Prices

April 24, 2014

Preliminary Census Data Has March Imports at 3.2 Million Tons

Written by Brett Linton

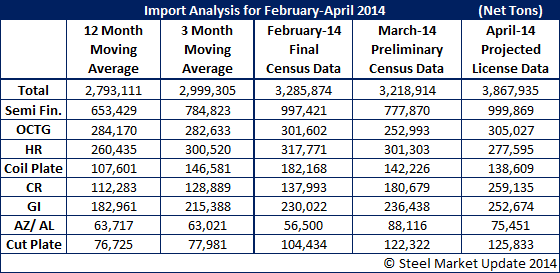

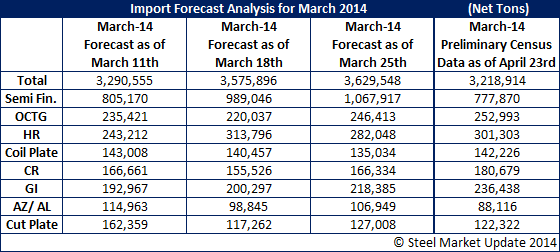

The U.S. Department of Commerce released preliminary steel import census data for March and reported total steel imports at 3,218,914 net tons (NT). Compared to February, March imports are down by 2.0 percent or 66,960 NT. Compared to the same month one year ago, total March 2014 imports are up 25.2 percent or 648,510 NT. As we have mentioned on numerous occasions, license data and projections from license data can be misleading and one should use that data as a way of identifying a trend but not a final number. The license data has been suggesting March imports would be 3.5 million tons instead of the just reported 3,218,914 net tons.

Slab imports fell 22.0 percent or 219,550 NT from February to March, but were up 56.6 percent over figures from the same month one year ago. As an aside, SMU is hearing that the biggest importers of slab are AM/NS Calvert, California Steel, NLMK USA and AK Steel.

Imports of oil country tubular goods (OCTG) in March were down 16.1 percent or 48,609 NT over February. Compared to import levels one year ago, March imports were up by 0.2 percent

Hot Rolled imports were down 5.2 percent over the previous month, but were up 40.4 percent compared to March 2013 figures.

March imports of cold rolled products rose 30.9 percent over February. Compared to one year ago, this month is an increase of 88.5 percent. The largest increase coming from Canada which increased by 20,000 net tons from the prior months and 25,000 tons compared to this time last year. China, compared to March 2013 was up 12,500 net tons while only being up 550 tons from the month of February. The top three exporters for the month of March were Canada, China and South Korea (up 55 percent from the month before).

Galvanized imports remained steady from February to March and increased by 2.8 percent. Looking back to the same month last year, March imports rose by 25.0 percent.

Imports of other metallic coated products (primarily Galvalume) were up 56.0 percent in March over the previous month. They were also up 41.2 percent over figures from March 2013. The biggest change coming from Taiwan which saw its exports rise by 15,800 tons compared to the previous month and up 17,160 tons over last March figures. The top 3 exporting countries are Taiwan, South Korea and China.

March imports for plates in coils fell 21.9 percent over February, but were up 96.6 percent compared to one year ago. The biggest change in plate in coils from last year were South Korea and Russia. South Korea is up by 23,300 tons and Russia by 14,800 tons.

Imports of plates cut lengths rose by 17.1 percent in March over the previous month. Looking back to this time last year, March 2014 imports are up 83.0 percent. Top three exporters are South Korea, Brazil and Turkey. South Korea had the largest increase over last year with 15,400 tons, Brazil was up 13,300 tons and Turkey also up 13,300 tons.

Below is a model of our import projections throughout the month of March and how they compare to the preliminary census data just released.