Market Segment

April 22, 2014

AK Steel Sees Industry Playing Catch Up Throughout the Summer

Written by Sandy Williams

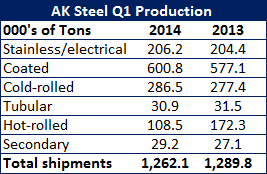

AK Steel reported a net loss of $86.1 million in the first quarter of 2014, compared to a net income of $35.2 million in the previous quarter. Net sales for Q1 were $1.38 billion on steel shipments of 1,262,100 tons, compared to Q1 2013 net sales of $1.37 billion on shipments of 1,289,800 tons, and net sales of $1.46 billion on shipments of 1,420,000 tons for the fourth quarter of 2013.

AK Steel earnings were impacted by the incident at the Ashland Works that resulted in an outage of the blast furnace and an acceleration of planned maintenance that was scheduled for second quarter. The outage reduced production by 100-150,000 tons. The extreme winter caused energy prices to soar pushing electric and natural costs up by $30 million compared to Q1 2013 and by $27 million compared to Q4 2013.

AK Steel earnings were impacted by the incident at the Ashland Works that resulted in an outage of the blast furnace and an acceleration of planned maintenance that was scheduled for second quarter. The outage reduced production by 100-150,000 tons. The extreme winter caused energy prices to soar pushing electric and natural costs up by $30 million compared to Q1 2013 and by $27 million compared to Q4 2013.

AK Steel’s average selling price in the quarter rose 3 percent to $1,096/ton, due mostly to value added products, but was offset by higher iron ore and carbon scrap. In addition, the company tentatively settled an antitrust lawsuit, incurring a charge of $5.8 million in the quarter.

In the company conference call James Wainscott, President & CEO, said because of delay of iron ore pellets due to the ice on the Great Lakes, AK Steel has reduced operating rates on two blast furnaces, increased production at the EAF at Butler Works and is supplementing its own carbon steel production with purchased slabs. Wainscott sees the steel industry playing catch up on ore shipments throughout the summer, and perhaps the entire year, due to the limited number of ore ships on the lakes.

Relatedly, AK Steel is working towards self sufficiency through vertical integration with its AK Coal and iron pellet facility Magnetation. Magnetation is on budget and on schedule to start production in late third or early fourth quarter of 2014. AK Steel’s mine in North Fork, PA will provide 500,000 tons of clean coal this year but the company is deferring opening of additional mines until market conditions improve.

Wainscott says he is not completely sold on the buzz coming from the aluminum industry. When it comes to light weighting vehicles, “Steel is not the problem, steel is a huge part of the solution,” says Wainscott. AK Steel is currently meeting all the needs of the auto industry and is ahead of the curve on development of 3rd generation high strength steels. Wainscott cautions consumers to choose wisely—to look at sticker price, insurance costs, aluminum vehicle repair, total emissions package and recycling. “When you look at those things, steel wins on all fronts,” he said.

Inventories are lean at AK Steel. The company reports the customer needs are being met despite the outages and iron ore shortage. “We honor agreements, no reset provision on those deals already set in place,” said Wainscott. The company has been increasingly approached to assist auto companies who are short on supply and facing outages but has limited tons available.

During beginning of first quarter the company was dealing 80/20 percent contract vs. spot price, but has improved to 75/25 with all coated and cold rolled spoken for. Recent price increases have been on hot rolled.

On the increase in steel imports and the widening spread between foreign and domestic steel, Wainscott said they believe the spread is around $100 or less per ton versus the $150 ton widely reported and not “especially meaningful” when considering the risk, time lag and freight costs.