Market Data

January 6, 2015

Currency Update for Steel Trading Nations

Written by Peter Wright

The value of the U.S. dollar is having a major impact on commodity, scrap and steel pricing. The strengthening of the dollar is something that Steel Market Update is watching very closely. We are therefor going to increase the number of times we provide currency updates from once per month to every three weeks (and maybe two weeks if necessary) in order to keep our readers abreast of the changes. The following article is written by contributing writer, consultant and Steel 101 instructor – Peter Wright.

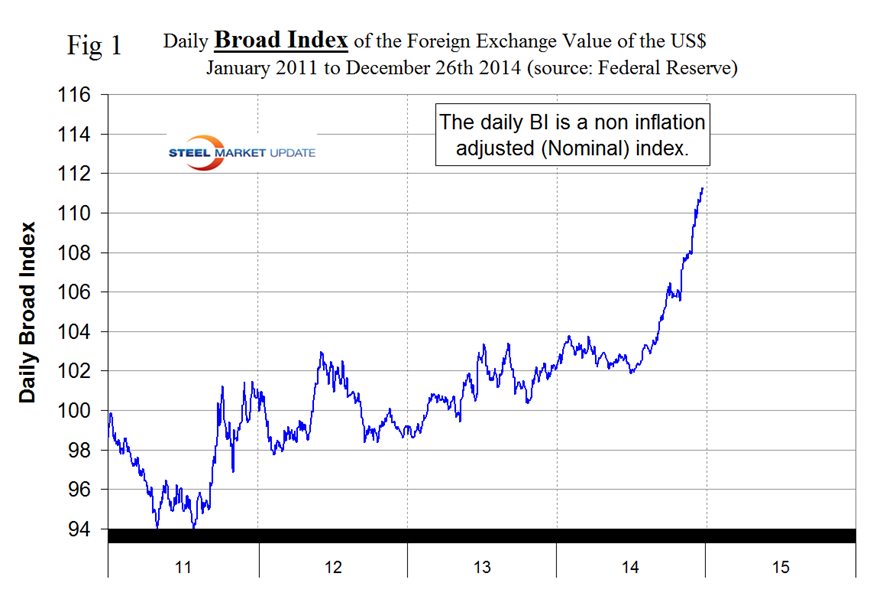

The currency markets continue to be dominated by a strengthening dollar and a weakening of third world currencies in particular. Based on the daily Federal Reserve Broad Index value of the US $ against our major trading partners we see a strengthening trend that has existed for the last three and a half years. The Fed reports a daily nominal, (non-inflation adjusted) index and a monthly real, (inflation adjusted) index.

On February 3rd 2014, the value for the daily index was 103.8026, the index then weakened, turned around at mid-year and on December 26th (the last date published by the Fed) had reached 111.2066, down slightly from 111.2855 on the 23rd which was the highest value of the year. After a brief respite in late October the dollar is again continuing to go straight north, (Figure 1).

