Prices

June 8, 2014

April Imports: An Additional One Million Tons

Written by Brett Linton

The U.S. steel mills exported 1 million tons of steel during the month of April. This is within the 12 month moving average and only slightly higher than the 1,041,387 net tons shipped in April 2013. During the same month (April 2014) foreign imports rose by 999,557 net tons compared to the same period one year ago. The just released final census data has imports at their highest mark in years at 3,738,027 net tons.

The revised May license data as of June 4th has May at 3.993 million net tons or 1.155 million tons greater than the same month last year.

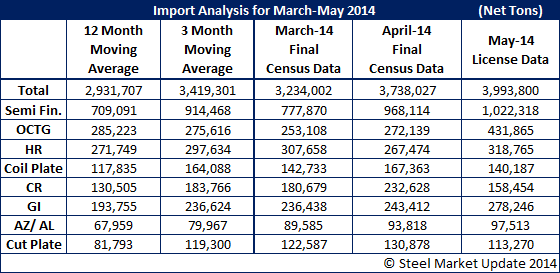

In the table below you can see how April imports stand up against the previous month (March 2014) as well as the 12 month and 3 month moving averages. In each case we would have to consider the 3.7 million net tons as representing a “surge” in imports. US DOC license data now compiled through June 4th indicates the surge of imports will continue into the month of May.

The steel mills themselves continue to be the single largest group of importers of foreign steel as almost 1 million net tons of semi-finished steel (mostly slabs) arrived into the United States to support the production of such mills as AM/NS Calvert, California Steel, NLMK USA, AK Steel, Evraz and others. It should also be noted that a not insignificant amount of the hot rolled imported is also for consumption by U.S. producing mills like USS/POSCO and Steelscape. Our Premium subscribers will get more details later this week on the imports by product, port and country which will assist in determining where the steel is going.

South Korea, oblivious to any risk they might have with their exports of oil country tubular goods (OCTG) due to the ongoing dumping investigation and final determination, shipped 94,795 net tons of OCTG during the month of April. They were by far the largest single exporter of OCTG to the U.S. followed by Canada at 36,401 net tons. As you see by our table below, the month of May is looking like OCTG imports will exceed 400,000 net tons. In a market that can support only 7 million tons the levels being seen and suggested are unsustainable to continue to have a viable U.S. OCTG industry. I thought the highlighted article in the Pittsburgh Post-Gazette might be of interest to our readers. It is about buyers of OCTG not buying American…

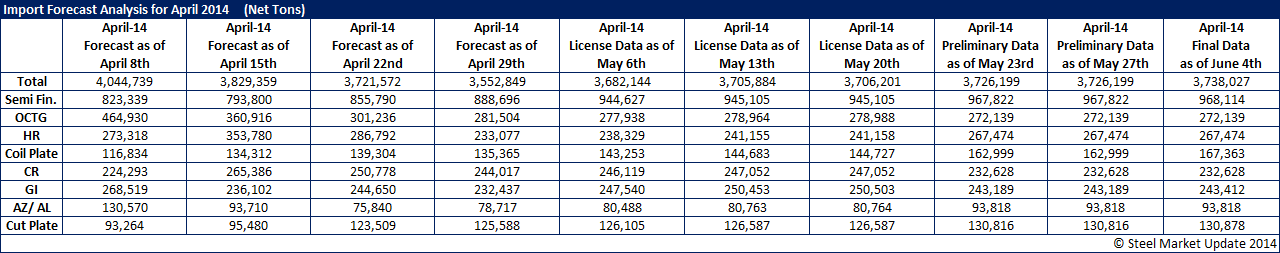

Steel Market Update analyzed April imports based on weekly license data, which we know is suspect as explained to our readers by David Phelps, the recently retired president of the American Institute for International Steel. We analyzed SIMA license data back on April 8th and came up with the potential for April imports to reach 4,044,739 net tons. We took the 4.0 million ton level with a grain of salt, as it was only based on one week’s worth of license data. Throughout the month of April our analysis of license data bounced around and and, at one point, was indicating imports as potentially low as 3,552,849 tons. The data was finalized by the Department of Commerce late last week, with total April imports coming at 3,738,027 tons, a 999,557 ton or 36.5 percent increase over the same month one year ago.

Below is a table with each of our import forecasts for April data. Note that these figures were calculated each time the US DOC updated their data (click the image to view a larger version).

Below is an interactive graphic on steel imports on various products, but it is only accessibly when you are logged into the website and reading the newsletter online. If you have not logged into the website in the past and need a new user name and password we can do that for you out of our office. Contact us at: info@SteelMarketUpdate.com or by calling 800-432-3475. If you need help navigating the website we would also be very happy to assist you.

{amchart id=”105″ Steel Imports- All Products, Final Data by Month}