Market Data

April 28, 2014

Key Market Indicators - April 28th 2014

Written by Peter Wright

One of the products which is provided to our Premium Level members only is our Key Market Indicators. Our KMI analysis is showing an improving (more positives than negatives) situation, especially in the flat rolled steel markets. An explanation of the Key Indicators concept is given at the end of this piece for those readers who are unfamiliar with it.

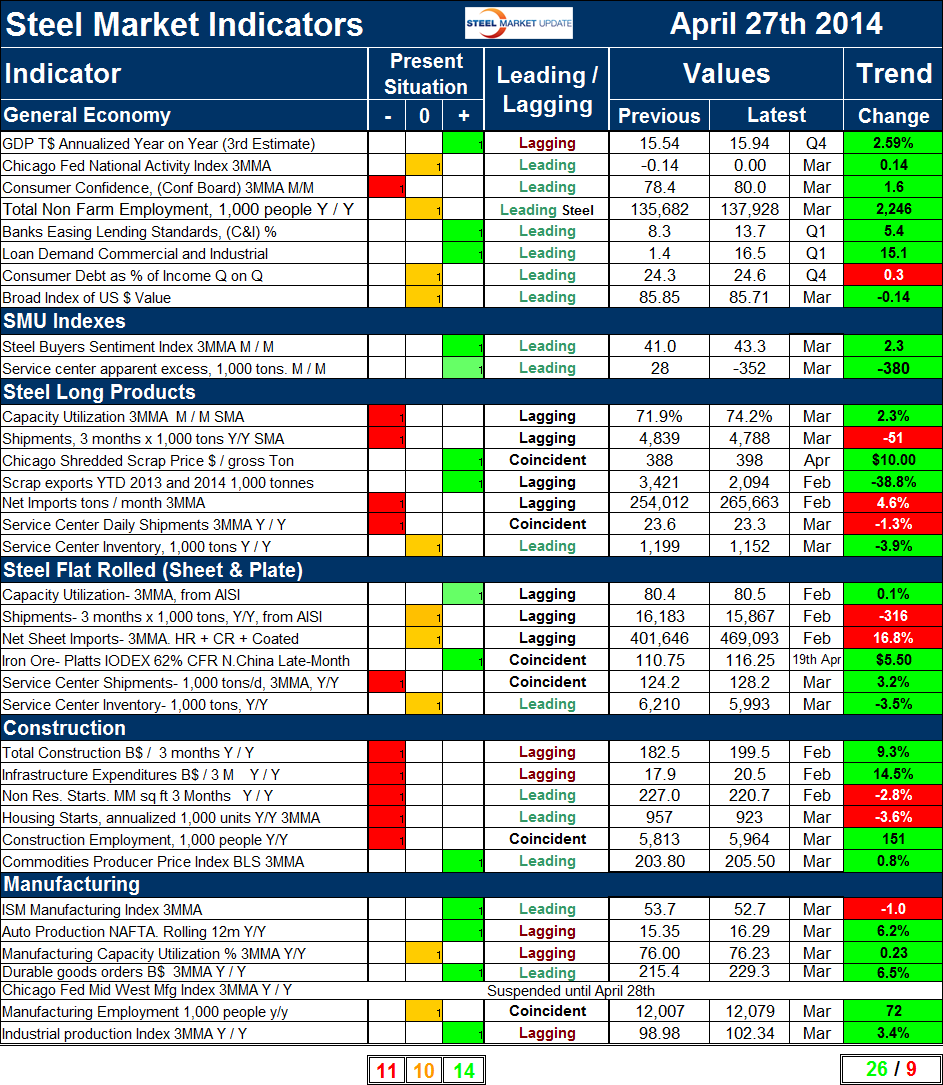

The total number of indicators considered at present is thirty five, a decrease of one as the Chicago Fed Mid-West Manufacturing Index has been put on hold until late April to enable the staff to complete a major re-vamp of the structure of their report. Please refer to Table 1 for the view of the present situation and the quantitative measure of trends. The present situation improved from last month’s analysis. Fourteen of the indicators based on historical standards were positive on April 27th and eleven were negative with ten considered to be close to the historical norm. This is the most positives and the least negatives since we began this analysis a year ago. Nine of the negative indicators were in the steel long products and construction sectors. It makes sense that these two groups would be in harmony. The general economy and manufacturing are with only one exception either positive or neutral. This broad look confirms that it is construction that is holding steel demand lower than is normal at this time in a cyclical recovery.

