Prices

September 25, 2014

August Steel Imports: Down 5 Percent over July, Up 27 Percent over Last Year

Written by Brett Linton

Foreign steel imports accounted for 27 percent of the August 2014 monthly usage and a like percentage for annual steel usage according to data just released by the American Iron and Steel Institute (AISI). Foreign imported steel tonnage was lower in August than the prior month but is way ahead of the tonnage received in August 2013. You can view the AISI press release by clicking here.

Below is a press release issued by the American Institute for International Steel (AIIS) titled “Steel Imports Slip to 3.67 Million Net Tons in August” :

(Falls Church, VA) – Steel imports in August remained well above their level of a year earlier, even as they dipped below the July numbers.

Imports decreased 5 percent from July to total 3.67 million net tons in August. Imports from South Korea and Brazil showed the biggest declines, with the former falling nearly 24 percent to 450,000 net tons and the latter dropping more than 29 percent to 312,000 net tons. As for the NAFTA countries, Canadian imports were down 5.7 percent to 497,000 net tons, while Mexican imports were up 11 percent to 326,000 net tons. Imports from the European Union fell 8.2 percent to 583,000 net tons.

Notwithstanding the month-to-month decreases, major trading partners increased their steel shipments to the United States relative to August 2013. Brazil was the exception, with imports from that nation almost 22 percent below the amount from a year earlier. Overall, imports were 27.4 percent higher in August 2014 than they were in August 2013.

The year-to-date import total was up 35.5 percent compared to the first eight months of 2013 to total 28.63 million net tons. Imports from Russia increased 243 percent year-over-year, while the U.S. bought 46 percent more steel from South Korea. Imports from the European Union were up 41.4 percent, Mexico 10.7 percent and Canada 8 percent.

Semifinished imports increased by one-third in the past year to reach 899,000 net tons in August. Year-to-date, though, they are 7.2 percent lower than they were through the first two-thirds of 2013.

The decrease in South Korean imports in August may be repeated in coming months. On Aug. 22, the U.S. International Trade Commission confirmed a Commerce Department ruling that found that South Korean companies had sold oil country tubular goods in the U.S. at what it considered to be less than fair value prices. As a result, duties are to be imposed on steel products from that country. Notably, about a month later, The Wall Street Journal published a story about how U.S. Steel is becoming more efficient and more competitive through a series of internal reforms. This approach recognizes and responds to underlying competitive challenges and doesn’t rely on branding legitimate price competition from imports as “unfair.”

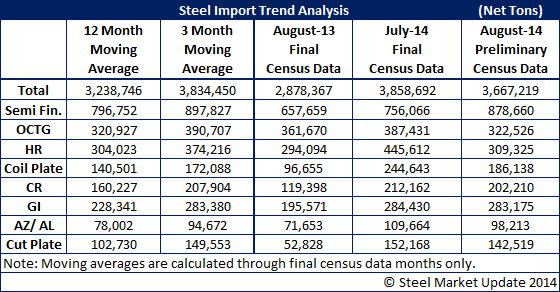

Below is a table by Steel Market Update showing import figures for select products for the months of August 2013, July 2014, and August 2014.