Prices

July 10, 2014

Steel Exports Remain Down in May

Written by Brett Linton

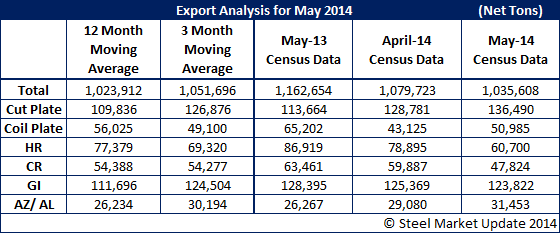

Total US Steel Exports in May were 1,035,608 net tons, down 4.1 percent over April tonnage and down 10.9 percent over May 2013 levels. Eighty Nine percent of May exports were to Canada and Mexico, receiving 559,231 and 363,325 tons respectively.

Exports of plate cut lengths were 136,490 tons, up 6.0 percent over April and up 20.1 percent over the same month one year ago. Plates in coils increased 18.2 percent over April to 50,985 tons but were down 21.8 percent over May 2013 exports.

Hot rolled exports dropped 23.1 percent over April to 60,700 tons, and were also down 30.2 percent over levels one year ago. Exports of cold rolled products were 47,824 tons in May, down by 20.1 percent compared to the previous month and down 24.6 percent over May 2013.

Galvanized exports were 123,822 tons in May, down 1.2 percent over April and down 3.6 percent over May 2013. Exports of other metallic coated products rose 8.2 percent month over month to 31,453 tons, an increase of 19.7 percent compared to levels one year prior.

The American Institute for International Steel (AIIS) reported the following:

Steel exports in May fell for the first time in three months.

The United States exported 1.04 million net tons of steel in May, 4.1 percent below April exports and 10.9 percent less than the May 2013 level.

Exports had increased by 3.8 percent in April and 15 percent in March

Exports to the U.S.’ two major steel trading partners – Canada and Mexico – were down only slightly to 559,231 net tons and 363,325 net tons, respectively. A 75 percent drop in exports to the Dominican Republic – which had spiked in April – to 6,077 net tons accounted for two-fifths of the overall decline. Exports to the European Union fell nearly 19 percent to 28,387 net tons.

For the year, exports are down 7.3 percent to 5,022,282 net tons. Canada has accounted for more than a quarter of the decrease in tonnage, with exports north of the border falling 3.7 percent. Exports to the EU through May are 22 percent lower than they were during the same time last year, while exports to Mexico are up 1.4 percent year-to-date. Not including the multi-nation EU, China has been the third-largest recipient of U.S. steel for the year, with exports up more than 30 percent over the first five months of 2013. Notwithstanding the significant drop in May, the Dominican Republic has been the fourth-largest recipient, though its year-to-date total is almost 54 percent lower than it was a year ago.

A 4 percent monthly drop in exports should not alarm anybody, especially when nearly half of the decrease can be tied to economic variables in a single small nation – the Dominican Republic. While the year-to-date decline is more significant, this reflects early 2014 numbers that were dampened by harsh winter weather. With the U.S., Canada, Europe and the rest of the Northern Hemisphere now into the summer construction season, we are likely to see overall steel use increase, a trend that could push up both exports and imports.

Total steel exports in May 2014 were 1.035 million tons compared to 1.080 million tons in April 2014, a 4.1 percent decrease, and a 10.9 percent decrease compared to May 2013. According to year-to-date figures, exports decreased 7.3 percent compared to 2013, or from 5.418 million tons in 2013 to 5.022 million tons in 2014.

SMU Note: You can view the interactive graphic of our steel exports history below, but only when you are logged into the website and reading the newsletter online. If you have not logged into the website in the past and need to know your log in information, please contact us at: info@SteelMarketUpdate.com or by calling 800-432-3475.

{amchart id=”107″ Total Exports- All Products, Monthly, Net tons}