Market Data

April 1, 2015

Key Market Indicators- March 30 2015

Written by Peter Wright

An explanation of the Key Indicators concept is given at the end of this piece for those readers who are unfamiliar with it.

The total number of indicators considered in this analysis is currently 36.

![]()

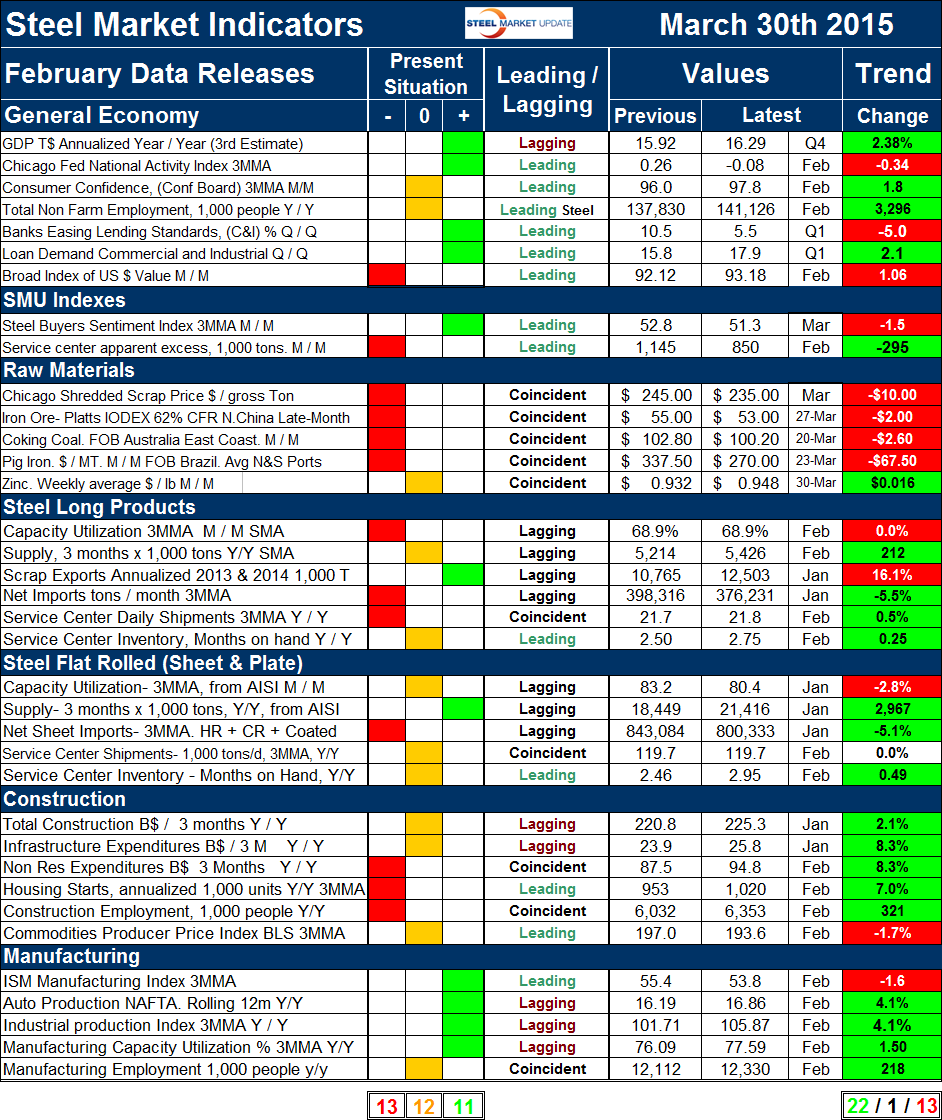

Please refer to Table 1 for the view of the present situation and the quantitative measure of trends. Readers should regard the color codes in the present situation column as a quick look at the current market condition. This is a subjective analysis based on our opinion of the level of each indicator. The “Trend” columns of Table 1, are also by their color codes designed to give a quick visual appreciation of the direction in which the market is headed. However the quantitative analysis of the value and direction of each indicator over time are the latest “facts” available. There is nothing subjective about the trends section which is designed for those readers who want to dig deeper. All data included in this table was released in March, the month or specific date to which the data refers is shown in the second column from the far right and all data is the latest available as of March 30th.