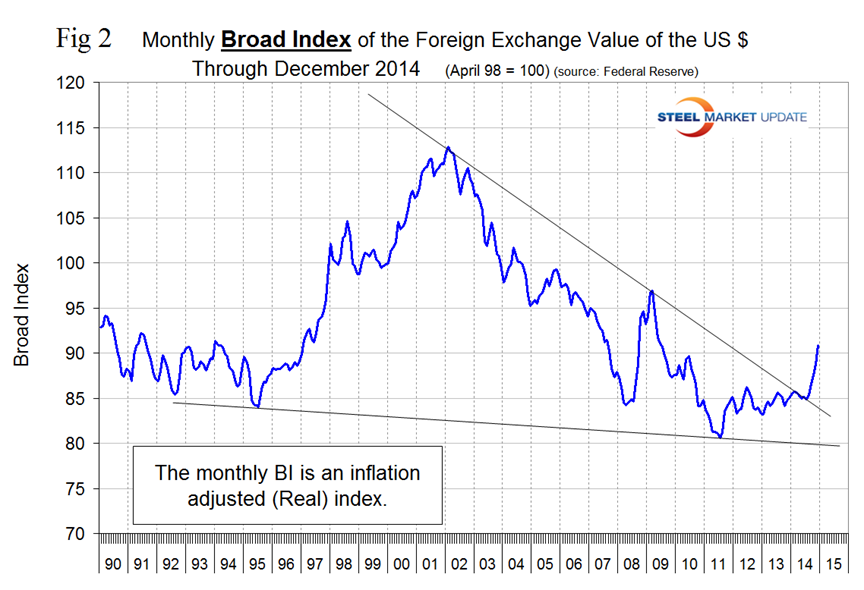

The daily Broad Index has strengthened by 4.8 percent in the last three months, 3.0 percent in the last month and 0.1 percent in the last seven days. Figure 2 shows the monthly “real” index since 1990.

In an article written by Worth Wray and published by Maudlin Economics this morning the following technical comments were made. “The dollar has just broken through the trend line of the biggest wedge pattern in the history of fiat money. For readers who are unfamiliar with technical analysis, breaking out from a wedge pattern often signals a complete reversal in the trend encompassed within the wedge. As you can see in SMU’s Figure 2, the US Dollar Index has been stuck in a falling wedge pattern since 2002, with all of its fluctuations contained between a sharply falling upward resistance line and a much flatter lower resistance line. Any breakout beyond the upward resistance is an incredibly bullish sign for the US dollar and an incredibly bearish sign for carry trades around the world that have been funded in dollars. As you can clearly see, the US Dollar Index, sitting at 91 today, has clearly broken above that trend line. This is a VERY big deal and a clear sign that we may be on the verge of the next phase of the global financial crisis, where financial repression finally backfires and forces all the QE-induced easy money sloshing around the world to come rushing back into safe havens. The US dollar gained against all 31 of its major counterparts in 2014 (for the first time in 25 years), but whether its upward surge continues depends on three factors; (1) continued policy divergence, which largely depends on continued economic divergence among key developed economies, (2) short covering by investors making levered bets in foreign markets with US dollar funding, and (3) global risk aversion and/or outright capital flight from emerging markets. Any one of these forces, if it becomes strong enough, is capable of driving the other two. For example, an early Fed rate hike, a serious easing announcement from the ECB, or perhaps even a surprise devaluation by the People’s Bank of China would be enough to send the US Dollar Index soaring into the mid-90s, which in turn would cause a rush of short covering, which would likely trigger a series of violent currency crashes across the emerging world. Or, it could be the other way around; a major balance of payments crisis in the emerging world – as we’ve started to see in Russia – could easily spread to other emerging markets; and if enough of those dominoes start to fall, the resulting backwash into US dollars would likely trigger short covering, which would only intensify the broad outflow pressures on emerging markets.” More from Worth Wray is woven in below.

