Prices

February 7, 2015

Final December & Calendar Year 2014 Foreign Steel Import Analysis

Written by Brett Linton

The U.S. Department of Commerce released final foreign steel import license data late last week, showing final December tonnage at 3.64 million net tons (3.30 metric tons). This is a 1.5 percent decrease over November imports but 45.1 percent higher than December 2013 levels.

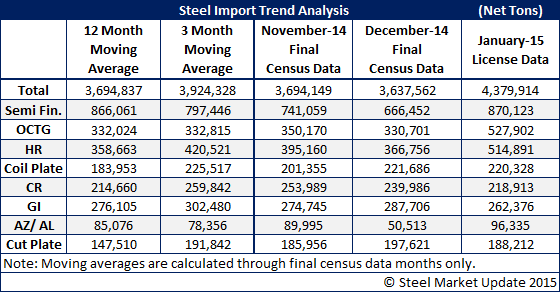

Below is a table comparing November, December, and January steel imports in addition to the twelve and three month moving averages. Note that the moving averages are through final December data. The numbers have all been converted to net tons from the US DOC report which is based on metric tons. The January numbers are based on license data reported through last Tuesday, February 3, 2015.

Steel imports for 2014 were significantly higher than previous years for all of the products followed by Steel Market Update. Total imports from January through December 2014 were 12.2 million or 37.9 percent higher than the same period in 2013. In that same time frame, cold rolled imports shot up 98.2 percent and plate imports rose 97.4 for plates in coils and 97.3 percent for plate cut lengths.

An interactive graphic of our Steel Imports History is below, but only viewable to those reading this article in our website. If you need assistance contact us at info@SteelMarketUpdate.com or call us at 800 432 3475.

{amchart id=”105″ Steel Imports- All Products, Final Data by Month}