Present Situation: There were no change to the present situation since this analysis was last published on March 1st. The number of indicators currently positive is 11, the number considered neutral is 12, and the number rated negative is 13. A quick visual appraisal shows that the general economy is good and steelmaking raw materials are historically weak. The present situation of the flat rolled steel sector continues to be better than for long products. Capacity utilization of the long product mills is classified as negative and of the flat rolled mills as neutral. Net imports continue to be high for both sectors. Long product apparent supply is neutral as flat rolled continued to be positive through January’s data, (latest available from AISI). However as we have reported elsewhere, imports absorbed almost all of the market growth.

Construction continues to be weak to neutral and manufacturing continues to be neutral to strong. Both nonresidential and residential construction starts are rated historically negative as is the total number of people employed in construction. No indicators are currently rated positive in the construction category. None of the manufacturing indicators on a present situation basis are currently negative. Four are positive and one, manufacturing employment is neutral.

Trends: Twenty two of thirty six indicators are still trending positive which was a decrease of one from the March 1st update. The number of negatively trending indicators increased by one from 12 to 13. One indicator, service center flat rolled shipments was unchanged in February.

Changes in the individual sectors are described below. (Please note in most cases this is not March data but data that was released in March for previous months.)

In the general economy, the Commerce Department released the third estimate of GDP for the 4th Q of 2014 on Friday and maintained the rate of 2.2 percent unchanged from the second estimate. In Table 1, GDP growth is reported as 2.38 percent which is the year/year rate and which we believe is more indicative of the real situation. Consumer spending was a major positive factor in Q4, contributing 2.98 percentage points to growth. This was driven by the continuing improvement in the employment statistics and the plunge in gas prices. Net exports and government expenditures were both negative contributors.

The Federal Reserve Senior Loan Officer Survey reported an improving trend for demand for commercial and industrial loans in Q1 2015, this was a reversal of the trend reported for Q4 2014.

Consumer confidence declined in February but the 3MMA trend which we report continued to increase. Expectations are for a further reduction in March when the data is reported tomorrow but this will probably still not be sufficient to cause a reversal of the 3MMA.

The Broad Index value of the US $ is shown to still be trending up in February. We report the “Real” monthly index in this report which is inflation adjusted. The daily “Nominal” index was last updated on March 20th and experienced seven straight days of decline following the Fed’s uncertain statement about a possible interest rate increase in June.

