Prices

July 10, 2014

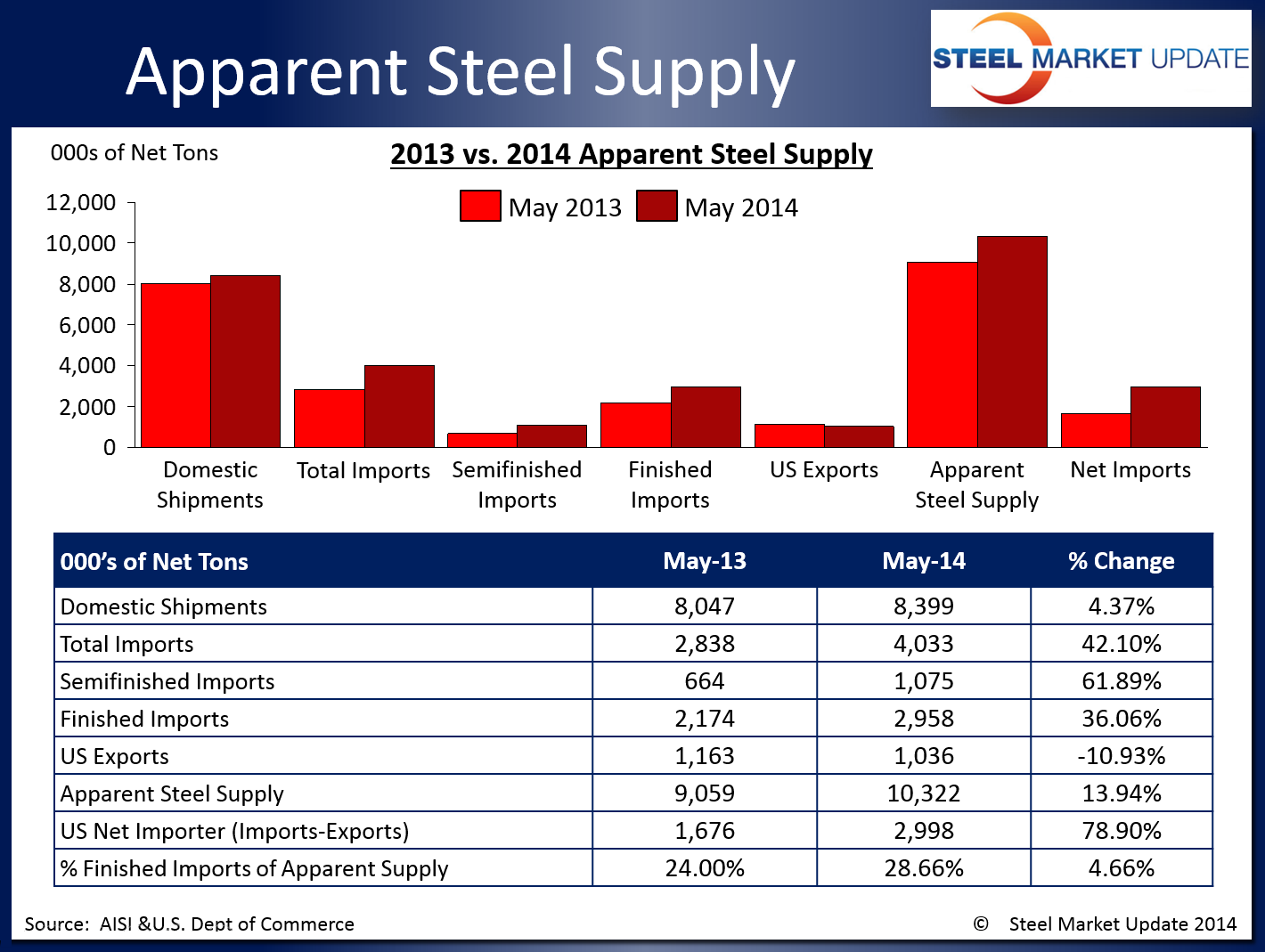

May Apparent Steel Supply at 4+ Year High

Written by Brett Linton

Apparent steel supply for May was 10,321,747 net tons, the highest figure Steel Market Update has in its recorded history back to January 2010 (by no means a historical record). Steel Market Update calculates apparent steel supply by adding domestic shipments and finished US imports and subtracting total US exports. May supply represents a 1,262,877 ton or 13.9 percent increase compared to the same month one year ago. This is primarily due to the massive spike in 2014 imports, with final May imports up 42.1 percent or 1,195,058 net tons over May 2013 tonnage. Domestic shipments and finished imports also increased over levels one year prior, while exports decreased. The net trade balance between imports and exports was a surplus of 2,997,743 tons in May, an increase of 78.9 percent from the same month last year, and also the highest figure in our 4+ year recorded history.

