Prices

December 31, 2014

December Steel Imports Expected to Exceed 3 Million Tons

Written by Brett Linton

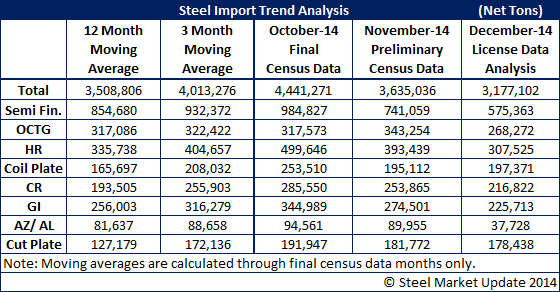

The U.S. Department of Commerce updated the December 2014 steel import license data. As suspected the volume of requests dropped dramatically from the 4.0 million net ton pace we were seeing earlier in the month to 3.0+ million tons as of December 30th.

December total steel imports (alloy and carbon) should be approximately 500,000 tons lower than what we saw in November and 1.2 million tons lower than October, the biggest month for imports this calendar year.

Compared to December 2013 we expect imports to be up about 700-800,000 tons, or about 24 percent higher than what we saw last year.

The domestic steel mills are responsible for importing approximately 25 to 30 percent of all steel products brought into the United States. All semi-finished steels (slabs, billets & blooms with almost all being slabs) are re-rolled by the domestic steel industry. In December semi-finished imports should total approximately 575,000 net tons, down from 741,059 net tons in November and well below both the three month and twelve month moving averages of 932,372 and 854,680 tons respectively.

With the cancellation of the Russian hot rolled suspension agreement, hot rolled imports will be about 20 percent lower than what we saw in November. There were approximately 47,000 net tons of license requests out of Russia but it remains to be seen whether any of those tons actually made it into the U.S. prior to the mid-December “drop dead” date when duties were to be reinstated.

Russia may have had their hot rolled exports taken from them but, they have suddenly become a major exported of coiled plate (which is nothing more than hot rolled which is thicker) with about 70,000 net tons of license requests for the month of December. Total coiled plate imports are expected to be similar to November around 195,000 net tons.

Russian license requests for cut plate also grew for the month of December at 10,000 tons. Last December Russia did not export any cut plate to the U.S.

Cold rolled imports from China will be down during December, probably due to the rumors circulating during the summer and early fall months about potential dumping suits on the product. Chinese license requests dropped to about 60,000 net tons or about 27 percent of the total license requests received through the 30th of December.

It is interesting to note that Russian cold rolled license requests were up to approximately 22,000 net tons or, almost double their biggest month (September 14,194 net tons). Last December Russia exported 221 net tons (not a typo) of cold rolled to the United States.

Galvanized import licenses are about 18 percent lower in December than what we saw for November (Preliminary Census Data). The three largest exporting countries were Canada, India and China. Of interest is the re-emergence of Brazil with 17,000 net tons of GI license requests. Last year Brazil had 11 tons (not a typo) of license requests to ship galvanized to the U.S.

December is traditionally a slower month for “other metallic” imports, of which most imported tons are Galvalume. The license requests for December at approximately 38,000 net tons are in line with what we saw last December.

We have been watching Oil Country Tubular Goods (OCTG) and the amount of South Korean OCTG being shipped into the U.S. since the decision to hit the country with anti-dumping duties. Of the approximately 268,000 net tons of licenses for the product 88,000 were from South Korea. This is more than the 62,345 net tons exported to the U.S. last December. The South Koreans shipped 214,905 net tons of OCTG which was received in the U.S. during the month of May 2014. That was their largest OCTG exporting month during calendar year 2014.