Market Data

February 8, 2015

SC Spot Prices Under Pressure

Written by John Packard

In Thursday evening’s issue of Steel Market Update we advised that our SMU Pricing Momentum Indicator continues to point to lower steel pricing over the next 30 days. One of our service center readers pointed out two reasons why he believes pricing will move lower when he wrote us, “Prices here are falling due to a) over-supply of inventory (driven by imports) and b) lower input costs for the mills. At some point, the over-supply will come back to balance, but I believe that the lower input costs for mills will be here to stay for a while. So, we will likely see the price over-correct lower until we get back to a supply and demand balance, and then it should recover back up to a level which reflects input costs and correlates to other global prices. My guess is that the low will be in the high $400’s and the future “balance” price will be in the low-mid $500/ton range.”

Service center inventories are a big part of the pricing equation. At this time last year the distributors were still relatively balanced and buying steel on a somewhat predictable basis. However, the price spread between domestic and foreign steel had grown to levels where even the meek distributor became a foreign buyer. The mills were slow to react and the flood gates opened and foreign steel has been pouring into the U.S. at a record pace. January import licenses are pointing toward a continuation of the trend.

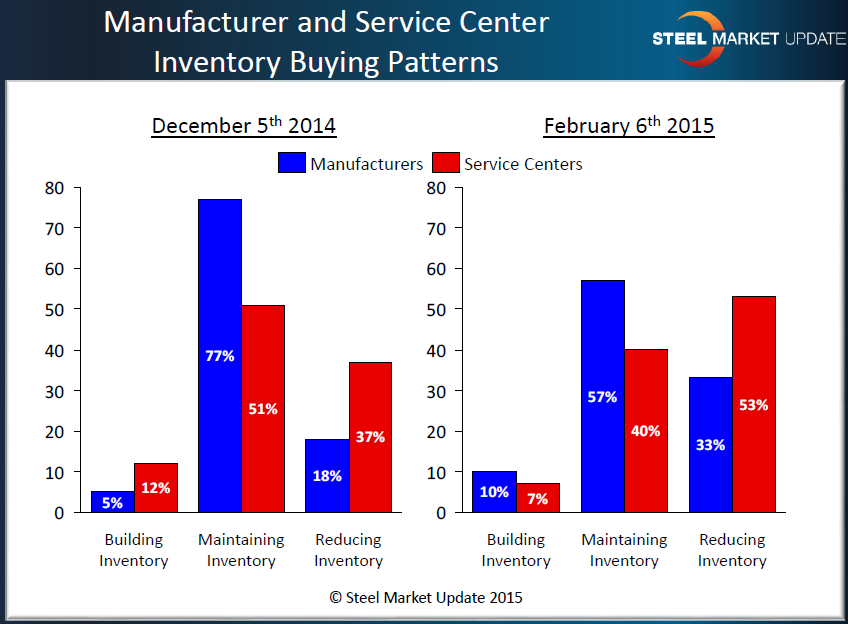

Service centers and manufacturing companies both are coming to terms with the inventory excesses. Our survey results from this past week provide a peek into the changes that are occurring. As you can see by the graphic below a majority of service centers are in an inventory reduction mode and a third of the manufacturing companies also reporting a need to adjust inventories. This will take time.