The present situation of the general economy is OK with three indicators positive, four neutral and only consumer confidence being negative.

Both the SMU buyer’s index and the SMU service center excess are currently positive. Service centers took in 352,000 tons less than they shipped which we interpret as positive for prices going forward as their inventories are lean.

Present situation indicators for long products are significantly worse than for flat rolled. Capacity utilization and mill shipments are both negative for long products but are positive and neutral respectively for flat rolled. Service center shipments are classified as historically week for both steel product groups but long products shipments are historically much worse than flat rolled. Net imports of long products are historically high but for flat rolled are neutral.

Five of the negative present situation indicators relate to construction, none of the manufacturing indicators are currently negative, four are positive and two are neutral.

The quantitative analysis of the value of each indicator over time is shown in the “Trend” column of Table 1. In last month’s report there was a significant shift in a negative direction, however the trends of data released in April improved and regained the level that has existed since October. (Please note in most cases this is not April data but data that was released in April for previous months.) In April twenty six of thirty five indicators trended in a positive direction, (up from twenty in March.)

Only one out of eight trends in the general economy trended negative in April, this was consumer debt which increased in the latest Federal Reserve estimate. Both the Chicago Fed National Activity Index and the Broad Index value of the US $ reversed course in April from negative to positive. (We regard a declining $ as positive because of its effect on net imports.)

The trend of the SMU steel buyer’s sentiment index continued to be positive and the trend of service center surplus intensified in a positive direction. We regard a deficit as positive as mentioned above. This indicator has moved from 150,000 ton surplus in February to a 28,000 ton surplus in March to a 380,000 ton deficit in April.

In the long product steel sector the 3MMA of capacity utilization improved from 71.9 percent in February to 74.2 percent in March. The price of Chicago shredded which had declined in March recovered by $10 in April and scrap exports YTD February were down by 38.8 percent year over year. Net imports measured as a 3MMA month / month increased by 4.6 percent in February / January. Other trends maintained their direction for long products, including service center shipments and inventory. Service center shipments of long products on a 3MMA tons / day basis year over year have contracted for 21 straight months. Likewise, total long product inventory on a y / y basis has declined every month in the same time period.

Of the six flat rolled steel indicators there was an improvement from four trending negative to four trending positive in the data released in April. Capacity utilization increased from 80.4 in January to 80.5 in February, both three month moving averages. Net imports of sheet products on a 3MMA basis continued to increase in February, up 16.8 percent from January. The price of iron ore which had been trending down recovered by $5.50 on April 19th. Service center shipments and inventories continued to trend in a positive direction. Service center tons / day shipments have now trended positive for eight straight months.

There was no change in construction trends in the last month. Four of six indicators are trending positive. The exceptions in data released in April were for nonresidential and residential construction starts in February and March respectively. Probably these contractions were weather related so we anxiously await the spring updates.

In the manufacturing sector one indicator reversed direction as manufacturing capacity utilization which contracted slightly in February, expanded by 0.23percent in March. Overall manufacturing had five positive trends and one negative in the latest data releases.

The key indicators analysis confirms our experience that the long products market driven by construction is in the doldrums but that the flat rolled market is much healthier. SMU has several benchmark analyses that show steel demand to be below the historical norm for this stage of a recovery. This is because the recession in non residential and housing construction was so extreme that it will be years before the 2007 levels are regained. In addition government funded infrastructure work is still depressed.

We believe a continued examination of both the present situation and direction will be a valuable tool for corporate business planning.

Explanation: The key indicators chart is designed to give a snapshot of the steel market on a specific date. The chart is stacked vertically to separate the primary indicators of the general economy, of proprietary Steel Market Update indices, of both flat rolled and long product market indicators and finally of construction and manufacturing indicators. The indicators are classified as leading, coincident or lagging as indicated.

Columns in the chart are designed to differentiate between the current situation and the direction in which the market is headed. The present situation is sub-divided into, below the historical norm (-), (OK), and above the historical norm (+). The “Values” section of the chart is a quantitative definition of the market’s direction. In cases where seasonality is an issue, the evaluation of market direction is made on a three month moving average basis and compared year over year to eliminate this effect. Where seasonality is not an issue concurrent periods are compared. The date of the latest data is identified in the third values column. Values will always be current as of the date of publication. Finally the far right column quantifies the trend as a percentage or numerical change with color code classification to indicate positive or negative direction.