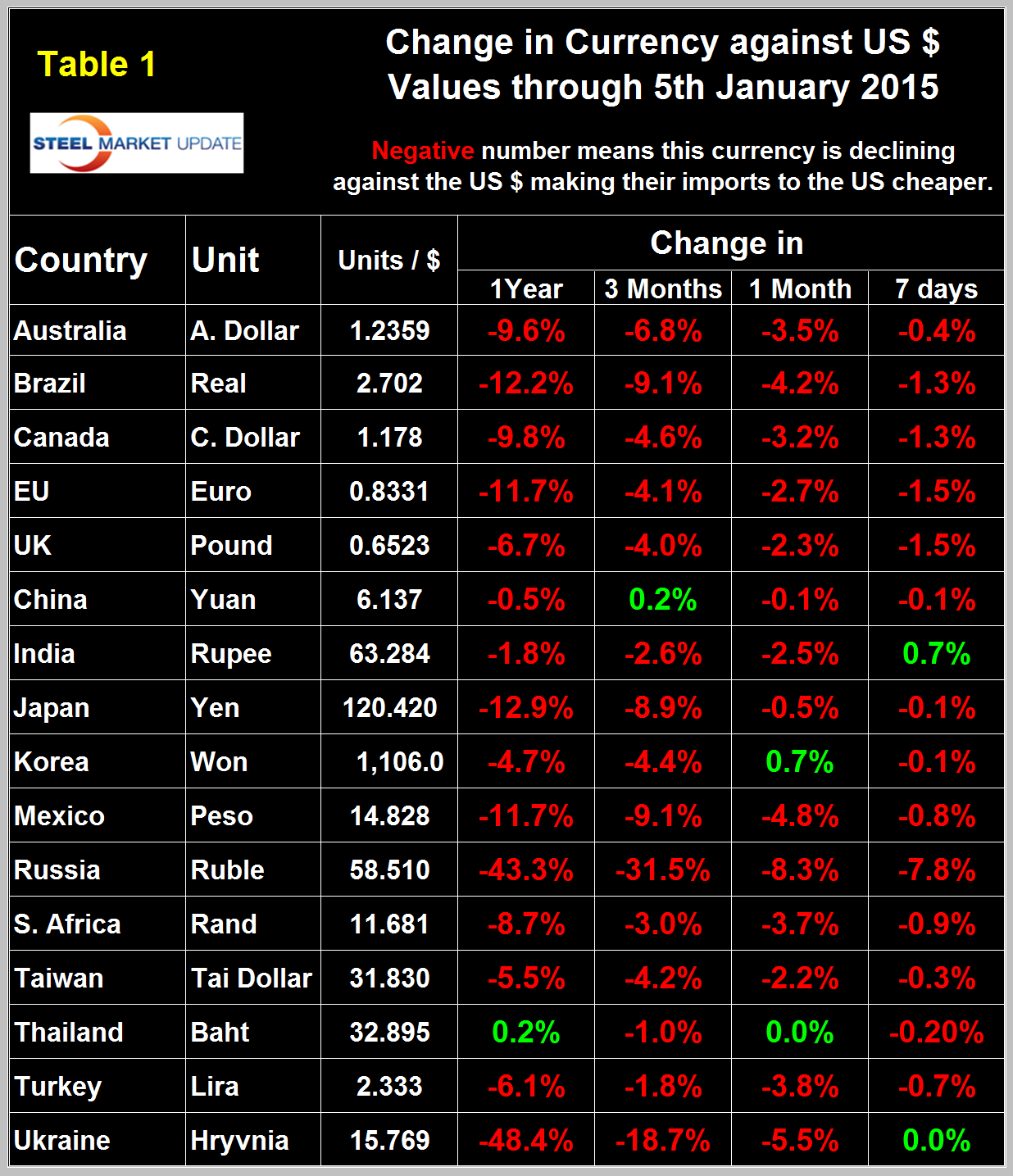

It does not necessarily follow that the currencies of the steel trading nations follow the Broad Index but this is currently the case. In the seven days through January 5th the dollar has strengthened against fourteen of the sixteen steel trading nations and weakened against two. Table 1 shows the number of currency units of steel trading nations that it takes to buy one US dollar and the change in one year, three months, one month and seven days. Negative values for change indicate that the dollar is strengthening against a particular currency. An explanation of the source data is given at the end of this piece. In the last twelve months the dollar has strengthened against 15 of the 16 currencies considered here, Thailand being the only exception. In the last three months the dollar has also strengthened against 15 of the 16 steel trading nation’s currencies, in this case China was the only exception. In the last month and week the dollar has strengthened against 14 of the 16 currencies considered here. Table 1 is color coded to indicate strengthening of the dollar in red and weakening in green. We regard strengthening of the US Dollar as negative and weakening as positive because the effect on net imports.

