Prices

September 11, 2014

Net Imports of Sheet Products through July 2014

Written by Brett Linton

The supply of sheet products had strong positive growth in the 3 months period May – July year over year (y/y) led by cold rolled which was up by 19.4 percent, (Table 1). In total on this basis sheet products were up by 14.8 percent.

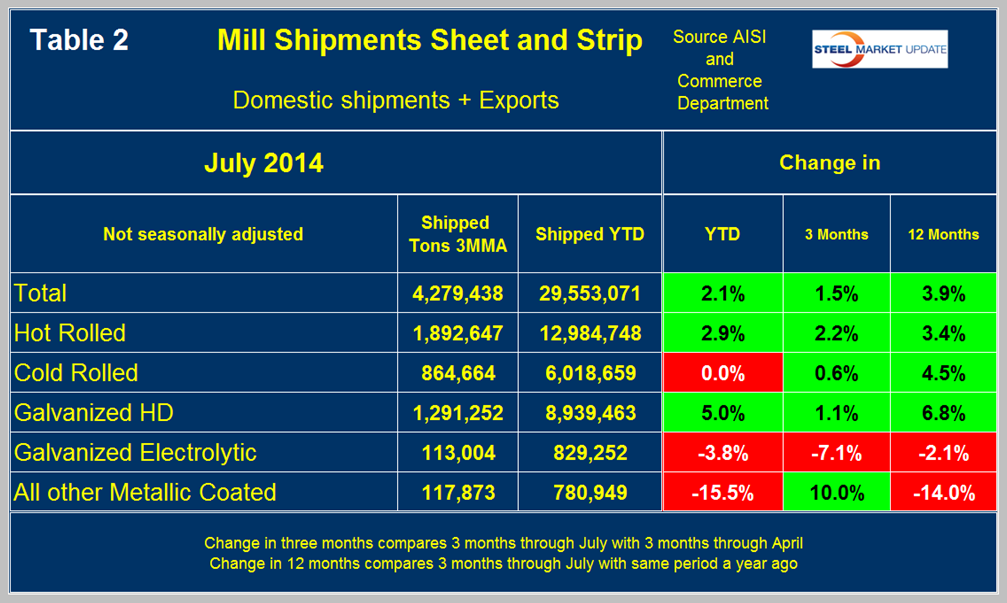

The sources of this analysis are the Commerce Department trade statistics and AISI steel shipment data. These results contrast markedly from the growth of mill shipments which are shown in Table 2. In the three months through July, mill shipments grew by only 1.5 percent year over year. The difference is imports which for sheet products in total were up by 62 percent in the same period year over year.

Net imports = imports minus exports, we regard this as an important look at the overall trade picture and its effect on demand at the mill level. Figure 1 shows that net sheet product imports on a three month moving average (3MMA) basis increased in July to the highest level since before the recession. The deterioration in net was entirely an import effect, exports have been fairly consistent since Q4 2009.

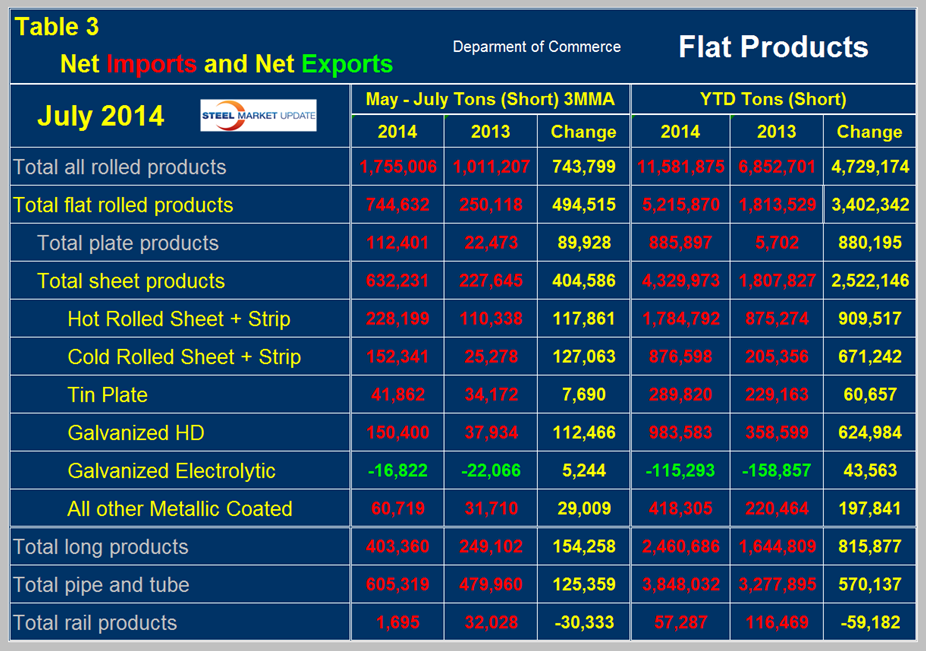

Table 3 shows net imports by product. Year to date through July, total flat rolled net imports were 5,215,870 tons of which 4,329,973 tons were sheet products. Net sheet imports more than doubled y/y being up by 2,522,146 tons. Net imports increased on all products except rail. Electro-galvanized was the only product to have a trade surplus in 2013 and 2014 year to date but this surplus declined in 2014. In Table 1 negative net imports, (which means a trade surplus) are shown in green.

Figure 2 shows the trend of monthly net sheet product imports since January 2011 on a 3MMA basis. Hot rolled, cold rolled and DG have increased strongly this year and are far higher than at any time since we began this analysis in January 2011. The trade surplus of electro-galvanized has been dwindling since late 2011.

It is clear from this analysis that the domestic sheet mills are having very little participation in the positive market growth that has prevailed in 2014.