Plate

April 23, 2015

Imports of Plate Products Strong in 2015

Written by Brett Linton

With Nucor CEO John Ferriola commenting today about the surge in steel plate imports over the last two months into the United States, Steel Market Update thought we would do a piece showing plate imports over the last few years and how they compare to recent levels.

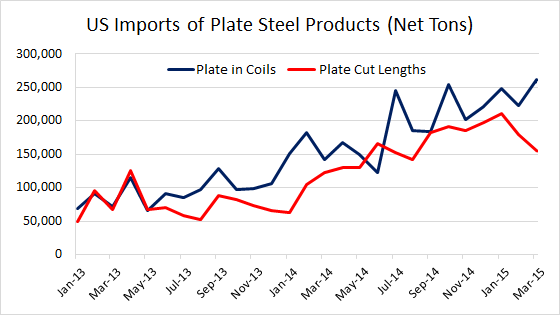

The monthly average import rate of plate in coils in 2013 was 93,176 net tons, which nearly doubled in 2014 to a monthly average of 183,953 tons. The 2015 monthly average through March is 244,564 tons. January 2015 imports of plate in coils were 248,608 tons, followed by 223,206 tons in February. March license data puts plate in coil imports at 261,879 tons.

The monthly average import rate of plate cut lengths in 2013 was 74,762 tons, which also nearly doubled in 2014 to a monthly average of 147,510 tons. The 2015 monthly average through March is 181,668 tons. January 2015 imports of plate cut lengths were 210,119 tons, followed by 179,405 tons in February. March license data puts plate cut lengths imports at 155,482 tons.

Below is a graphic showing imports of plate in coils and plate cut lengths since January 2013. Tonnage is in net tons.