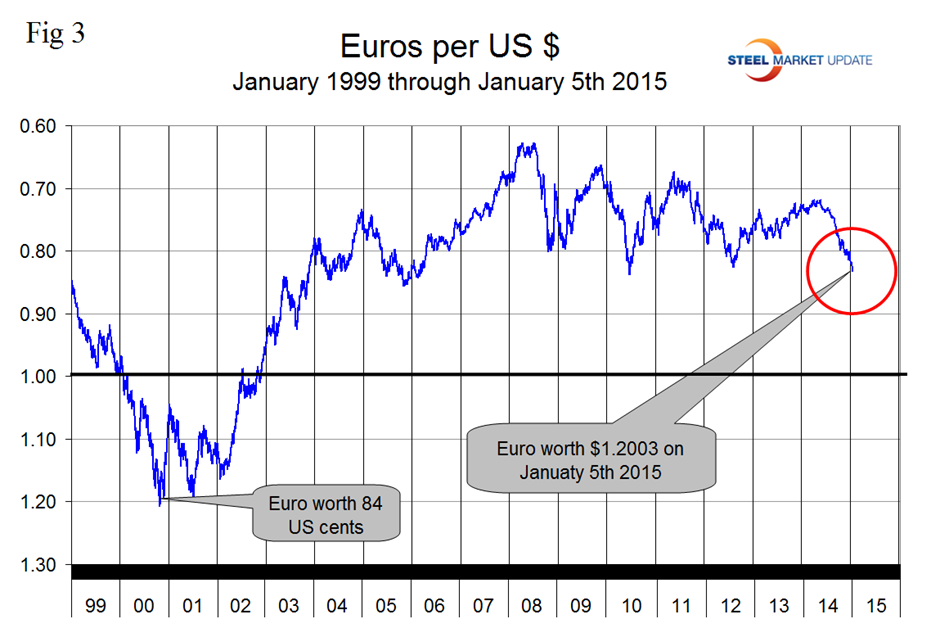

On September 6th the Euro broke through the 1.3 US $ / Euro level for the first time since July 11th last year and since our last report on December 11th when it closed at 1.2395 the currency has declined further to 1.2003. On January 5th the Euro stood at 0.8331 to the US$ and had declined by 4.1 percent in the last three months, (Figure 3). A devalued Euro means that US exports will be more expensive in Europe and European imports will be cheaper here. This is particularly true for steel trade. In addition European scrap will be more attractive to Turkish buyers than supplies from the US which will put downward pressure on domestic scrap prices.

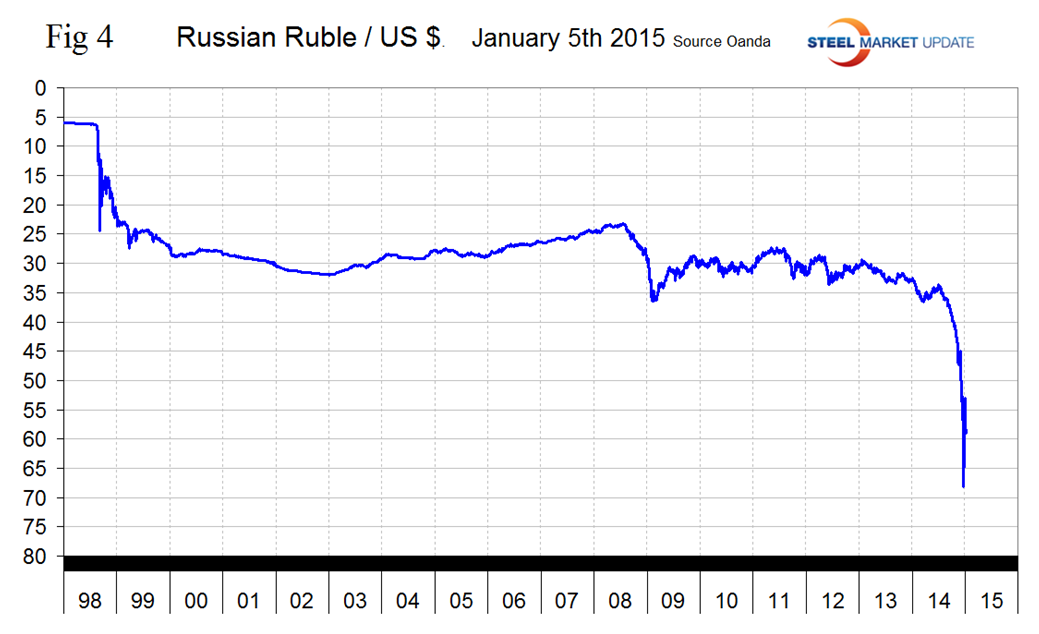

The Russian Ruble has had the largest decline of all the steel trading nations in the last three months, one month and seven days and is in virtual free fall, (Figure 4). Multiple interest rate increases have so far had no effect on the rate of decline. These moves are intended to bolster the currency that has been hurt both by sanctions and by the drop in the price of oil which is Russia’s major export and income earner. Worth Wray, “Those of us who watch the US dollar were not surprised by the collapse in oil prices, because the dollar’s surge was already telling us something about global demand. What did surprise a lot of economists (myself included) was the breakdown within OPEC, particularly Saudi Arabia’s willingness to accept whatever price the market offered in order to protect its market share. Conspiracy theories aside as to whether OPEC’s move constitutes an anti-American trade war against US shale producers or a pro-American squeeze on Russia, Iran, and Venezuela, it’s already putting a serious squeeze on Texas oil men, Russian “oligarchs,” and oil-exporting emerging markets.”

