Prices

March 8, 2015

Final January Steel Imports are 37% Above One Year Ago

Written by Brett Linton

The U.S. Department of Commerce (US DOC) released final foreign steel import census data late last week, showing final January tonnage at 4.39 million net tons (3.99 million metric tons). This is a 20.8 percent increase over December 2014 imports and 37.1 percent higher than January 2014 levels.

Total January imports were the highest seen since October 2014 when the US imported 4,441,271 net tons or 4,029,058 metric tons of steel products. Prior to the October 2014 high, the last time a single month of foreign steel imports were higher than the January 2014 totals was in August 1998 when total steel imports were 4,417,812 net tons or 4,007,776 metric tons

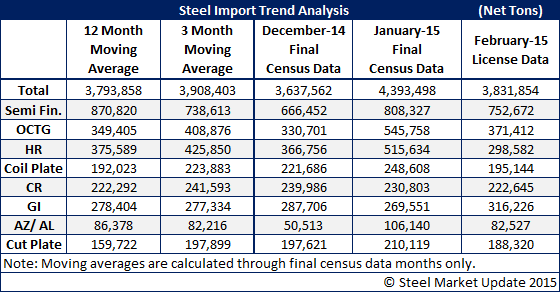

Below is a table comparing December, January, and February steel imports in addition to the twelve and three month moving averages. Note that the moving averages are through final January data. The numbers have all been converted to net tons from the US DOC report which is based on metric tons. The February numbers are based on license data reported through Friday, March 6th, 2015.

An interactive graphic of our Steel Imports History is below, but only viewable to those reading this article in our website. If you need assistance contact us at info@SteelMarketUpdate.com or call us at 800 432 3475.

{amchart id=”105″ Steel Imports- All Products, Final Data by Month}