Prices

December 11, 2014

Apparent Steel Supply at 6+ Year High

Written by Brett Linton

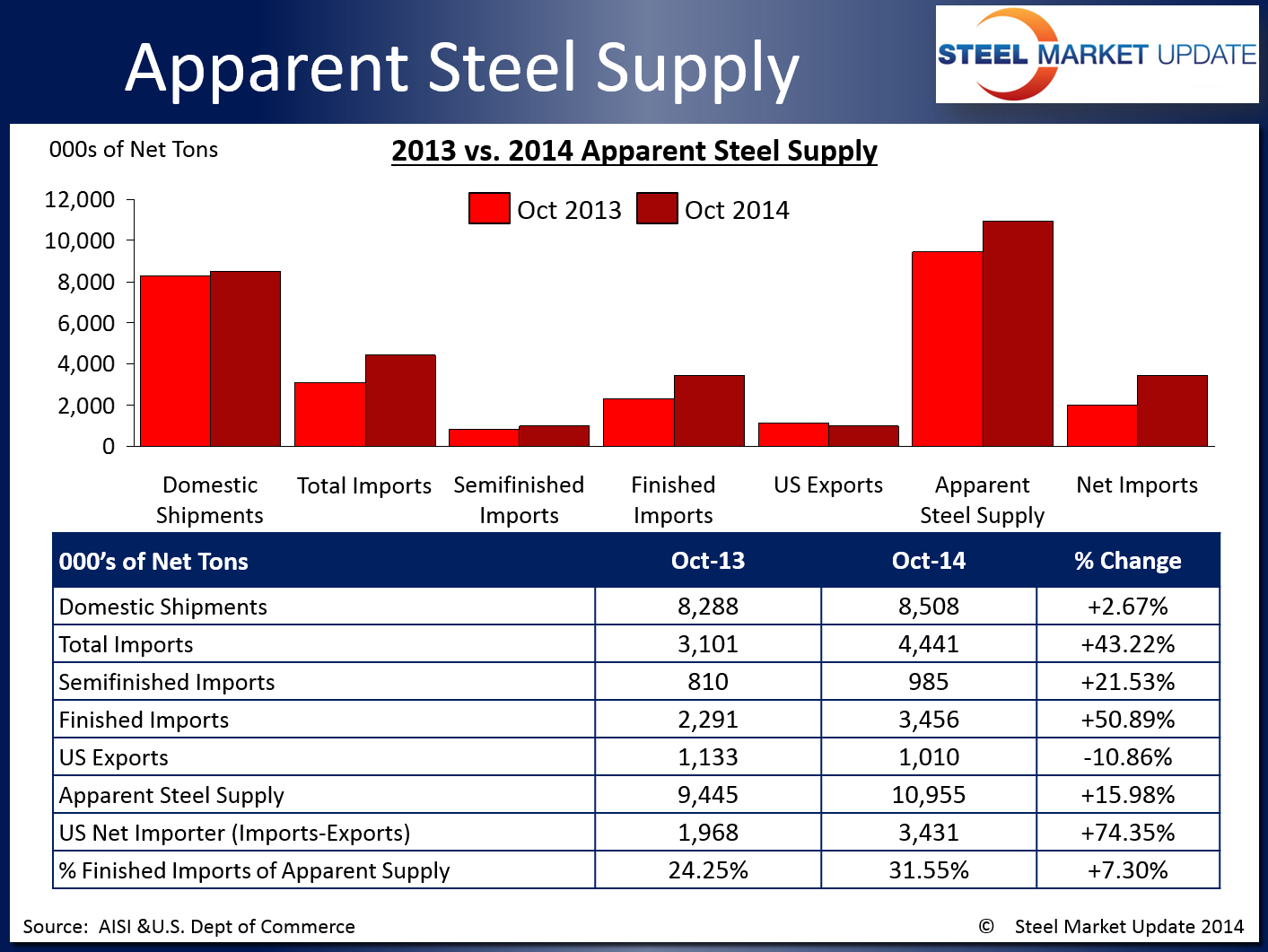

Apparent steel supply for October 2014 was 10,954,832 net tons, the highest monthly figure we have seen since the beginning of the Great Recession. Apparent steel supply is calculated by adding domestic shipments and finished US imports and subtracting total US exports.

October supply represents a 1,509,671 ton or 16.0 percent increase compared to the same month one year ago. This is primarily due to the massive spike in 2014 imports, with total October imports up 43.2 percent or 1,340,208 tons over October 2013 tonnage. Domestic shipments and finished imports also increased over levels one year prior, up 2.7 and 50.9 percent respectively, while exports were down 10.9 percent. The net trade balance between imports and exports was a surplus of 3,431,182 tons in October, an increase of 74.4 percent from the same month last year.

SMU Note: Our Premium Level apparent steel supply analysis goes into more detail as we provide data on apparent steel supply for flat and long products. We plan to publish this analysis later this week.

