Market Data

December 2, 2014

SMU Price Momentum Indicator: Price Pressures Continue

Written by John Packard

It has now been five weeks (October 28th) since AK Steel became the first domestic steel mill to announce a price increase on flat rolled steel. The relatively modest $20 per ton move was, in many steel buyers’ opinions, meant to stem the decline in steel prices. At that point in time benchmark hot rolled was averaging $630 per ton based on the SMU HRC average price. Since that time, HRC has moved between $635 and $630 per ton and as of last week our average was holding at $630 per ton.

This week we are seeing some weakness in the numbers as the upper portion of our range is shrinking on many products and we have seen a number of “special” offers on hot rolled for tonnage buyers. Our new range on HRC is $600 to $640 per ton with an average of $620 per ton ($31.00/cwt).

The last time HRC average pricing was below $630 per ton was the week of March 17, 2014 when the bottom of the winter cycle was achieved at $620 per ton.

During the first week of December 2013 benchmark hot rolled prices were $45 per ton higher than where we see our average this week. December 2013 HRC price average was $670 per ton. Busheling scrap prices during that same week were $440 per gross ton or $90 per gross ton lower than what we saw in November of this year. December prices are forecast to move sideways (+/- $5 per gross ton) due to weather, lack of exports, short month and dealers willing to sit on scrap if necessary due to expected limited flows into the yards.

As we look toward 2015 early indications are pointing toward sideways to lower flat rolled steel prices from here. Therefore, Steel Market Update has our Price Momentum Indicator pointing toward Lower prices over the next 30 to 60 days.

Here are some of the reasons why we think steel prices will trend lower:

On the world scene iron ore prices have collapsed. On December 4, 2013 spot 62% Fe fines were selling at $139.7 per dry metric ton. This morning The Steel Index (TSI) reported 62% Fe fines CFR, Tianjin Port (China) at $69.7 per dry metric ton. Ore is trading at essentially half of what it was one year ago.

Iron ore prices here in the United States are generally sold on a contractual basis and may not be as low as what we are seeing in Asia but, they should be much lower than what was seen one year ago.

We have already discussed scrap prices which are down $80-$100 per gross ton this year compared to last. One of our scrap sources told us at the beginning of November, “… expectations for the next few months seem to be that we have hit a temporary stable level as flows into dealer yards will invariably slow down with shorter days, holidays, deteriorating weather, and some serious transportation limitations for trucks, rail, and barges. No one is expecting a big bounce to a higher level, but I am also not hearing of another step lower just yet of the size we experienced in November.”

One of the issues we have with scrap here in the U.S. is the amount of material that normally is exported to places like Turkey. Those deals have slowed to almost nothing due to the appreciation of the U.S. dollar which makes our scrap more expensive to export (and countries like Russia less expensive). If it is not going overseas it has to go somewhere and it is making its way inland to the mills in the Ohio Valley and beyond. This helps keep a lid on pricing.

Scrap from Europe is also being imported into the United States. We have seen reports out of MetalPrices.com that Nucor and Steel Dynamics are buying scrap overseas and shipping it to their mills here in the United States. This is yet another way to keep pressure on U.S. scrap prices to insure they do not rise as much as they possibly could during the colder winter months.

So, we see input costs as remaining low keeping the domestic mills costs down and providing them the flexibility to be price competitive when they need to be.

The lower iron ore costs in the international markets, appreciating dollar vs. other currencies and weakening economies in Asia, South America and Europe opens the door even wider for foreign steel to come to North America.

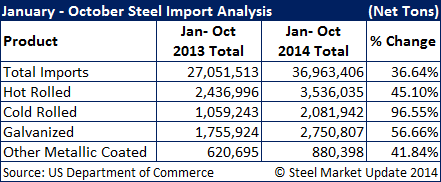

Let’s take a quick look at what has transpired during the first 10 months 2014 vs. the same time period 2013:

As you can see total imports (all products) were up 36.64 percent. However, flat rolled steel, led by cold rolled out of China, are all up significantly year-over-year (YOY). Hot rolled is up 45.10 percent, cold rolled +96.55 percent, Galvanized +56.66 percent and Galvalume +41.84 percent.

Imported steel is affecting the domestic market in a number of ways: 1) Imported steel is helping to keep a cap on domestic prices and preventing the domestic mills from being able to collect new price increases. 2) The tonnage is growing inventories at service centers. With higher inventories there are fewer tons needing to be purchased. 3) With higher inventories at service centers the domestic mills aren’t able to get the capacity utilization rate higher than the 78 percentage rate (all products) or less that we have been seeing all year. The manufacturing growth in the U.S. is being absorbed with foreign tonnage.

With the rest of the world suffering from weak or weakening economies all eyes are on the U.S. market as the place to move off unwanted tonnage.

Projections are for growth in apparent steel supply in 2015 to be somewhere around 4-5 percent. Automotive will probably be flat to up a couple of percent (compared to 2014) and could actually be lower depending on the impact of the Ford F150 with its new aluminum body panels. Construction is forecast to be higher (3-5 percent) but most of that will be in the second half 2015.

With oil under $70 per barrel we anticipate that new drilling will slow down if not cease thus creating an excess of steel pipe – much of which is hot rolled based and that hot rolled steel has to go somewhere.

SMU is going to take an optimistic view and anticipate that domestic steel usage will increase by 4-5 percent in 2015.

How many tons of flat rolled are being added back into the market with all of the integrated steel mills having concluded very expensive maintenance projects on their blast furnaces?

AK Steel had major problems this year with their Ashland, Kentucky blast furnace. Those issues have been (knock on wood) resolved and the furnace is back online.

ArcelorMittal had its huge Indiana blast furnace down for an extended period of time in 2014. Those repairs should be done, or just about done, and all of their furnaces will be back online.

U.S. Steel had a number of issues with furnaces during 2014. Our understanding is many, if not all, of those issues were addressed during 2014 and they too will have more tons to offer into the market in 2015.

There has been consolidation with a number of facilities in North America. However, public companies do not easily change their stripes. These mills (SDI Columbus, AK Steel Dearborn, Nucor Kentucky) will all be to not only produce at the levels they did in 2014 but to do more in 2015.

Steel Market Update is asking the industry if their company will continue to buy foreign steel at similar, higher or lower levels in 2015 than they did in 2014. The results are not yet complete but we are finding less of a mood to move back to domestic than what we anticipated.

A service center executive told us this morning that their cost to get foreign steel into the Central Plains states was $50-$55 per ton less than domestic. The closer they went to the ports the higher the spread. The only exceptions were for those areas in the Midwest that were located in close proximity to a domestic producing steel mill. At $50-$55 per ton he felt the risk was minimal and worth buying foreign vs. whatever the domestic number will be by 2nd Quarter 2015 when the steel would arrive.

It is SMU opinion that imports, higher levels of inventories at the service centers, shorter lead times and lower mill input costs (iron ore/scrap) will keep pressure on prices even as we move into 1st Quarter 2015.