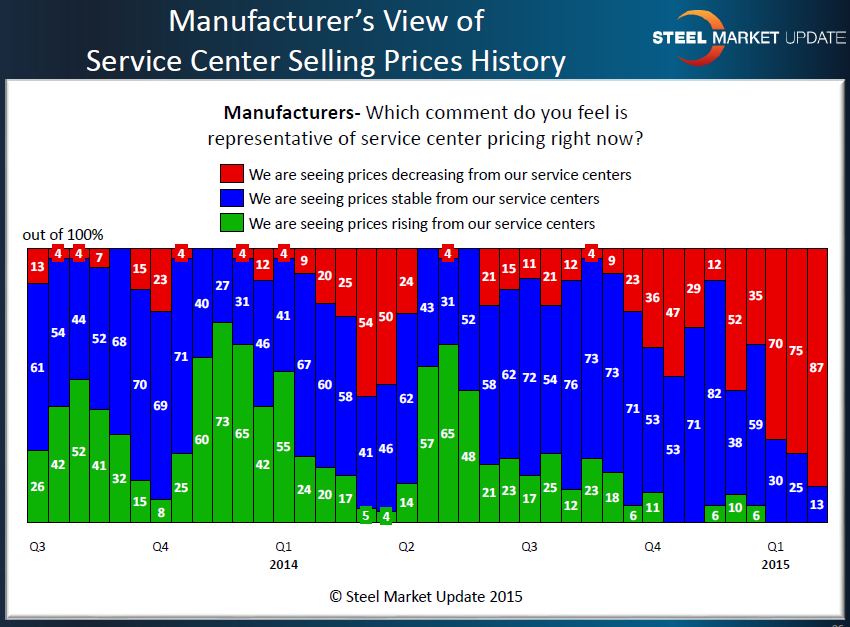

Those of you who have been reading Steel Market Update for an extended period of time know that we follow service center spot pricing both from a manufacturers and distributor perspective. The manufacturers have been reporting service center spot prices as dropping for a number of weeks. This past week 87 percent of the manufacturing companies responding to our survey reported distributor prices as falling up from 75 percent two weeks ago. In mid-December only 35 percent of the manufacturing companies were reporting falling service center spot prices.

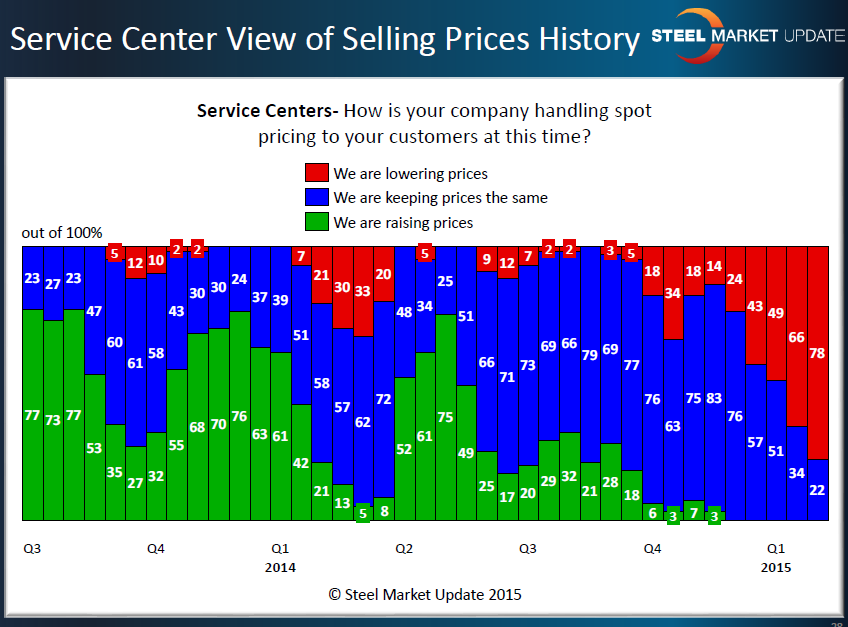

Perhaps the most telling graphic we have seen in awhile is that of the service centers who responded to our question as to how their company was handling spot pricing at this time. As you can see by the graphic below, spot prices are falling off a cliff as 78 percent of the distributors responding that their company was lowering prices. This is within the “capitulation” range we have spoken about previously. Capitulation is the point when virtually every service center decides they have to move inventory no matter what the cost in lost margin or cash flow. In the past, this was the time when the domestic mills have been able to announce price increases and turn prices into their favor.

That was then, this is now. The conditions which are driving pricing go beyond simple inventory patterns. There has been a fundamental reset in commodity prices (iron ore, coal, scrap, etc.) and that has been leading to a reset in flat rolled steel pricing. Commodity prices may be hitting bottom but steel will most likely take awhile to find its bottom and then where it can go from there.