When compared to last month when apparent steel supply was at 10,305,707 tons, October supply increased by 649,125 tons or 6.3 percent. A 16.5 percent jump in finished imports accounted for the majority of the apparent supply increase, with a slight decrease in total exports and a small increase in domestic shipments attributing as well.

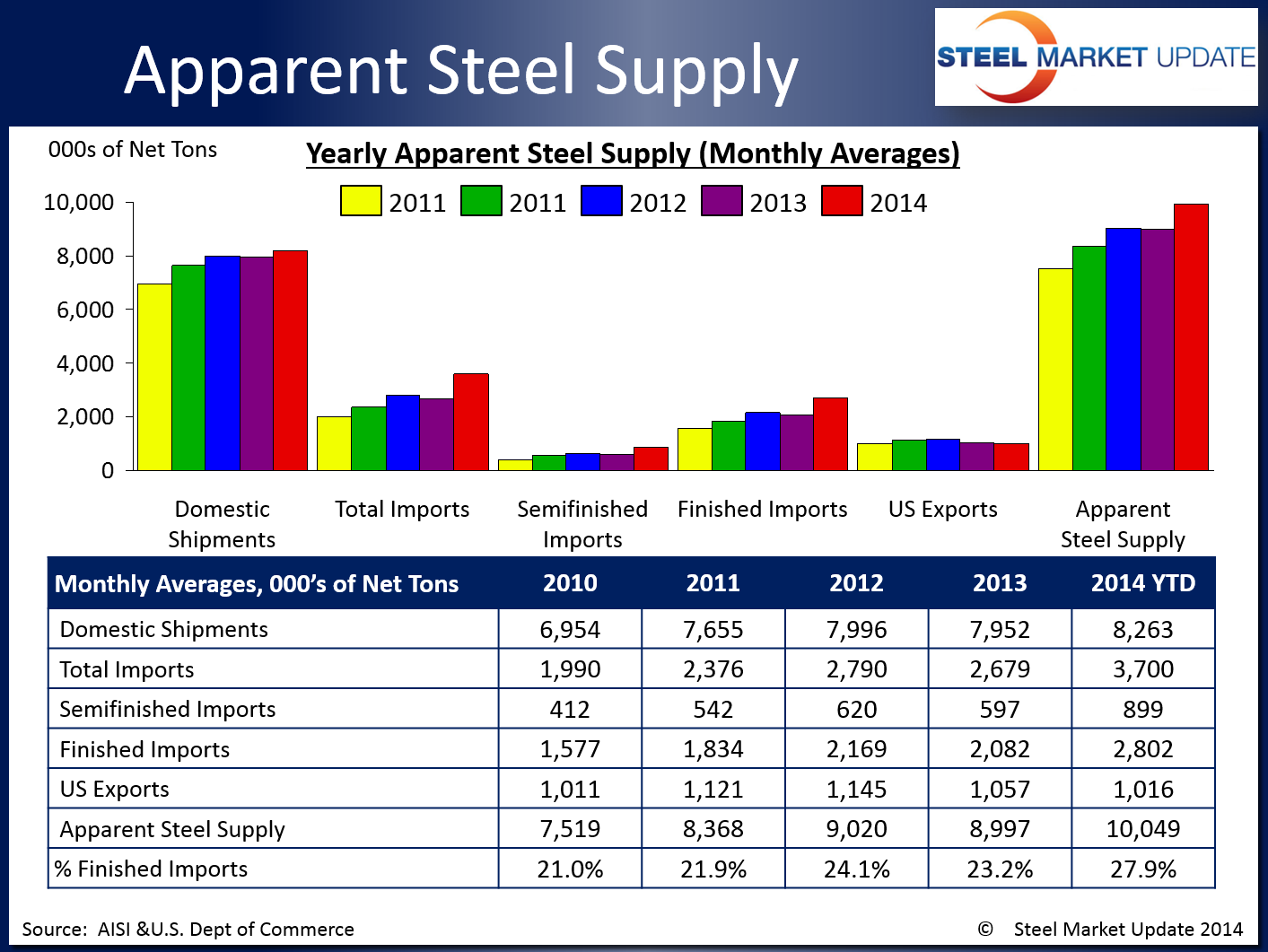

On a year to date basis (YTD), the 2014 averages remain above what we experienced during previous years, with the exception of total exports which have remained slightly down to steady. At this time, the U.S. is on pace to exceed 2013 apparent steel supply by approximately 12 percent.

You can view the interactive graphic of our Apparent Steel Supply history below when you are logged into the website and reading the newsletter online. If you need help accessing or navigating the website, don’t hesitate to contact us at info@SteelMarketUpdate.com or 800-432-3475.

{amchart id=”120″ Apparent Steel Supply- Domestic Shipments, Semi-Fin Imports, Exports}