Market Data

September 5, 2014

Key Market Indicators September 4th 2014

Written by Peter Wright

An explanation of the Key Indicators concept is given at the end of this piece for those readers who are unfamiliar with it.

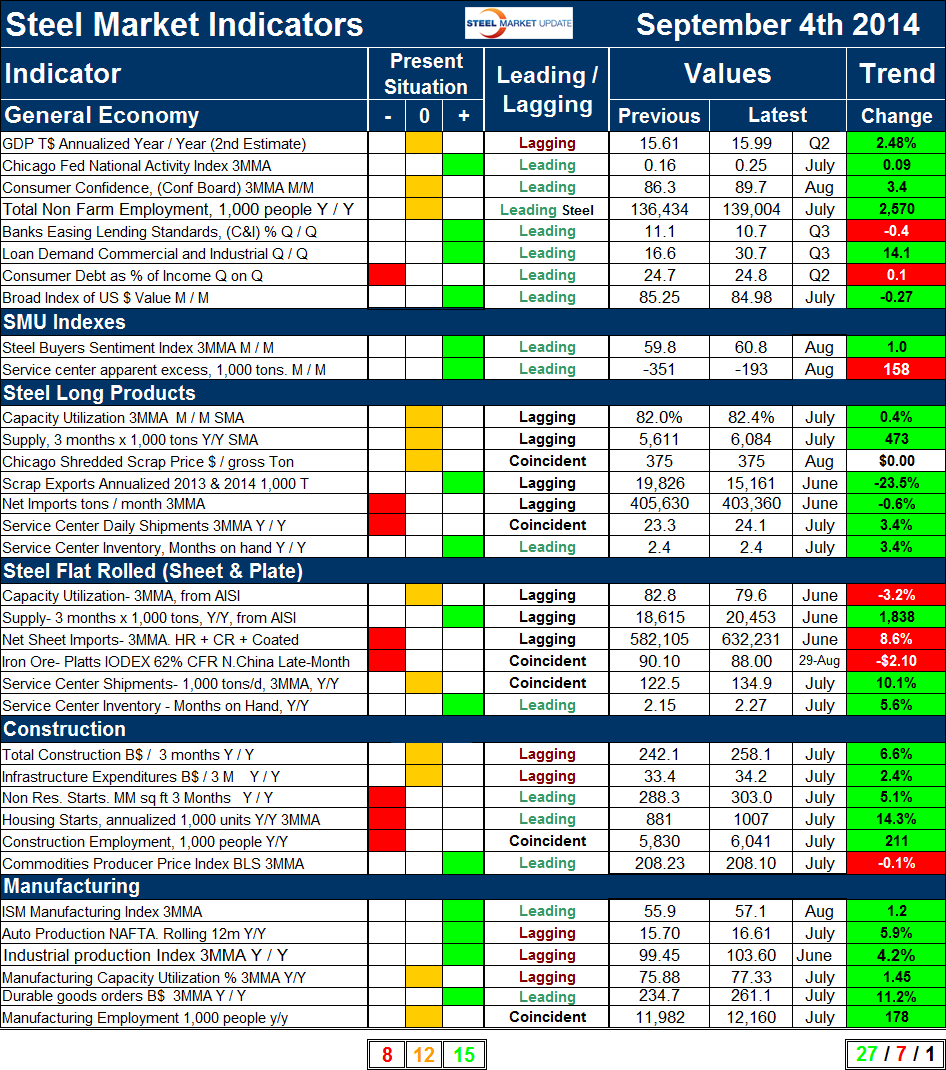

The total number of indicators considered at present is thirty five, the Chicago Fed Mid-West Manufacturing Index is still on hold to enable the staff to complete a major re-vamp of the structure of their report. Please refer to Table 1 for the view of the present situation and the quantitative measure of trends. Fifteen of the present situation indicators based on historical standards were positive on September 4th and eight were negative with twelve considered to be close to the historical norm. This is an increase of two positive and a decrease of two neutral since the last publication one month ago.

Our view of the present situation of the general economy improved in the last month and is looking much better with four indicators positive, three neutral and one negative. It now looks as though the result for Q1 GDP was an outlier and that growth in Q2 returned to the trend line that was established in 2013. Having said that, the Q1 result was much more than a weather event as both net exports and the inventory contribution were very deleterious. The changes in the last month were as follows. The Chicago Fed National Activity Index (CFNAI), was moved from neutral to positive on the strength of their latest report which itself is a composite of 84 sub-indices. Consumer confidence was moved from negative to neutral. Even though multiple analysts still regard consumer confidence as depressed, the fact is that the value of the composite index published by the Conference Board is now almost at the average for the last 34 years, (1980). The Broad Index value of the US $ was moved from neutral to positive on the strength of a decline of 0.27 which will help retard imports and promote exports.

