Prices

January 20, 2015

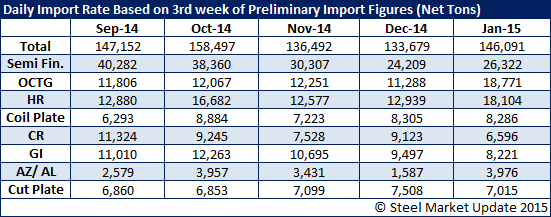

January Import License Data Suggest Another Big Month of Foreign Steel

Written by Brett Linton

The U.S. Department of Commerce updated its import license data earlier today. January import levels continue to be at very high levels compared to November and December and very similar to what we saw in September when imports totaled 3.9 million net tons. The daily rate is about 10,000 tons per day higher than November when we saw total imports at 3.694 million tons. Based on this data through the 20th of January we believe total imports will come in between those two numbers – 3.694 to 3.9 million tons.

Semi-finished imports appear they will be lower than September, October and November and similar to December.

Hot rolled coil, even with the elimination of the Russian tonnage, is running higher than all of the past months. The Russian tons were easily replaced by Korea, Brazil, Netherlands, United Kingdom, Australia and New Zealand.

Just when the bottom fell out of oil prices OCTG imports start to rise. At the moment the trend is for OCTG imports to be higher in January than each of the previous four months. As of today, OCTG license requests average 18,771 tons per day. South Korean OCTG imports are poised to be at their highest export level since May 2014. South Korea has already requested 187,000 tons of licenses for January.

The only good news appears to be in cold rolled where the license rate is less than what we have seen over the past four months. Looking at the countries, China is still the major player but at lower levels than during the past four months. Coming on is Brazil with double the license requests they had in December.