Market Data

January 30, 2015

Key Market Indicators January 30 2015

Written by Peter Wright

An explanation of the Key Indicators concept is given at the end of this piece for those readers who are unfamiliar with it.

The total number of indicators considered in this analysis is currently 36.

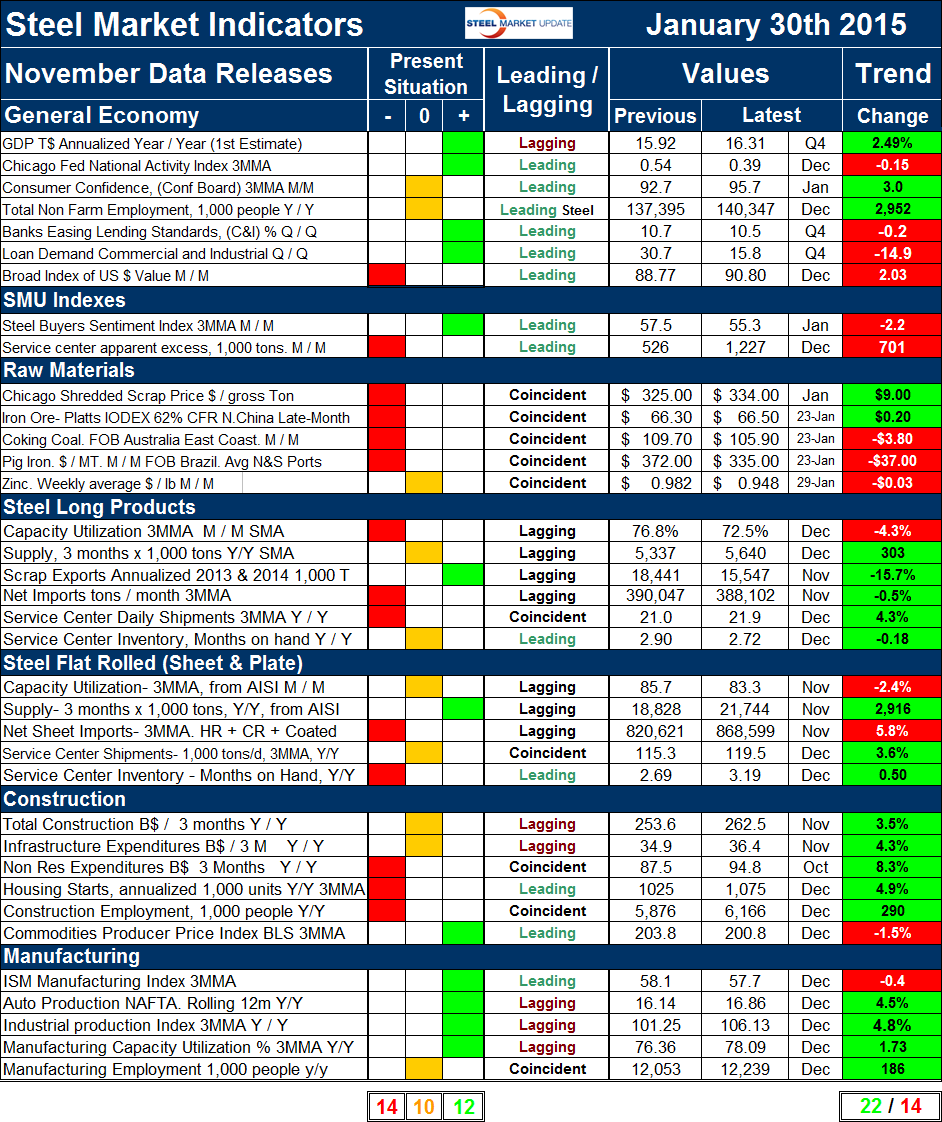

![]() Please refer to Table 1 for the view of the present situation and the quantitative measure of trends. Readers should regard the color codes in the present situation column as a quick look at the current market condition. This is a subjective analysis based on our opinion of the level of each indicator. The “Trend” columns of Table 1, also by their color codes are designed to give a quick visual appreciation of the direction in which the market is headed. However the quantitative analysis of the value and direction of each indicator over time are the latest “facts” available. There is nothing subjective about this section which is designed for those readers who want to dig deeper. All data included in this table was released in January, the month or specific date to which the data refers is shown in the second column from the far right and all data is the latest available as of January 30th.