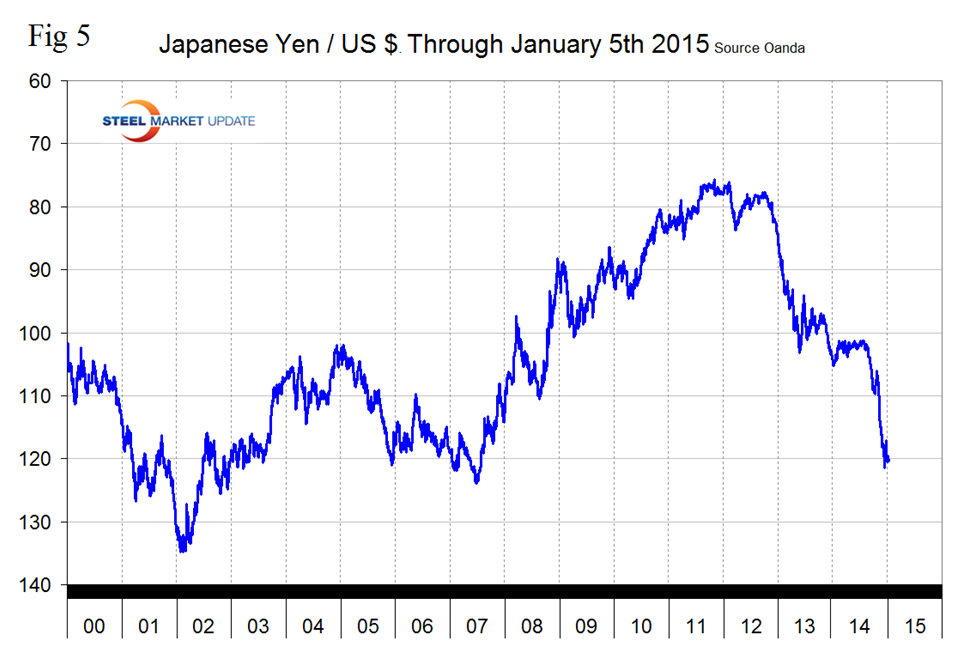

The Japanese Yen broke through the 120 level on December 6th before rallying slightly and closing at 120.42 on January 5th, (Figure 5). It looks as though central bank intervention has stabilized the Yen for the moment and reduced its decline to only 0.5 percent in the last month. The Yen is down by 12.9 percent in 12 months and 8.9 percent in 3 months. Some analysts are predicting a level of 200 Yen / Dollar in the not too distant future. Lacy Hunt of Hoisington Investment Management wrote recently, “Even leaving aside contagion effects and dollar short covering, the divergence in debt loads among the United States, Japan, and the Eurozone is enough to explain a lot of the economic divergence we are seeing; and he suggests that the trend should continue for the foreseeable future; US growth is outpacing that of Europe and Japan primarily because those economies carry much higher debt-to-GDP ratios. Based on the latest available data, aggregate debt in the US stands at 334 percent, compared with 460 percent in the 17 economies in the euro-currency zone, and 655 percent in Japan. Economic research has suggested that the more advanced the debt level, the worse the economic performance, and this theory is in fact validated by real-world data [not to mention recent experience]. From that perspective, there’s no reason we should expect a major departure from easy monetary policy in Japan or from the expectation (if not the realization) of easy-money policy to come in Europe. Inflation expectations are far too low in both regions, and the erosion of economic activity is far too worrying.”

