Market Data

January 4, 2015

Calendar Year 2014 at a Glance

Written by John Packard

Everyone wants to know how the steel industry did from our perspective over the calendar year 2014.

We decided to take a look at the year using quarterly averages as a way of smoothing out the data and giving us a clearer picture of key data and commodity and steel pricing trends.

As you can see in the table below, SMU Steel Buyers Sentiment Index improved (more optimistic) from 1st Quarter to 2nd Quarter and again to 3rd Quarter (current Sentiment). However, some of that enthusiasm began waning in 4th Quarter. When looking at our Index on a 3 month moving average (3MMA) basis we got the same results. We will need to watch this carefully as we enter into calendar year 2015. Our first Sentiment Index measurement will be taken this week and reported in Thursday’s newsletter.

For the year, benchmark hot rolled coil prices based on Steel Market Update index, averaged $651 per ton. In comparison, CRU averaged $653 and Platts averaged $658 per ton.

As you can see, spot iron ore prices in China, which ended 2013 at $134.2/dmt on 62% Fe fines, dropped significantly during the year (based on The Steel Index data). The drop in iron ore, along with the decline in oil prices, are two of the biggest stories of the year which will be following the industry into the New Year.

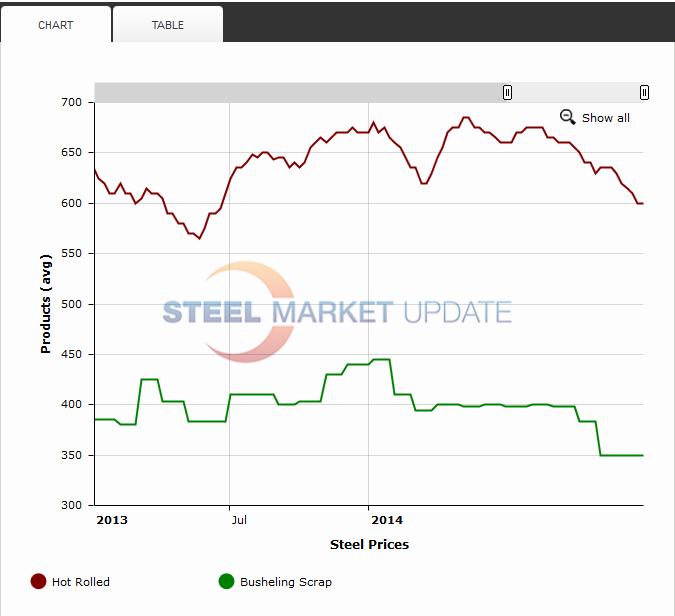

Busheling scrap, one of the key indicators for one of the domestic mini-mills began the year at $445 per gross ton. By the end of the calendar year it was down $95 per gross ton ($350) in the Chicago area markets.

Below is a graph taken from the Price History section our website showing the relationship between Busheling scrap and hot rolled coil pricing. The year began with hot rolled at $680 per ton and ended at $600 per ton. SMU Note: You can graph more than one product in the Price History section by using the control (Ctrl) key and then left click your mouse.

One of the keys for 2015 is our Service Center Inventory Apparent Excess/Deficit data (Premium product). As you can see in the table below the year began with a deficit which then grew during 2nd Quarter 2014 before shrinking in 3rd Quarter and moving into Excess during the 4th Quarter 2014. This will be one of the biggest concerns the mills will face as we move into calendar year 2015.

The second area of concern the industry faces (related to the service center inventory situation discussed above) are imports. As you can see imports have been growing from quarter to quarter.

From a simple observation:

The keys for 2015 will be: controlling service center inventories, controlling foreign steel imports, oil and natural gas prices and their impact on the energy markets (especially drilling as represented by rig counts) and iron ore spot prices which at the moment have flattened out around $70 per dry metric ton on 62% Fe fines. Iron ore and oil prices are forecast to stay down during this year providing there is no “Black Swan” event.

The other item which impacts world steel prices, including import offers into the U.S. market, commodity prices and the scrap markets, is the value of the U.S. dollar against foreign currencies. At the moment, the dollar is projected by economists to remain strong, thus keeping commodity prices low, keeping scrap exports low and keeping foreign steel offers low.