Please refer to Table 1 for the view of the present situation and the quantitative measure of trends. Readers should regard the color codes in the present situation column as a quick look at the current market condition. This is a subjective analysis based on our opinion of the level of each indicator. The “Trend” columns of Table 1, also by their color codes are designed to give a quick visual appreciation of the direction in which the market is headed. However the quantitative analysis of the value and direction of each indicator over time are the latest “facts” available. There is nothing subjective about this section which is designed for those readers who want to dig deeper. All data included in this table was released in January, the month or specific date to which the data refers is shown in the second column from the far right and all data is the latest available as of January 30th.

Present Situation: There has been a deterioration in the present situation since this analysis was last published on December 31st. Thirteen of the present situation indicators based on historical standards were positive on December 31st, 10 were negative with 13 considered to be close to the historical norm. By January 30th the number of indicators currently positive had declined by 1 to 12, the number considered neutral had increased by 3 to 10, and the number rated negative had increased by 4 to 14.

The four indicators that were changed from neutral to negative were as follows; the broad index value of the US $ on the international exchange markets, the average price of pig iron FOB Brazil N and S ports, long products capacity utilization and service center months on hand of flat rolled products. The capacity utilization of the flat rolled mills was re-classified from positive to neutral.

There were no other changes in the present situation.

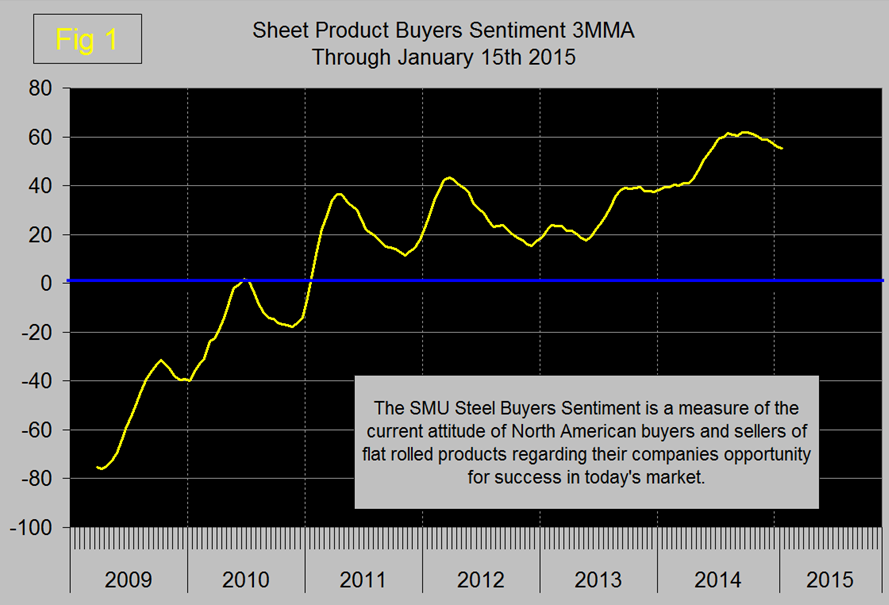

The SMU buyer’s sentiment index is a measure of the current attitude of North American buyers and sellers of flat rolled products regarding their company’s opportunity for success in today’s market. This index was at an all-time high in August of 68.0 and continued to be very strong through January 15th with 3MMA of 55.3, Figure 1 shows the progression of the 3MMA of the sentiment index since January 1st 2009. The buyer’s index is based on a survey of sheet producers and consumers and is not intended to be inclusive of long product market conditions.

