Prices

January 13, 2015

First Look at January 2015 Steel Imports

Written by Brett Linton

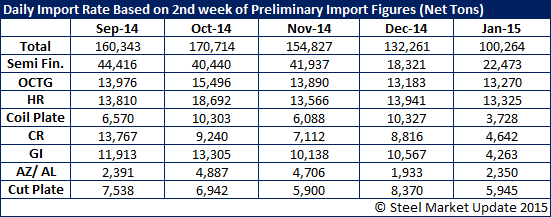

The U.S. Department of Commerce updated the import license data earlier this afternoon. Based on data collected through January 13, 2015, import licenses are lower at this point in the month than what we saw in September, October, November and December. Licenses for all steel products totaled 100,264 net tons which is much lower than the 132,000 to 170,700 we saw during the previous four months.

The most dramatic reductions are in coiled plate, cold rolled and galvanized steels. One item that needs to see a significant reduction is oil country tubular goods which continues to be in line with the four previous months.

In the table below, we are comparing license data from the second week of the month for the past four months against the data released for January earlier today.