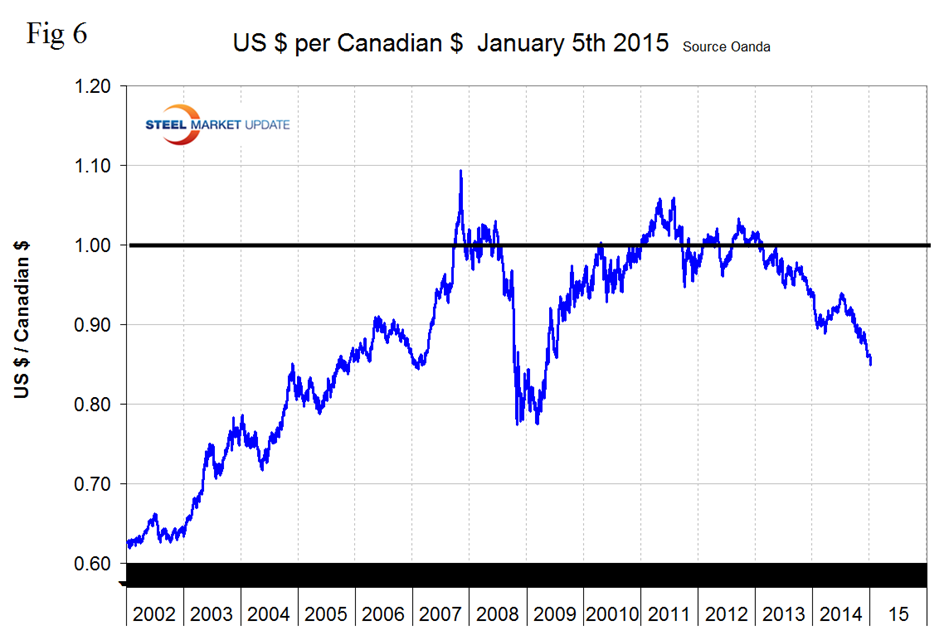

After flirting with the 90 US cent valuation early in 2014, the Canadian $ broke through that level on September 27th and declined to <85 US cents two days ago closing at 84.89 cents on January 5th. The decline has been pronounced since mid-year. The Canadian $ has declined by 9.8 percent in the last year, 4.6 percent in three months, 3.2 percent in one month and 1.3 percent in seven days, (Figure 6).

