Prices

May 20, 2014

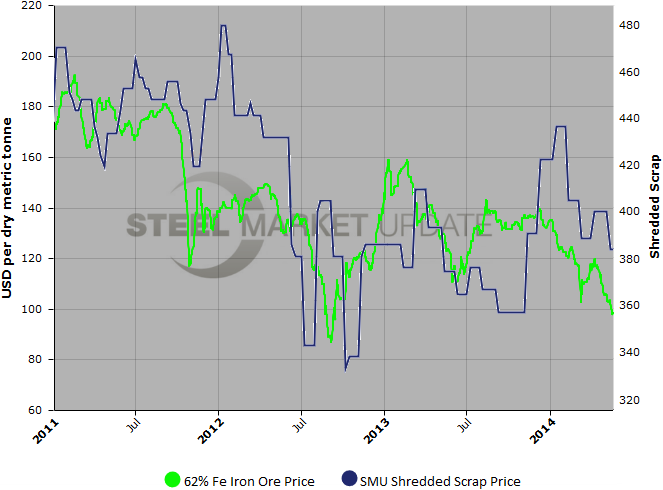

Iron Ore Prices Slip Will Scrap Prices Follow?

Written by John Packard

Iron ore spot prices in China have been falling and may continue to decline to the lows last seen in September 2012 when prices for 62% Fe fines reached into the $80’s (currently trading at $97.5/dmt). Steel Market Update has been reviewing the relationship between iron ore and ferrous scrap prices using shredded scrap as our base product. We have been told in the past that there was a direct relationship between the products (see graphic).

As we inquired with a number of our sources today, we were reminded of what we were told in the past as one scrap dealer said, “There is definitely a correlation between ore and scrap prices. There always has been and always will be because they are both iron units. I am far from an expert in the technical analysis of the correlation. But my understanding is that scrap prices can trade at 3-5 ore values. In the 2012 period you referred to, scrap traded around 3-3.5x ore. My sense is that scrap is tighter today than it was two years ago (i.e., volumes are much lower), so the multiple could expand from where it was then. If ore stays around $100/ton, scrap could still stay where it is currently or not drop much and the multiple would be around 4x which doesn’t seem unreasonable to me.”

We traded emails with Mike Marley of Metal Prices. Mr. Marley has long been considered the guru of the scrap market and we are looking forward to Mr. Marley participating as one of our speakers at this year’s Forecasting and Steel Summit Conference to be held in Atlanta on September 3 & 4th. He provided us the following commentary:

“I’m not sure it can fall that low [$340 per gross ton for shred] and stay there without severely crippling the supply.

“There is a correlation between iron and scrap, but it is a laggard. Scrap prices tend to follow the moves in iron ore by a few months. There are several reasons for this but the most important is that the U.S. is not as dependent on iron ore as China, Japan and South Korea. If we exclude Canada, the only imported iron brought to the U.S. is pig iron from Brazil, Ukraine and Russia. HBI [hot briquetted iron] is a nonfactor because of the chaos in Venezuela. HBI is available from Russia and Ukraine, but the U.S. mills consider it dirtier and don’t like it.

“Currency exchange rates play a minor role. Turkey is a still a driver, particularly on the East and Gulf Coast. But it has not been as strong this year as it has in the past. Its scrap imports from the U.S. are off by one third. So are shipments to Asia. Overall U.S. scrap exports are tracking at a 14 million metric tonne rate this year, down from 20 million metric tonnes plus in the recent past.

“The delivered to the mill prices for shredded is now $380-400 per gross ton and dealers are talking about a softer market in June. That means zero to minus $10, but the mills and brokers will be looking to take back $20 or more. So, we could be halfway there by June.

“One factor that gets overlooked is feedstock, the flow of shreddable materials into dealers’ yard. One example and I’ll try to keep this brief. Now most shredders are offering $275 to $300 per ton for junk cars. If shredded slips to $340 per ton, they will have to cut their buying prices by $40 per ton or more. That will take the prices down to below $250 per ton and probably will reduce the flow of cars. Junk yards wield more power these days, in part because of the intense competition among the shredders. That means less material to shred. Also, Zorba (aluminum shredder residue) prices have fallen and that has cut profit margins. So, if mills and their brokers beat the prices down to $340 that reduces the flow into yards. It also gives the exporters an advantage. All of those folks operate mega-shredders at their docks.

“But we have a new wild card this year. Nucor’s DRI plant in Louisiana. It pumped out 450,000 tons in the first quarter but will not do as much this quarter because of a scheduled three-week maintenance outage. Still, it is having an effect on Nucor’s scrap consumption. Nobody is quite sure of its impact. Most believe Nucor will use less busheling. If that’s the case, there could be excess busheling and that price could tumble. It still serves as price ceiling for all the mill grades of scrap. So, even if shredded supplies shrivel, some mills could shift to busheling and not feel the shred loss as severely as they have in the past.

“In essence, I’m saying I don’t know yet. A well known industry analyst thinks shredded could drop to $300 per ton by year’s end, but I think that is an ill-informed opinion. If it drops that much and the steel industry is still running in the upper 70 percent operating rate, that will shut off the supply of feedstock. The mills can’t afford to do that. Shredded alone accounts for about one-third of the scrap supply and is consumed by all the mills—both the integrated and mini-mills.”