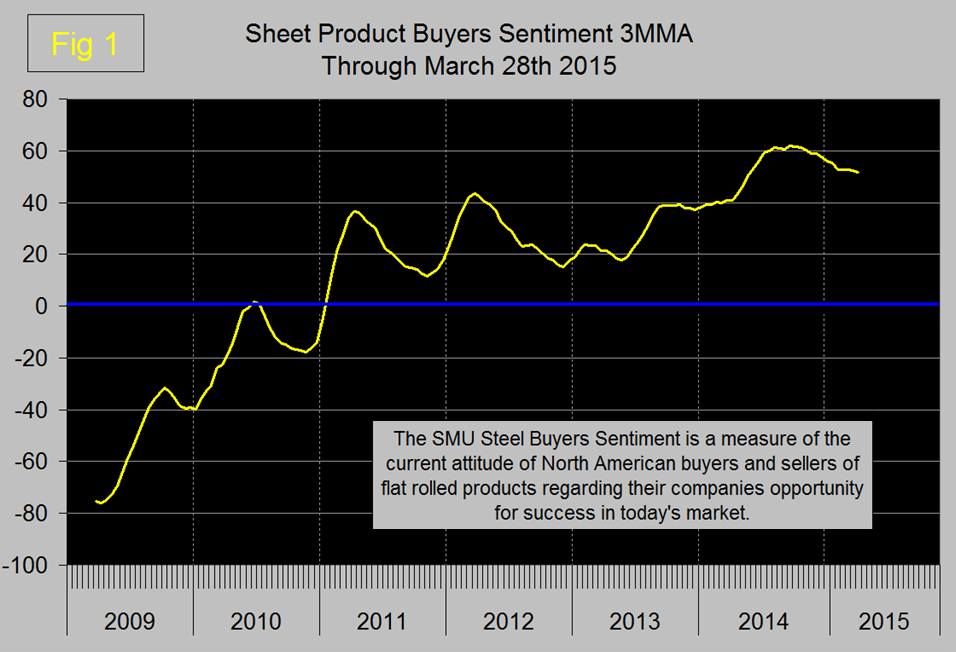

The trend of the SMU proprietary steel buyer’s sentiment index reversed course in a negative direction in the latest data. This index is a measure of the current attitude of North American buyers and sellers of flat rolled products regarding their company’s opportunity for success in today’s market. Sentiment had been declining since it’s all-time on September 15th, it eked out a small gain in the February 12th result but since then has slid slightly. However this index is still historically strong (Figure 1).

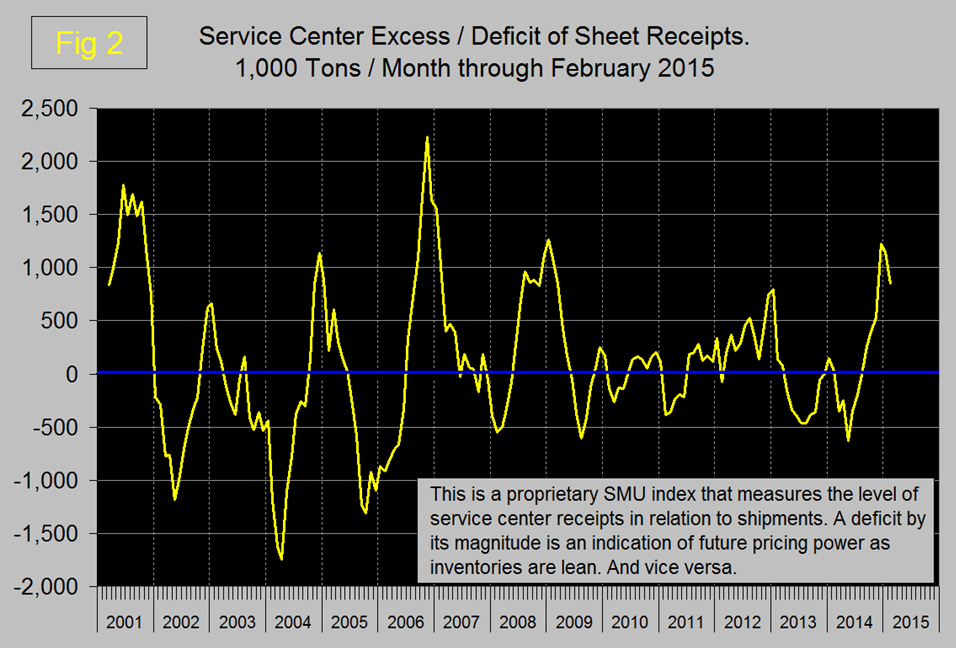

The service center excess declined in February (Figure 2). This indicator was developed by SMU for sheet products and when in surplus as it is today indicates rising inventories and falling pricing power. SMU is forecasting an excess through July, which is as far out as we look in this context.

