Prices

November 7, 2014

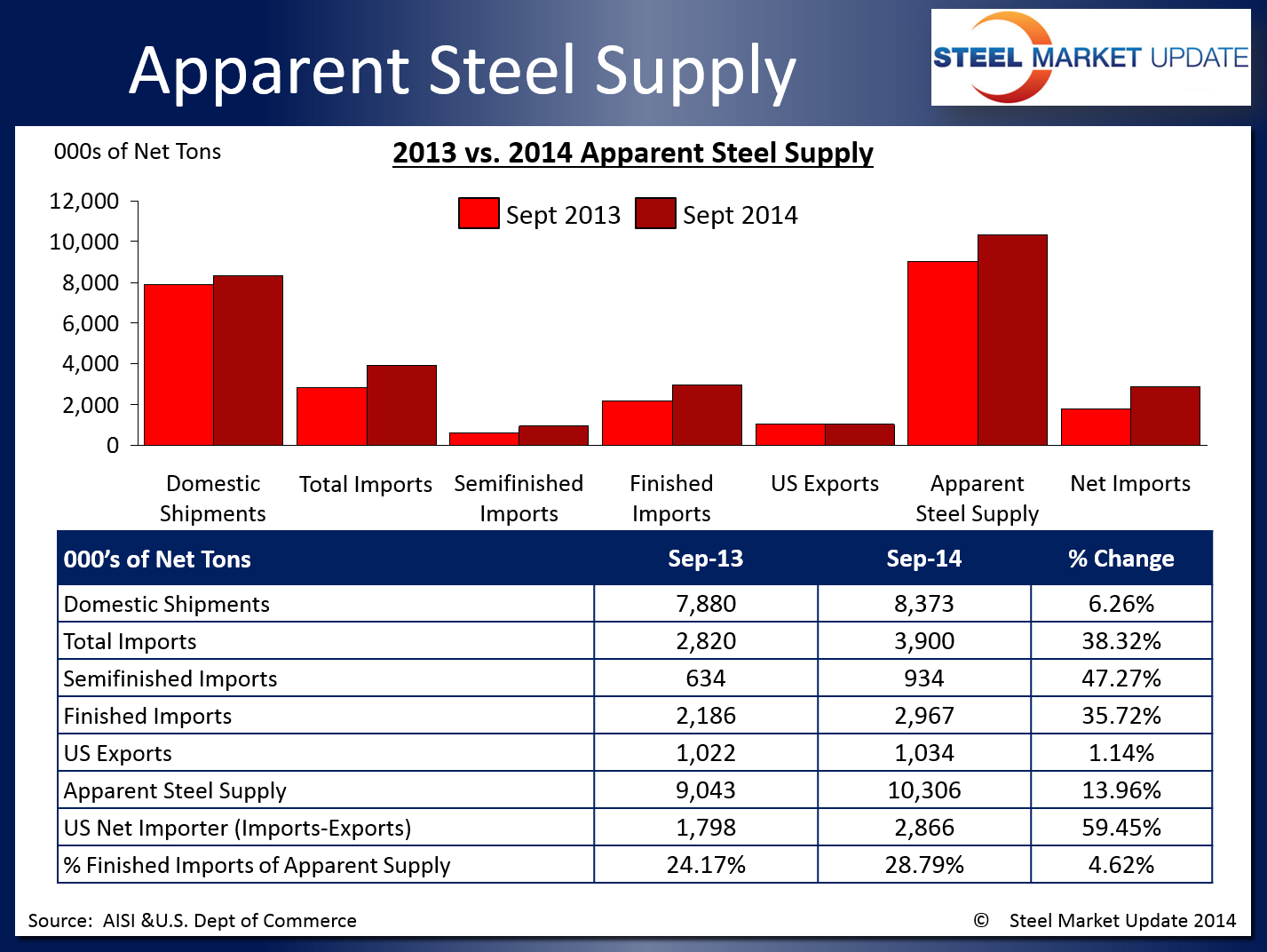

Apparent Steel Supply Exceeded 10M Tons in September

Written by Brett Linton

Apparent steel supply for September was 10,305,707 net tons, the third biggest month since the beginning of the Great Recession. Apparent steel supply is calculated by adding domestic shipments and finished US imports and subtracting total US exports. Note that our Premium member analysis breaks down apparent steel supply by flat and long products.

September supply represents a 1,262,287 ton or 14.0 percent increase compared to the same month one year ago. This is primarily due to the massive spike in 2014 imports, with total September imports up 38.3 percent or 1,080,448 tons over September 2013 tonnage. Domestic shipments and finished imports also increased over levels one year prior, while exports have remained fairly steady. The net trade balance between imports and exports was a surplus of 2,866,387 tons in September, an increase of 59.5 percent from the same month last year.