Both the SMU buyer’s index and the SMU service center excess are currently positive. Service centers took in 193,000 tons less than they shipped which we interpret as positive for prices going forward as their inventories are lean. The steel buyer’s sentiment index is at another all-time high at 60.8 having increased from 59.8 at this time a month ago. The buyer’s index is based on a survey of sheet producers and consumers and is not intended to be inclusive of long product market conditions.

There were no changes in the present situation of the long products indicators. Net imports and service center shipments continue to be unsatisfactory by historical standards. In the flat rolled section “supply” was changed from neutral to positive in recognition that monthly tonnage is now back to where it was before the recession. Net imports of sheet products continue to surge and are now up by 100 percent since late 2011. The price of iron ore fell to $88 on August 29th and has since fallen further resulting in a re-classification from neutral to negative. A high iron ore price is indicative of a strong global market, the reverse suggests that tonnage will increasingly be crossing the oceans looking for a home on our shores.

Our view of the current state of both construction and manufacturing is unchanged in the last month. Both nonresidential and residential construction starts are rated historically negative as is the total number of people employed in construction. The only indicator rated positive in the construction category is the producer price index of commodities for which we believe a high value is correlated with industrial construction activity, particularly in the energy sector. None of the manufacturing indicators on a present situation basis are currently negative, four are positive and two are neutral which is unchanged in the last month.

This is the best review of the present situation since February 2010 when we first began this analysis.

The quantitative analysis of the value of each indicator over time is shown in the “Trend” columns of Table 1. There is nothing subjective about this section of the analysis. Reported numbers are the latest “facts” available. The total number of positive trends in August increased by one from our July 29th report with a total of 27 out of 35 indicators heading in the right direction, also the best result in the time that we have performed this analysis. Changes in the individual sectors are described below. (Please note in most cases this is not August data but data that was released in August for previous months.)

In the general economy the CFNAI and the value of the Broad Index of the value of the US $ both reversed direction from negative to positive. We regard a falling $ as a positive because of its influence on net imports.

There was no change in trend direction of the SMU proprietary indexes. Buyer’s sentiment once again broke new ground on the high side and the service center excess declined for the second consecutive month.

In the long products section, net imports reversed direction and trended positive in the June data but only slightly and are still extremely high. Net imports of long products were zero in late 2011! The price of Chicago shredded was unchanged in August. Service center shipments and inventory both increased for the fourth consecutive month.

In the flat rolled section the capacity utilization of the US mills declined for the second straight month but total supply, (domestic shipments + imports) increased for the third straight month. This is because imports took domestic share and then some. Net imports increased by 8.6 percent in August compared to July on a three month moving average basis. Iron ore continued to decline as mentioned above and this is regarded as a negative trend. Service center shipments trended positive for the twelfth straight month.

In the construction section only one indicator reversed direction from positive to negative. This was the producer price index of commodities and the negativity was very slight. We regard this indicator as a driver of industrial construction which is still strong. Nonresidential and residential construction continue to improve but as we have reported elsewhere they both have a long way to go.

All trends in the manufacturing sector have been positive for four straight months. The ISM manufacturing index surprised on the upside in August at 59.0. The three month moving average rose to 57.1, the highest level since May 2011.

The key indicators analysis is looking much better in its measure of the present situation and trends are very good which bodes well for the balance of 2014. SMU has several benchmark analyses that show steel demand to be below the historical norm for this stage of a recovery. This is because the recession in non residential and housing construction was so extreme that it will be years before the 2007 levels are regained. In addition government funded infrastructure work is still depressed. We believe a continued examination of both the present situation and direction is a valuable tool for corporate business planning.

Explanation: The point of this analysis is to give both a quick visual appreciation of the market situation and a detailed description for those who want to dig deeper. It describes where we are now and the direction in which the market is headed and is designed to give a snapshot of the market on a specific date. The chart is stacked vertically to separate the primary indicators of the general economy, of proprietary Steel Market Update indices, of both flat rolled and long product market indicators and finally of construction and manufacturing indicators. The indicators are classified as leading, coincident or lagging as shown in the third column.

Columns in the chart are designed to differentiate between where the market is today and the direction in which it is headed. It is quite common for the present situation to be predominantly red and trends to be predominantly green and vice versa. The present situation is sub-divided into, below the historical norm (-), (OK), and above the historical norm (+). The “Values” section of the chart is a quantitative definition of the market’s direction. In cases where seasonality is an issue, the evaluation of market direction is made on a three month moving average basis and compared year over year to eliminate this effect. Where seasonality is not an issue concurrent periods are compared. The date of the latest data is identified in the third values column. Values will always be current as of the date of publication. Finally the far right column quantifies the trend as a percentage or numerical change with color code classification to indicate positive or negative direction.