There were several changes in the trends of raw material prices. After rising by an inexplicable $9.00 in January, Chicago shredded crashed by $89 in February and then declined by a farther $10 in March The long term relationship between the prices of Chicago shredded and the IODEX has been 3.2, with quite a wide spread in each direction. For four years through December 2013 scrap was advantageously priced on a historical basis compared to ore. Throughout 2014 scrap became increasingly uncompetitive and today the ratio is 4.3. This is a big deal in the US flat rolled business where the EAF producers have been taking share from the integrateds since 1995. It also gives a competitive advantage to those long product manufacturers overseas who are blast furnace based, China in particular. With well in excess of $100 billion having been spent on iron ore mine expansion since 2011, there seems to be little incentive, as yet, for the low-cost producers to cut back production. The 62 percent Fe IODEX price of iron ore delivered N. China continued to trend negatively and on March 23rd fell $2.00/dry mt (or 3.6 percent) on the week to finish at $53/dmt. This was a nearly 6.5-year low for spot iron ore prices, and was the lowest point the IODEX has been assessed at since its inception. The price of coking coal FOB Australia’s East Coast declined a further $2.50 through March 20th. There has been a steady decline this year after being quite flat for the final three quarters of last year. The price of pig iron (an average of Brazilian N and S port exports FOB) which had been inexplicably defying the iron ore logic, declined abruptly to $335 in January from the December value of $372, February remained unchanged then in March collapsed a further $67.50 to $270/tonne. The price of zinc reversed direction and gained 1.6 cents/lb. through March 30th month over month

In the long products section, apparent supply reversed course from negative year over year growth in January to positive in February. Scrap exports reversed direction from negative YTD growth in December to positive in January. The other indicators trended positive, net imports were down and both the MSCI shipments and inventories had encouraging results in February.

In the flat rolled section, (total of sheet and plate) the only trend change was for service center shipments which were exactly unchanged year over year in February, January had had positive growth. Capacity utilization continued to decline and apparent supply driven by imports continued to increase. Net sheet imports were down in both December and January though are still historically very high. Note that capacity utilization and supply of long products are one month more current that for flat rolled because the SMA gets their data out faster than does the AISI.

In the construction section there were no changes in the direction of trends, only one indicator, the price of commodities is trending negative. We regard this indicator as a driver of industrial construction which is still strong driven by energy projects which have yet to be hit by the decline in the price of oil. Nonresidential and residential construction starts continue to improve but as we have reported elsewhere they both have a long way to go.

The seven month string where all manufacturing trends were positive was broken in December when the ISM index reversed direction and experienced a small, 0.1 decline. In January and February that decline continued when the three month moving average of the index fell to 53.83 still a historically strong result. The industrial production index and auto production continue to expand, both at a 4.1 percent annual rate. Manufacturing employment grew by 218,000 year over year, less than construction which added 321,000 positions.

The key indicators analysis is still looking good. SMU has several benchmark analyses that show steel demand has recovered more slowly than the general economy and is still not where it should be at this stage of a recovery. This is because the recession in non-residential and housing construction was so extreme. Steel supply is now beginning to close the gap as construction slowly picks up the pace but imports are taking up almost all of the demand increase.

We believe a continued examination of both the present situation and direction is a valuable tool for corporate business planning.

Explanation: The point of this analysis is to give both a quick visual appreciation of the market situation and a detailed description for those who want to dig deeper. It describes where we are now and the direction in which the market is headed and is designed to give a snapshot of the market on a specific date. The chart is stacked vertically to separate the primary indicators of the general economy, of proprietary Steel Market Update indices, of raw material prices, of both flat rolled and long product market indicators and finally of construction and manufacturing indicators. The indicators are classified as leading, coincident or lagging as shown in the third column.

Columns in the chart are designed to differentiate between where the market is today and the direction in which it is headed. It is quite possible for the present situation to be predominantly red and trends to be predominantly green and vice versa depending on the overall direction of the market. The present situation is sub-divided into, below the historical norm (-), (OK), and above the historical norm (+). The “Values” section of the chart is a quantitative definition of the market’s direction. In most cases values are three month moving averages to eliminate noise. In cases where seasonality is an issue, the evaluation of market direction is made on a year over year comparison to eliminate this effect. Where seasonality is not an issue concurrent periods are compared. The date of the latest data is identified in the third values column. Values will always be current as of the date of publication. Finally the far right column quantifies the trend as a percentage or numerical change with color code classification to indicate positive or negative direction.