Market Segment

February 24, 2015

Theoretical Mill Cost to Produce Hot Rolled Coil: Debate Continues

Written by Brett Linton

With the reset of iron ore and ferrous scrap pricing there is an extraordinary amount of interest in trying to figure out the cost to produce a hot rolled coil at the domestic steel mills. This is a question Steel Market Update is asked on an almost weekly basis. We wrote about the subject recently using the comments from one of the metals and mining analysts. That article prompted a number of comments and questions.

Then last week World Steel Dynamics produced a “Death Spiral Alert” for their clients (WSD Inside Track #138). Buried amongst their comments on a whole host of subjects was an analysis they did regarding the “operating cost to product” a hot band. What World Steel Dynamics was attempting to do was to point out the variance between integrated operational costs versus that of the electric arc furnace (EAF) or mini-mills.

In the WSD analysis they showed the intergrated steel mills having an “average cost” to produce a hot band that was $119 per metric ton ($108 per net ton) better than that of the EAF producers back in September 2014. Since that time, ferrous scrap costs have been coming down and the advantage WSD gave to the integrated steel mills has been reduced to $37 per metric ton ($34 per net ton) as of February 2015.

We do not know what went into the cost analysis that World Steel Dynamics did in September or earlier this month.

However, one of the items we discuss in our Steel 101: Introduction to Steel Marking & Market Fundamentals workshop is an analysis of the differences in marginal cost (before taking into consideration overhead and margin) between the integrated producers and that of the EAF or mini-mills. So, out of curiosity we wanted to share some of the data worked up by one of our metallurgists.

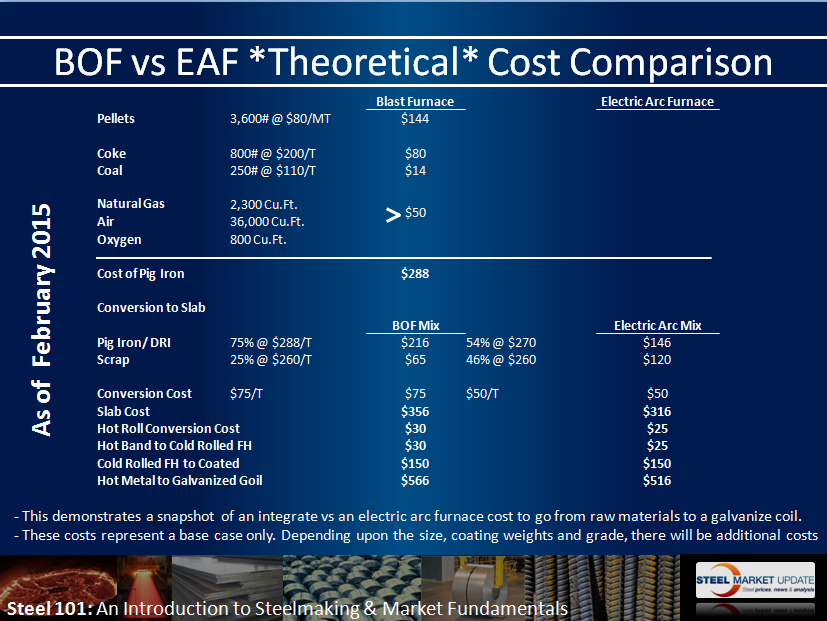

The information below are “theoretical” calculations that we share with those taking our Steel 101 workshop. The information is theoretical because there are differences between mills and their production capabilities. But, this is our best analysis as to what the marginal cost is for an integrated mill buying pellets at $80 per ton, coal at $110 per ton, coke at $200 per ton and a round number for natural gas, air and oxygen to produce a hot band (hot rolled coil).

On the EAF side we used an average scrap cost of $260 per ton and pig iron/DRI at $270 per ton (we had recently learned of a shipment of Brazil pig iron to be shipped to the U.S. for $268.50 per metric ton CFR April shipment). Again, these are theoretical calculations (and looking at future versus today’s cost as pig iron has been closer to $315 until recently).

The spread between EAF and integrated producers is very close to what World Steel Dynamics reported as the range ($34 per ton). Only we have the EAF mills as having an approximately $35 advantage over the integrated mills (versus WSD integrated advantage over EAF).

Again, it is important to note that this is an exercise only and not necessarily a true tabulation of any specific steel mill’s cost to produce (don’t run out and try to beat up your mill rep looking for price reductions based on this exercise).

There is no clear agreement either by the analysts, metallurgists or consultants as to exactly what it cost each mill to produce a hot band. The closest we have heard a mill to reporting their cost to produce was Steel Dynamics (Keith Busse as CEO) who mentioned a number of years ago that he used prime scrap plus $150 per ton. If that is still correct with prime grades going for $260 per ton we would get a HRC cost of $410 per ton. In the table below we have calculated that cost to be (using our formula) $341 per ton. The $69 difference could very well be the missing overhead number.

One of the things that is not mentioned in the calculations we provided is they are based on running the mill to peak capacity and with the right product mix in order to be the most efficient. We believe the flat rolled mills are running somewhere around 72 percent to 85 percent capacity at this time.

As mentioned above we have the issue of overhead (people, equipment, R&D, inventory, depreciation, etc.) and what is a fair return on investment for a steel mill operation? Whatever that number is, it is not reflected in our calculation (thus our cost is theoretical).