Market Data

November 6, 2014

By 3-1 Margin Steel Buyers Non-Believers in Price Increase

Written by John Packard

Steel Market Update (SMU) conducted our early November flat rolled steel market survey this week. We invited approximately 600 companies to participate in the process. Of those participating 44 percent were manufacturing companies and 44 percent were steel service centers. The balance of the respondents was comprised of 6 percent trading companies, 5 percent steel mills and 1 percent toll processors.

![]() We asked our respondents if, in their opinion, the $20 per ton price increase announced by AK Steel, Nucor, USS and ArcelorMittal would be collected on new spot flat rolled orders. Seventy five percent of the respondents said “no” with the remainder believing the increase would be collected.

We asked our respondents if, in their opinion, the $20 per ton price increase announced by AK Steel, Nucor, USS and ArcelorMittal would be collected on new spot flat rolled orders. Seventy five percent of the respondents said “no” with the remainder believing the increase would be collected.

We had some interesting comments from our respondents on this subject:

A service center steel buyer told us, “This increase was intended to stop the slide. I think it will accomplish that but no increase will be collected.”

A corporate buyer for large manufacturing group told us, “Not even mentioned at our most recent discussions post the announcement. They are all about holding the current state as they have been incredibly successful at holding a price level not supported by all the fundamentals.”

Another manufacturing executive told us, “The mills don’t think they’ll get it either, that’s why they only raised it $20. Some didn’t even bother with it. Inventories are UP at the SSC [steel service centers], Imports are the 3rd highest on record, Iron Ore is down almost 50% from the high of last year, and scrap is coming down. Business is fair at best, so how do they keep the price elevated?”

The president of a Midwest service center told us, “Dollar incredibly strong /weak scrap prices/ service center inventories growing equals a failed attempt to increase prices.”

Another service center reported to SMU during the survey process, “not until everyone has January lead-times”

A manufacturing steel buyer told us, “Maybe, but if so, the only question will be for how long.”

Another manufacturing steel buyer reported, “They will get some part of it, they are all hurting for business.”

While a service center told us, “it will provide a floor until the December books are closed. Then they will raise again and begin to collect it.”

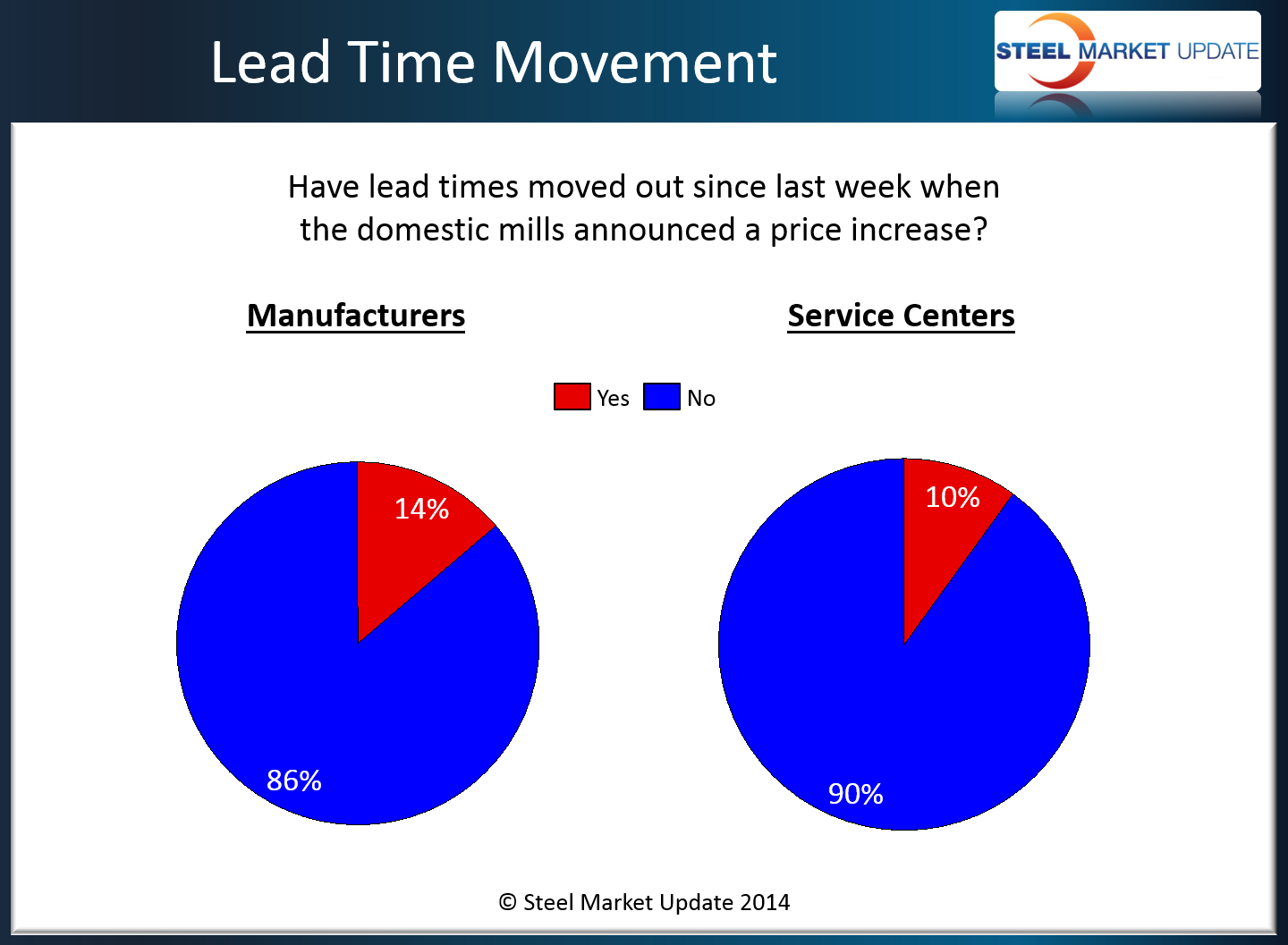

Usually, when a price announcement is made lead times tend to extend signifying strength in the order books of the domestic mills making the announcements.

SMU asked our respondents if the lead times have moved out since the price increase announcement was made last week. Here is how they responded:

Steel Market Update is of the opinion that we are still early in the process and we continue to have our SMU Price Momentum Indicator pointing toward Neutral, indicating market prices are either in transition (moving from Lower to Higher) or will tread sideways for a period of time. It is important for the domestic mills to get their lines full for the balance of this calendar year and then hope the industry has a normal surge of orders in early January.

Our sources are advising us that NLMK USA and Steel Dynamics are making sounds as though they too will join AK Steel, USS, ArcelorMittal and Nucor in the coming days. SMU will wait at least until the middle to end of next week before making any decisions regarding changing our Momentum Indicator direction.