Prices

October 21, 2014

October Steel Import License Trending Report

Written by Brett Linton

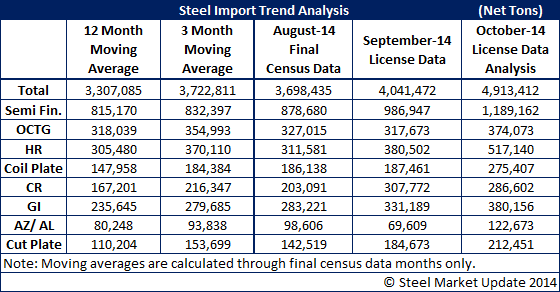

The following is our October analysis of the flat rolled and OCTG imports based on license data through October 21, 2014. As we have mentioned many times, license data is not exact and many times can lead one to over or under project final steel import numbers. We have seen license data for the first three weeks of this month at very high levels which leads us to believe imports could very well match the September 4.0 million net tons.

If October comes in at 4.0 million tons it would be the third time the U.S. has seen imports at that level during this calendar year. The license data is currently “suggesting” that imports could exceed 4.0 million tons if licenses continue to pour in at the current rate.

The largest single product imported into the United States continues to be semi-finished steels (mostly slabs) which are brought in by the domestic steel industry. We anticipate that close to 25 percent of the imports will have been purchased by the steel mills themselves.

Hot rolled is also trending to exceed its 12 month and 3 month moving average. South Korea is currently the largest supplier, which makes sense as they have to feed HR to USS/Posco. There are quite a few countries which have already requested in excess of 20,000 net tons of licenses for HRC: Canada, Russia, Japan, Australia and the Netherlands.

South Korea continues to be a big player in the OCTG with almost 50 percent of the licenses coming from that one country.

We continue to see China as the major exporter of cold rolled and galvanized.

Taiwan is the big player when it comes to “other metallic” of which most is Galvalume.