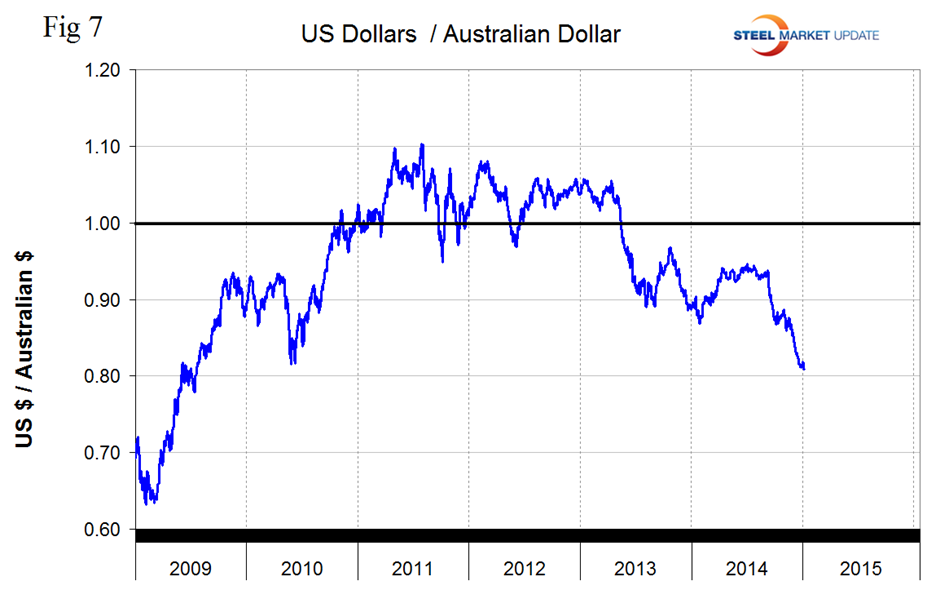

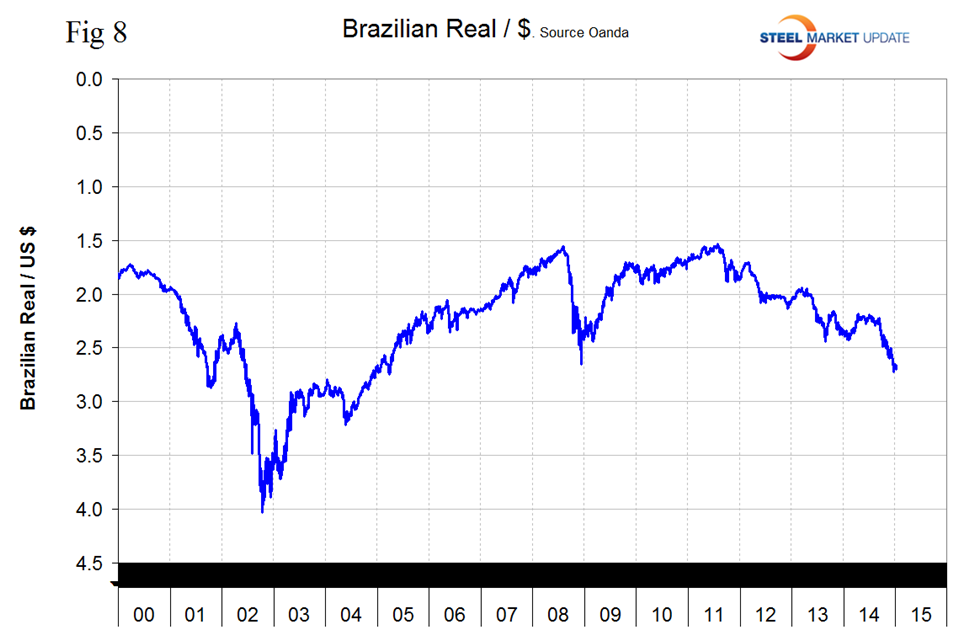

The reversal of the ‘carry-trade’ (borrow US$, buy something else higher yielding) has been well underway since the Fed announced last year that it would end QE3. Emerging country currencies have plummeted, together with commodity prices. Australian and Canadian commodity producers that borrowed heavily in USD have been doubly hit by a stronger US$ and plunging commodity prices, including iron ore, and their share prices have plummeted. The Australian $, (Figure 7) and Brazilian Real, (Figure 8) are being hit even harder than the Canadian $ in the last three months being down by 6.8 percent and 9.1 percent respectively.

