Prices

March 10, 2015

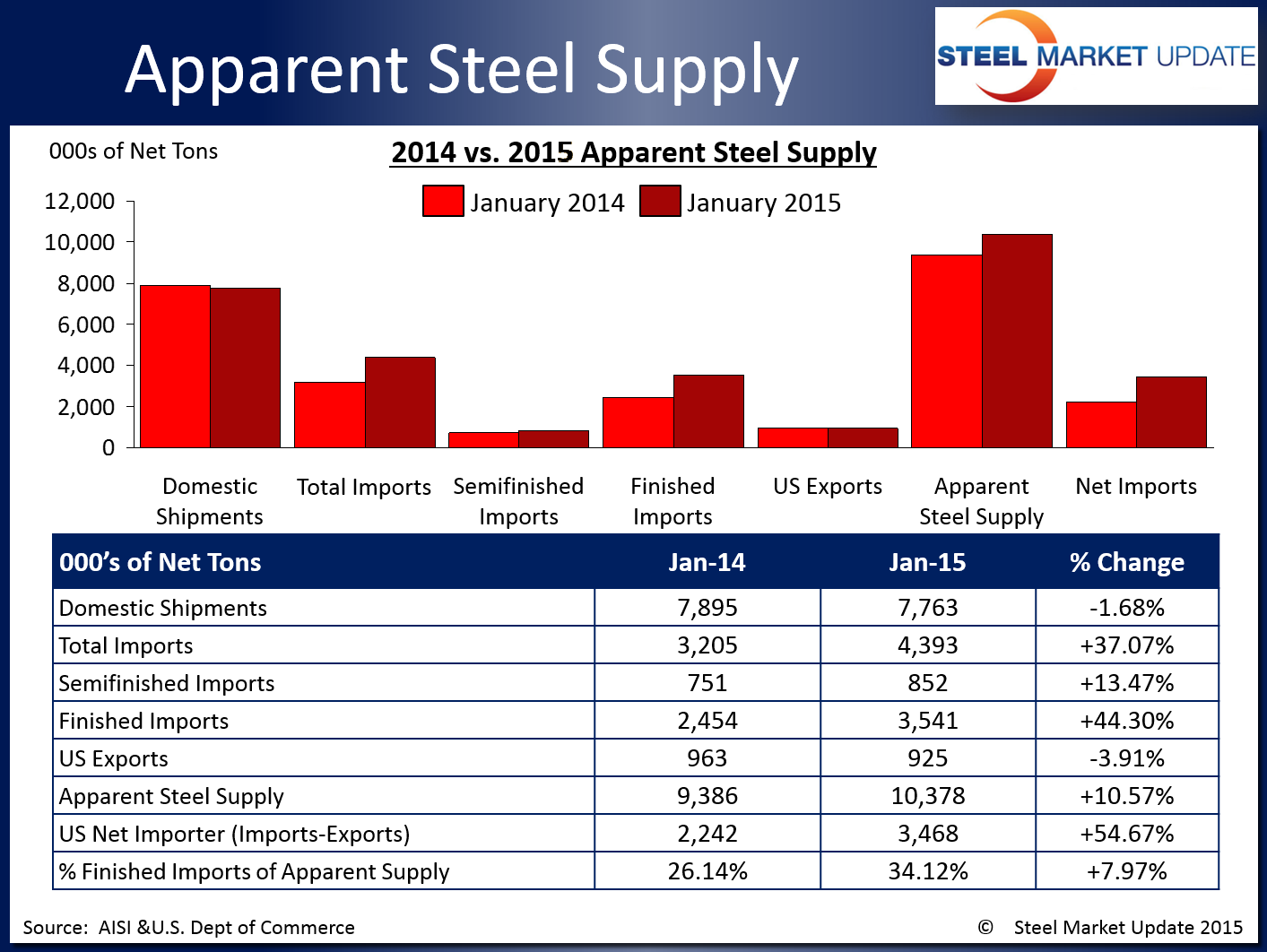

January Apparent Steel Supply Up 11% Over Last Year

Written by Brett Linton

Apparent steel supply for the month of January 2015 was 10,378,392 net tons (9,415,130 metric tons). Apparent steel supply is calculated by adding domestic steel shipments and finished US steel imports and subtracting total US steel exports.

January supply represents a 992,133 ton or 10.6 percent increase compared to the same month one year ago. This is primarily due to the massive spike in imports over the last few months, with total January imports up 37.1 percent or 1,188,252 tons over January 2014 tonnage. Finished imports increased by 44.3 percent of 1,087,052 tons year over year, while domestic shipments and total exports decreased 1.7 and 3.9 percent respectively. The net trade balance between imports and exports was a surplus of 3,468,070 tons in January, an increase of 54.7 percent from the same month last year.

When compared to last month when apparent steel supply was at 10,020,704 tons, January supply increased by 357,688 tons or 3.6 percent. Finished imports were up 27.9 percent while domestic shipments fell by 2.7 percent and exports declined by 0.4 percent. The net trade balance between imports and exports increased 28.0 percent or 759,224 tons from December to January.

You can view the interactive graphic of our Apparent Steel Supply history below when you are logged into the website and reading the newsletter online. If you need help accessing or navigating the website, don’t hesitate to contact us at info@SteelMarketUpdate.com or 800-432-3475.

{amchart id=”120″ Apparent Steel Supply- Domestic Shipments, Semi-Fin Imports, Exports}