest.”

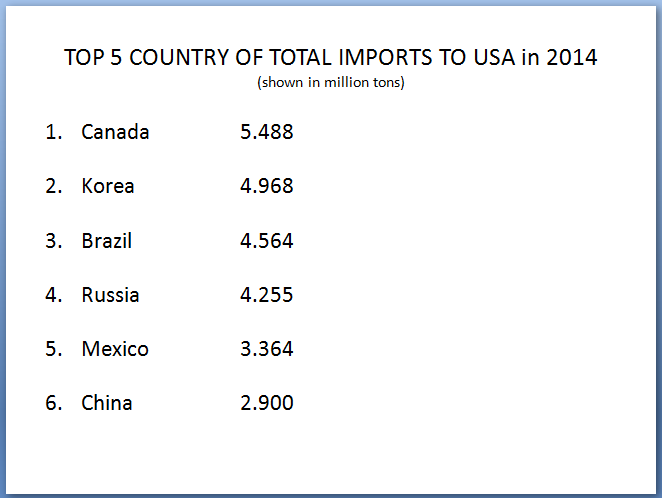

On another power point slide which was used during the ASD presentation, Mr. Plummer pointed out that there were 75 individual countries which exported steel to the United States during calendar year 2014. The top six countries (includes China at #6) accounted for 25.539 million tons or 63.5 percent of the total. As a country, China exported 91.3 million metric tons of steel last year. The U.S. accounted for 3.3 percent of total Chinese exports. So far in 2015, China is the 7th largest steel supplier to the United States.

In his letter to SMU he continued with, “Steel sales prices dropped about about $200/t in 2014. Domestic mills claim it was the result of illegal dumping. Step back and consider the following:

• IRON ORE costs dropped about $70/t since Jan 2014. This $70 drop in iron ore has a cost savings to the producing mill of about $110/t. Remember it take 1.6 tons of iron ore to produce a ton of steel so a $10/t drop in iron ore equates to a $16/t cost savings to the producer.

• Today’s newsletter shows Coking Coal prices as down about 35-40%.

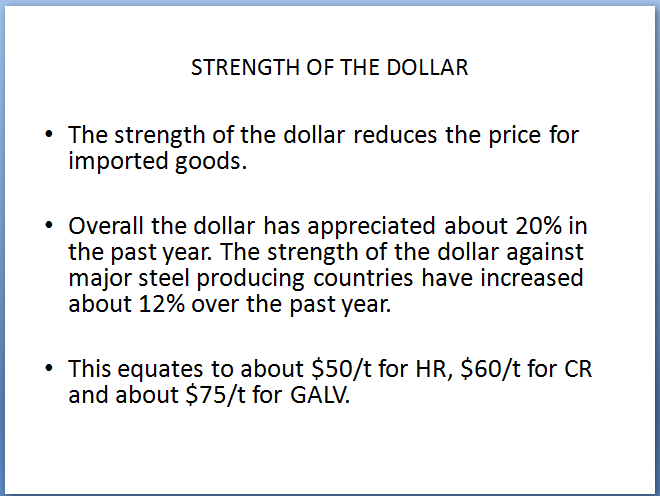

• Strength of the dollar last year appreciated about 20% (overall 12% with major steel trading nations). This effectively lowers the foreign price by the same percentage with sales in the USA.

Overall, this easily explains approx $175-$225/t of the over-all price drop in 2014. The drop in pricing in 2014 can all be justified by lower input costs, lower energy costs, lower freight costs, and the strength of the dollar.

I looked at the CRU (Sorry John-Did not use SMU) prices levels of HR, CR and GI. You would expect that with all the complaining on CR and GI that the prices would have diverged from the typical HR fluctuations but they appear to mirror HR. A question remains, did the import CR and GI price influence the domestic price on CR and GI or, did Domestic HR pricing influence the price of CR and GI?

My experience is that HR sets the price for all downstream products.

I then took a look in another way which I have not seen anyone else put much time on. I looked at the spread between HR and GALV and then the spread between HR and CR. Again the logic would be that the spread would have narrowed as imports of CR and GI were dumped to a greater degree. When I worked at a domestic steel mill my recollection was that typically the spread would be about $100/t. The CRU graph actually shows the spread running closer to $110. What was surprising to me was that at the beginning of 2014 the domestic mills INCREASED the spread to over $120/t and kept it there all year. I don’t know if we ever had a full year period where the spread was over $120/t.

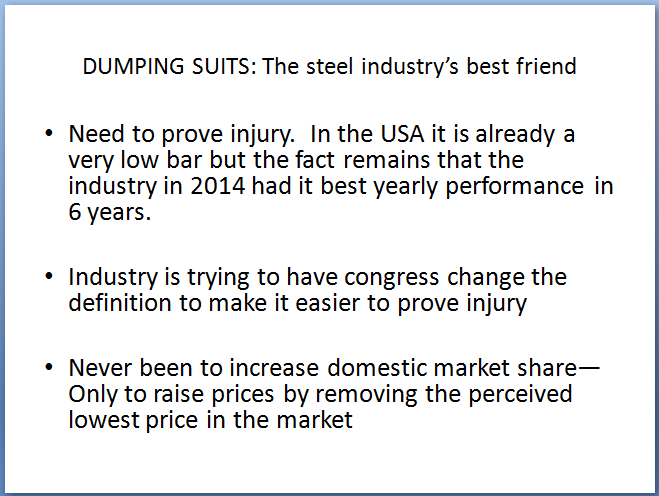

I think it would be very difficult for the mills to make the case that the “increased illegal dumping of CR and GI” had the impact of causing serious injury to the industry. Instead, from my perspective it seems that Cold Rolled and Galvanized performed favorably this past year.

In the past the Chinese have basically not cooperated with the US in dumping investigations and received very high penalties. I have been told if there are filings on CR and GI they will aggressively fight the cases.”

This was the end of the letter sent to SMU late last week. However, there were a number of Power Point slides that we think our readers should see:

Mr. Plummer suggested in one slide that perhaps the best resolution of the dumping issue would be to go to a “Voluntary Restraint Agreement or Quotas” on foreign steel.

He pointed out that the domestic steel industry is trying to get Congress to pass legislation in order to, “Try to get Congress to make filing dumping suits quicker and easier to prove injury.” (SMU Note: This is what is trying to be added to the TPP or TPA legislation which provides the president with the authority to negotiate trade deals which then have to be approved by a yes or no vote (no amendments) by Congress.

He then pointed out in the Power Point presentation that doing nothing and living with the status quo is not a good strategy for the domestic steel industry. The author told the ASD attendees, “One of the reasons why imports increased last month is the over-hang of potential dumping suits.” (SMU Note: In other words the threat of a dumping suit is a double edged sword, buyers respond by taking import positions sooner than normal and build inventory when they might otherwise not do so.)

Mr. Plummer also pointed out that the industry does need a long term solution. However, imports are an important piece of the industry for a number of reasons: “The domestic industry is incapable of handling the entire USA market.” He also pointed out, “Domestic manufacturers need a source for a lower priced material to compete against international manufacturers.”

SMU Note: The debate is sure to heat up whether the domestic mills follow through on their threats to file dumping suits or not. Obviously, threats alone are not helping the industry as it seems to be counter-intuitive as imports have been growing over the past year. There needs to be some sort of resolution as the domestic steel producers are important to USA.

If you would like to weigh in on this debate you can send your opinions to: info@SteelMarketUpdate.com.

If you are attending our Steel Summit Conference in September, the issue of trade will be on the agenda. You can see more on our program, speakers, past attending companies, cost and how to register on our website.