SMU Note: Our Premium Level apparent steel supply analysis goes into more detail as we provide data on apparent steel supply for flat and long products. We plan to publish this analysis later this week.

When compared to last month when apparent steel supply was at 10,252,449 tons, September supply increased by 53,258 tons or 0.5 percent. A slight decrease in total exports and an increase in domestic shipments attributed to this change.

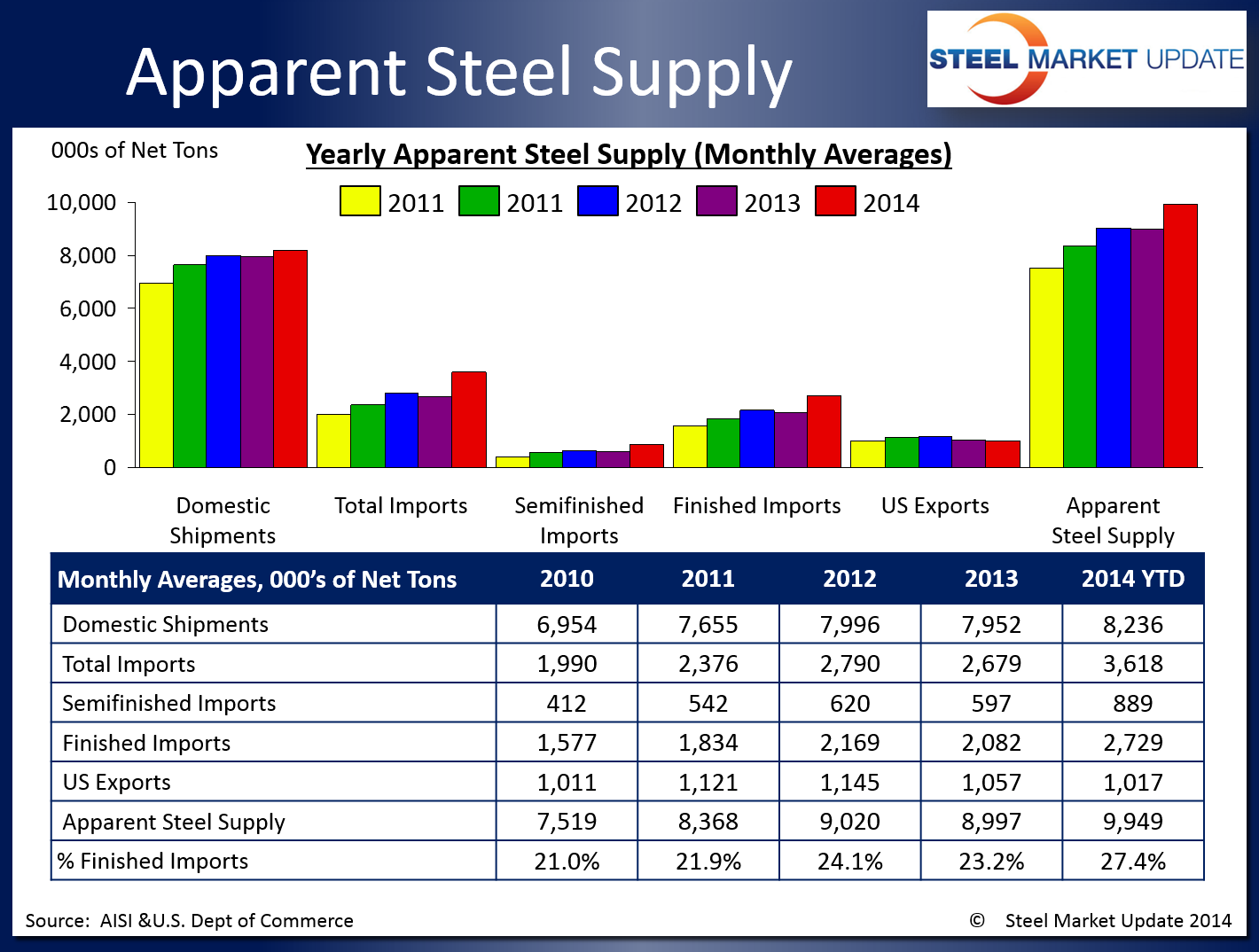

On a year to date basis (YTD), the 2014 averages remain above what we measured during the previous two years, with the exception of total exports. At this time, the U.S. is on pace to exceed 2013 apparent steel supply by approximately 11 percent.

You can view the interactive graphic of our Apparent Steel Supply history below when you are logged into the website and reading the newsletter online. If you need help accessing or navigating the website, don’t hesitate to contact us at info@SteelMarketUpdate.com or 800-432-3475.

{amchart id=”120″ Apparent Steel Supply- Domestic Shipments, Semi-Fin Imports, Exports}