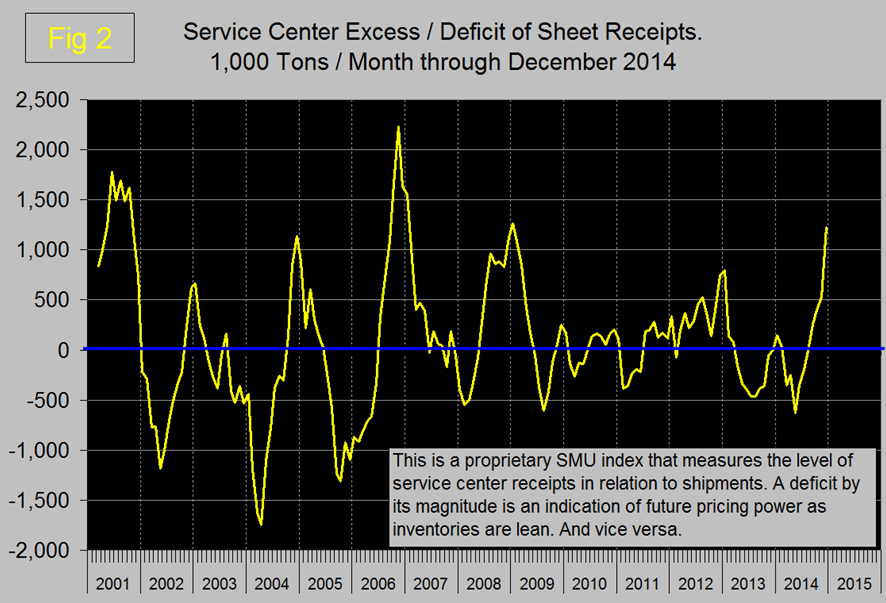

The service center excess continued to be in surplus and in December exceeded a million tons for only the 4th time in 14 years. A surplus is regarded as a negative for prices going forward as it suggests that service center inventories are high. Figure 2 shows the progression of this index since January 2001.

In the raw materials section there are presently no positive indicators, four are negative and one is neutral.

The present situation of the flat rolled steel sector continues to be better than for long products. Net imports continue to be high for both sectors. Last month we didn’t update the capacity utilization and apparent supply of long products because the November results were so much worse than the normal seasonal decline that we questioned them. December data was similar to November and capacity utilization was re-classified to negative. Flat rolled apparent supply continued to be positive through November’s data but as we have reported elsewhere, imports absorbed almost all of the market growth.

Construction continues to be weak to neutral and manufacturing continues to be neutral to strong. Both nonresidential and residential construction starts are rated historically negative as is the total number of people employed in construction. The only indicator rated positive in the construction category is the producer price index of commodities which we believe to be highly correlated with industrial construction activity, particularly in the energy sector. However with the falling price of commodities we expect this indicator to be re-classified as neutral next month. It seems as though the commodity price index reported by the Bureau of Economic Analysis has yet to reflect the huge decline in the price of oil. None of the manufacturing indicators on a present situation basis are currently negative. Four are positive and one, manufacturing employment is neutral.

Trends: Twenty two of thirty six indicators are still trending positive which was a decrease of one from December’s update however there were several trend reversals of individual indicators.

Changes in the individual sectors are described below. (Please note in most cases this is not January data but data that was released in January for previous months.)

In the general economy, the Commerce Department released the first estimate of GDP for the 4th Q of 2014 today with a Q / Q growth annualized of 2.62%. In Table 1, GDP growth is reported as 2.49% which is the year / year rate and which we believe is more indicative of the real situation. The Q4 result was a disappointment, driven down by net exports and a negative growth of government expenditures. (See out Sunday Executive newsletter for a complete description.) The Chicago Fed National Activity Index which had advanced strongly in November declined in December to 0.39 which is still a historically good result. This indicator is a composite of 84 sub-indexes and which we believe to be a very credible measure of the direction of the economy. Consumer confidence as reported by the Conference Board in December bounced back from the November decline and continued to advance strongly in January. Consumer confidence is now higher than the average value since 1980. There was no new data for bank lending standards in December. This data is reported quarterly by the Fed and will not be updated until early February.

The trends of both of the SMU proprietary indexes continued to be negative for the third straight month. The sentiment index was down to 55.3 on a 3MMA basis on January 15th but is still historically strong. The service center excess rose from 399,000 tons in October to 526,000 tons in November to 1,227,000 tons in December. This indicator was developed by SMU for sheet products and when in surplus as it is today indicates rising inventories and falling pricing power. SMU is forecasting an excess through May, which is as far out as we look in this context.