When compared to last month when apparent steel supply was at 9,925,287 tons, May supply increased by 396,461 tons or 4.0 percent. This is due to an increase in domestic shipments, total imports, and finished imports, but a decrease in total exports.

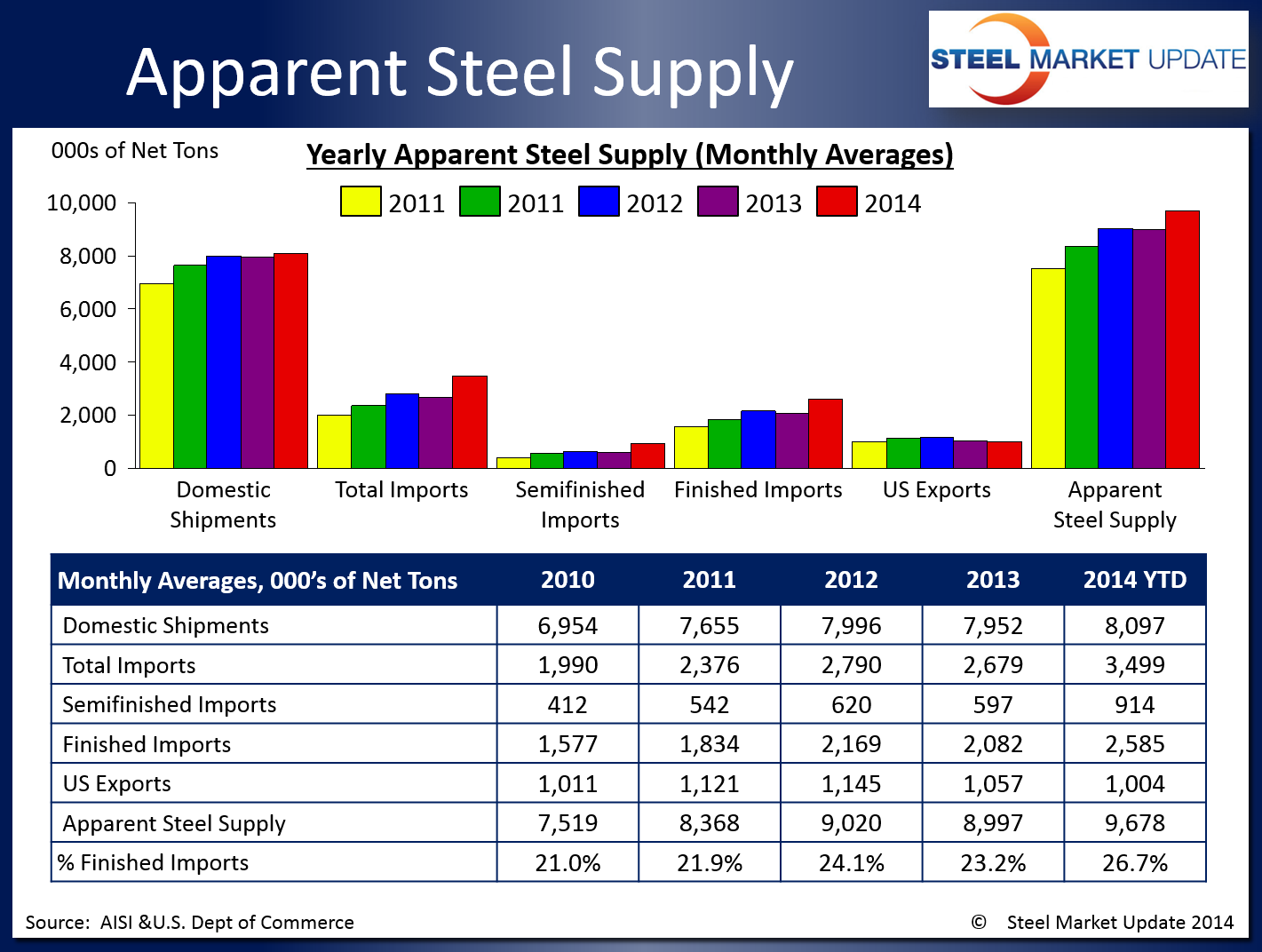

On a year to date basis, the 2014 YTD averages are all above what we saw during in the previous two years, with the exception of total exports. They are significantly higher than the averages we saw in 2010 and 2011.

SMU Note: You can view the interactive graphic below when you are logged into the website and reading the newsletter online. If you have not logged into the website in the past and need a new user name and password we can do that for you out of our office. Contact us at: info@SteelMarketUpdate.com or by calling 800-432-3475. If you need help navigating the website we would also be very happy to assist you.

{amchart id=”120″ Apparent Steel Supply- Domestic Shipments, Semi-Fin Imports, Exports}