Prices

September 30, 2014

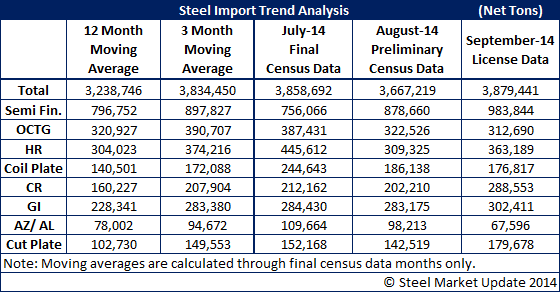

Steel Import License Data Suggests September Will Be Another Big Month

Written by Brett Linton

As we try to point out on regular basis, import license data is an imperfect program and can only suggest what ballpark the final number will be in. Last week the import license data was suggesting September would meet or exceed 4.0 million net tons (all products). Based on license data updated on September 30th, September now looks to be another strong month with total imports expected to come in somewhere between 3.7 and 3.9 million net tons.

The biggest difference between last week’s license data and this week is in semi-finished steels. Last week it looked like the mills would receive somewhere between 1.0 and 1.2 million net tons of semi-finished steels (slabs, billets, blooms). The most recent data has that number closer to 900,000 to 1.0 million net tons which is still a big number when compared to the 12 month moving average.

Cold rolled is still on pace to exceed June’s high for this calendar year (233,790 net tons) with China requesting 142,436 net tons worth of licenses.

Galvanized also continues to look like it will challenge the May high of 294,306 net tons.

Galvalume are declining and appear will come in below both the 12 month and 3 month moving averages.

Please remember that our analysis is based on U.S. Department of Commerce import license data which is updated by the US DOC on their website every Tuesday evening (in metric tons – we convert the data to net tons for our readers). Licenses are good for recognizing trends but can sometimes miss the final census mark by a wide margin. The last column of the table above is based on license data collected through September 30, 2014. We would expect there to be adjustments to these numbers when the preliminary census numbers are released later in October.