Market Data

March 19, 2014

Apparent Excess at +28,000 tons in February

Written by Brett Linton

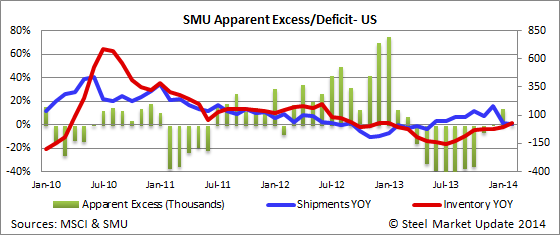

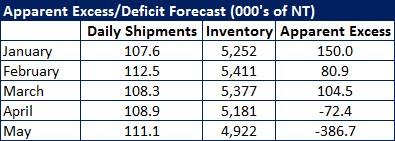

Based on the most recent MSCI flat rolled steel data Steel Market Update has calculated that U.S. service centers dwindled their “Excess” inventories from +150,000 tons at the end of January to +28,000 tons at the end of February. Our forecast from last month was for service center excess to drop to +80,900 tons. So, we weren’t too far off. The “SMU Apparent Excess/Deficit” service center inventory analysis and forecast are based on a proprietary model which projects future shipments and inventory levels at the domestic distributors.

As you can see by the graphics below February flat rolled shipments and inventories were almost exactly the same compared to this time last year.

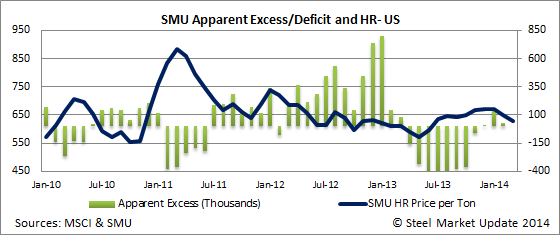

Below is a graphic comparing our SMU Apparent Excess/Deficit to the movement in hot rolled steel average pricing (SMU index). As you can see prices were rising when service center inventories were projected to be in Deficit. In January we moved from Deficit to Excess – albeit at relatively minor rates (balanced inventories) and HRC prices turned over and began heading lower.

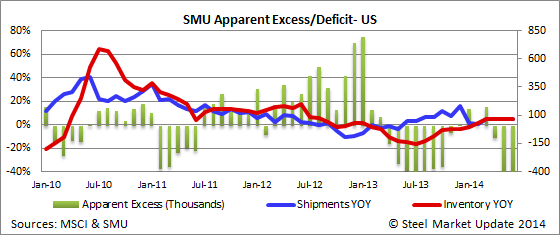

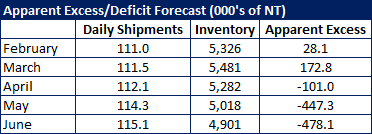

Forecast

We anticipate shipment levels to improve slightly and we expect modest growth in inventories during the month of March. Our forecast is for the Apparent Excess in service center inventories to increase in March to +173,000 tons but return to deficit levels in the following months. We are taking into consideration anticipated higher foreign steel imports affecting inventories in March.

Our price forecast is for hot rolled coil to rebound as inventories move into Deficit after the month of March. Between now and then we anticipate a flat market.

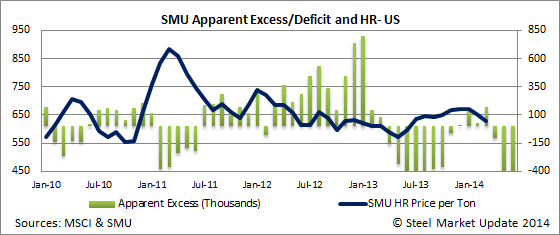

Here is our current inventory forecast through June:

And our inventory forecast from last month: