Prices

March 2, 2014

January Preliminary Imports 27 Percent Higher than December

Written by Brett Linton

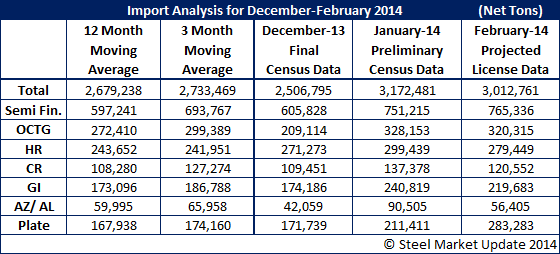

The U.S. Department of Commerce recently released updated import statistics including preliminary January figures. According to the latest data, total steel imports in January were 3,172,481 net tons (NT), up 26.6 percent compared to the 2,506,795 NT imported in December. Total February imports are projected to be 3,012,761 NT, a 5.0 percent decrease over January. On a moving average basis, total January preliminary imports are well above both the 3-month-moving-average (3MMA) and 12-month-moving-average (12MMA).

Here is a link to a previous article by David Phelps regarding the Steel Import Monitoring and Analysis System (SIMA) and how it operates.

Semi-finished imports (blooms, billets and slabs) for January were up 24.0 percent over December to 751,215 NT, well above both the 3MMA and 12MMA.

Imports of oil country tubular goods (OCTG) for January were at 328,153 NT, up 56.9 percent over December, slightly above the 3MMA and well above the 12MMA.

Hot rolled imports in January were reported to be 299,439 NT, up 10.4 percent over December figures and well above the 3MMA and 12MMA.

January cold rolled imports are currently at 137,378 NT, 25.5 percent higher than December tonnage. They are well above the 12MMA but only marginally above the 3MMA.

Galvanized imports for January were up 38.3 percent over December to 240,819 NT, well above both the 3MMA and 12MMA.

Other metallic coated imports, primarily Galvalume, were reported at 90,505 NT in January, up a 115.2 percent over December and well above the 3MMA and 12MMA.

The table below shows total imports and imports by product for December through February along with the 3MMA and 12MMA.

The table below shows the progression of SMU import projections for January starting on January 14th.