Trends in raw materials changed significantly in the latest data. Chicago shredded which held steady in December rose $9 in early January, a change that we found hard to explain. There has been a de-coupling between the price of scrap and the price of iron ore which we believe will be have to be reconciled by falling scrap prices in the near future. We agree with the comments made in Nucor’s investor conference call this week that scrap is poised for significant declines in the next few months. The decline in the price of iron ore slowed in December and the IODEX recovered by 20 cents in January to $66.50 / dmt. Coking coal continued its decline in January to $105.90 FOB East Coast of Australia. The price of Brazilian pig iron (an average of Brazilian N and S port exports FOB) which had been inexplicably defying the iron ore logic, declined abruptly to $335 on January 23rd from the December value of $372. The price of zinc which had declined slightly in September picked up a cent in October and another in November then declined back to $0.982 on December 30th and to $0.948 on January 29th.

In the long products section, all indicators trended positive except for capacity utilization which reversed course from the November result. Net imports changed direction from growing in October to declining in November but are still historically very high. Net imports of long products were zero in late 2011! Service center shipments increased in December for the ninth consecutive month but are still very depressed by historical standards.

In the flat rolled section the only trend reversal was for capacity utilization which declined to 83.3% from 85.7%. In three months through November supply increased at a rate < 10 million tons per year compared to last year. This was the ninth straight month of increasing supply on a 3MMA basis but ass mentioned above, imports took the icing on the cake. Net imports continued to increase in November which is the latest month for which this data is available for the eleventh straight month. Based on license data, imports of flat rolled decreased in December but the 3MMA continued to increase. Service center flat rolled shipments in December grew by 3.6% on a 3MMA basis year over year which was the seventeenth straight month of growth. Months on hand at the end of December at 3.19 increased more than the seasonal norm.

In the construction section there were no changes in the direction of trends, only one indicator, the price of commodities is trending negative. We regard this indicator as a driver of industrial construction which is still strong driven by energy projects which have yet to be hit by the decline in the price of oil. Nonresidential and residential construction starts continue to improve but as we have reported elsewhere they both have a long way to go.

The seven month string where all manufacturing trends were positive was broken in December when the ISM index reversed direction and experienced a small, 0.1 decline. In January that decline continued when the three month moving average of the index fell a further 0.4 to 57.7 still a historically strong result. The industrial production index and auto production continue to expand at a 4.8% and 4.5% rate respectively. Manufacturing employment grew by 186,000 year over year, less than construction which added 290,000 positions.

The key indicators analysis is still looking good in spite of this month’s decline in the present situation. SMU has several benchmark analyses that show steel demand has recovered more slowly than the general economy and is still not where it should be at this stage of a recovery. This is because the recession in non residential and housing construction was so extreme. Steel supply is now beginning to close the gap as construction slowly picks up the pace but imports are taking up almost all of the demand increase.

We believe a continued examination of both the present situation and direction is a valuable tool for corporate business planning.

Explanation: The point of this analysis is to give both a quick visual appreciation of the market situation and a detailed description for those who want to dig deeper. It describes where we are now and the direction in which the market is headed and is designed to give a snapshot of the market on a specific date. The chart is stacked vertically to separate the primary indicators of the general economy, of proprietary Steel Market Update indices, of raw material prices, of both flat rolled and long product market indicators and finally of construction and manufacturing indicators. The indicators are classified as leading, coincident or lagging as shown in the third column.

Columns in the chart are designed to differentiate between where the market is today and the direction in which it is headed. It is quite possible for the present situation to be predominantly red and trends to be predominantly green and vice versa depending on the overall direction of the market. The present situation is sub-divided into, below the historical norm (-), (OK), and above the historical norm (+). The “Values” section of the chart is a quantitative definition of the market’s direction. In most cased values are three month moving averages to eliminate noise. In cases where seasonality is an issue, the evaluation of market direction is made on a year over year comparison to eliminate this effect. Where seasonality is not an issue concurrent periods are compared. The date of the latest data is identified in the third values column. Values will always be current as of the date of publication. Finally the far right column quantifies the trend as a percentage or numerical change with color code classification to indicate positive or negative direction.