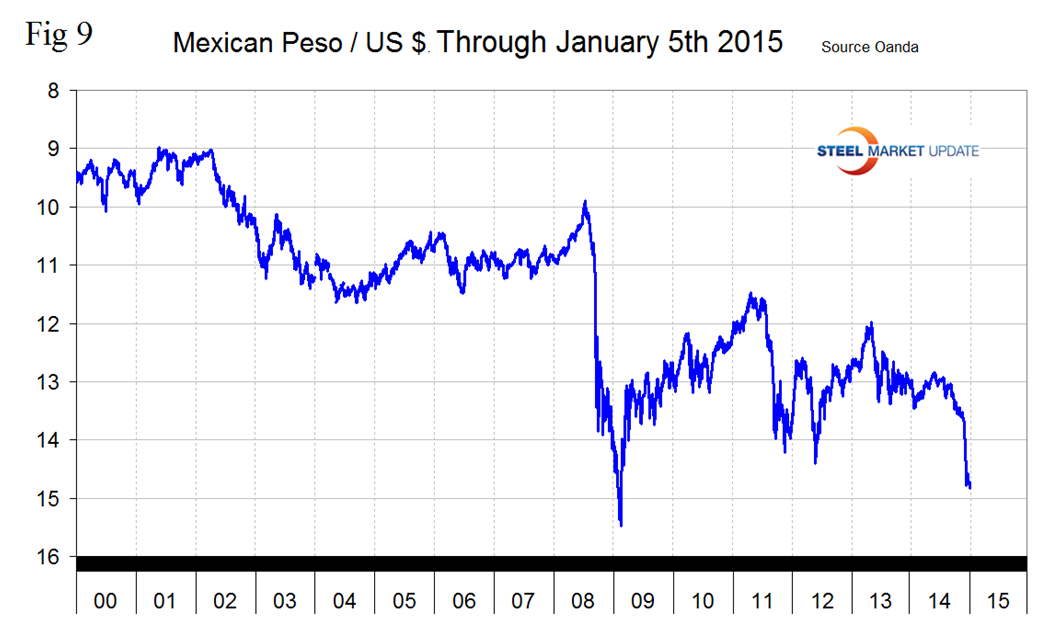

The Mexican Peso closed at 14.83 on January 5th, down by 9.08 percent in three months, and in free fall for all of December and into January, (Figure 9). The Peso has broken through the previous low point which occurred on June 6th 2012 and is now at its lowest point since March 16th 2009.

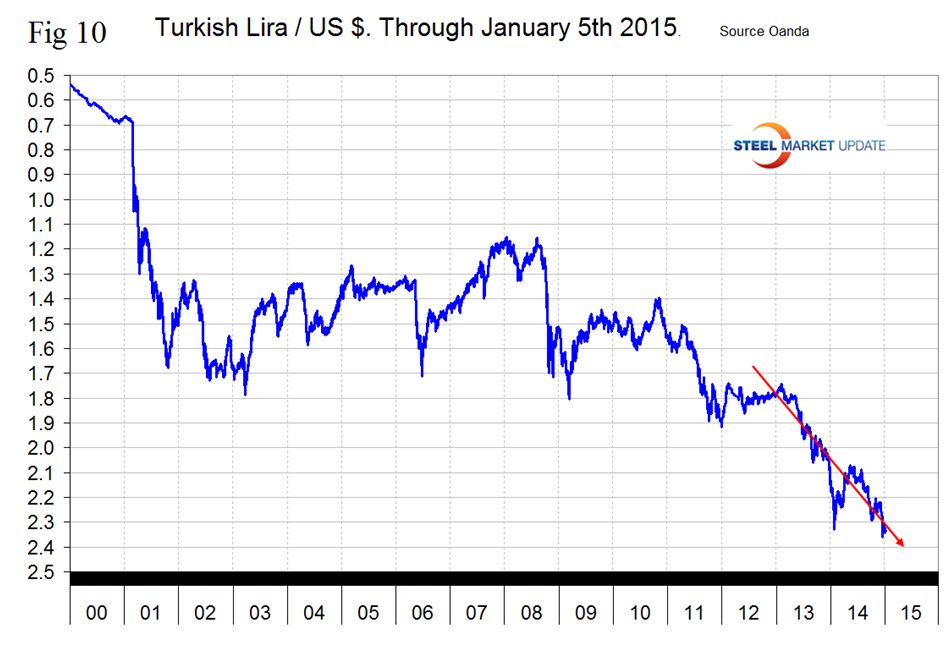

The Turkish Lira closed at 2.3325 to the $ on January 5th, down by 3.8 percent in the last month and by 0.7 percent in seven days, (Figure 10).

SMU Comment: Reports in the press are not exaggerated. The US dollar is escalating rapidly in the global currency markets and against the currencies of the major steel trading nations. This not a good trend for US steel market competitiveness and will continue to drive net imports higher and raw materials prices lower. In this monthly analysis we report on the currencies that we think have the most immediate significance, but all 16 steel trading nation graphs are available on request if any reader has a special interest that we haven’t covered.

Explanation of Data Sources: The broad index is published by the Federal Reserve on both a daily and monthly basis. It is a weighted average of the foreign exchange values of the U.S. dollar against the currencies of a large group of major U.S. trading partners. The index weights, which change over time, are derived from U.S. export shares and from U.S. and foreign import shares. The data are noon buying rates in New York for cable transfers payable in the listed currencies. At SMU we use the historical exchange rates published in the Oanda Forex trading platform to track the currency value of the US $ against that of sixteen steel trading nations. Oanda operates within the guidelines of six major regulatory authorities around the world and provides access to over 70 currency pairs. Approximately $4 trillion US $ are traded every day on foreign exchange markets.