Market Data

April 10, 2014

BofAML Quarterly Steel Outlook

Written by Sandy Williams

Bank of America Merrill Lynch gave their quarterly global steel outlook on April 8. BofAML predicts demand for finished steel in China will grow 4.4 percent in 2014. Chinese crude steel production is expected to increase 4.6 to 815 million tons. The outlook is for a trend of slowing but positive growth.

Despite mill closings due to government crackdowns on environmental issues and tougher credit requirements, China still has over one billion tons of overcapacity. The recent slowdown in production is attributed to seasonal slowing with production picking up in March and with warmer weather.

Iron ore and coking coal prices have fallen but margins remain low due to lower steel prices, but there are some signs of profitability in recent financial results. There is also optimism in some markets based on talks of government stimuli for social housing and infrastructure.

In Japan, BofAML is seeing strong domestic demand and an influx of imports; exports are weak. Domestic spot prices have jumped with galvanized up JPY 7,000-10,000 ($68-$98/ton)—a 7-10 percent increase. Specialty steel rose JPY 10,000/ton ($98/ton) or 5-7 percent. Mini mill steel is very strong in tandem with a strong automotive market. EAF margins are expected to expand with weak steel scrap prices.

India steel demand is down and is expected to grow 3.2 percent y/y in FY 2014 and 6.8 percent in FY 15. Higher exports combined with outages and delays have helped to balance the domestic market in the first half of FY 2014. Overcapacity is still a threat as new capacity ramps up.

India is facing high interest rates, poor auto demand, weak infrastructure activity and construction. It is expected that India will remain a net exporter of steel. Domestic steel prices have been steady but a recent drop in input prices may cause steel prices to fall. Some price cuts have been announced in April with more likely ahead.

In Russia, the domestic market rose 3 percent in 2013 driven by an 8 percent y/y increase in construction. In the last quarter of 2013, year over year demand fell by 4 percent and continued into January and February. March saw a pickup in activity but volumes were still down 6 percent y/y. Seasonality plays a big part in consumption with construction stronger in summer months. The geopolitical challenges portend a weak year for Russia. The Russian ruble fell 8 percent year to date.

US sanctions may not have much effect on the steel industry in Russia, said Eduard Faritov, Russia Metals & Mining analyst, since the three major producers, Severstal, NLMK and Evraz have strong presences in the US with sales going to their own operations. Faritov commented that it is less acceptable to have assets outside of the country. There is a strong feeling that if you want to be a Russian oligarch your assets should be in Russia not elsewhere.

Turkey steel demand rose 10 percent in 2013. There is excess demand in the flat steel segment, said BofAML, but excess supply in the long steel segment. Most long steel is made by EAF making Turkey one of the largest scrap importers globally. The GDP fell to 2 percent from 4 percent. Upcoming elections are putting pressure on producers and consumers.

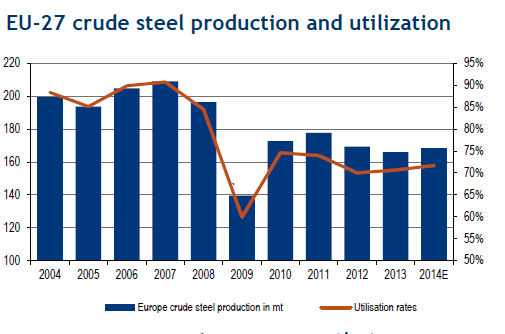

Europe is expected to have modest recovery in 2014 with a steel demand growth of 1.5 percent. HRC prices averaged $614/t in the first quarter but are beginning to soften. ArcelorMittal just announced a price hike but BofAML does not see higher prices sticking because of lower raw material costs.

Latin America flat steel demand is expected to remain flat in 2014 while long steel demand grows 2-3 percent. Flat steel producers raised prices around 10 percent to automakers and 6 percent to distributors. Steel demand for automotive use remains low with auto production down 8.5 percent year to date.

North America has suffered from supply shocks that have helped the flat steel market. Imports were 30 percent higher in the first quarter and with recent steel price hikes, more imports are expected to follow. Offers from China on cold rolled coil were $150/ short ton below domestic prices on deliveries to Chicago and the West Coast. Steel makers are keeping an eye on pending dumping cases.

Customer inventories are lean says BofAML, making cycles more volatile. Scrap prices rose $10/t in April after declining for 2 months. Utilization rates are averaging around 76.4 percent.