Prices

February 25, 2014

Imports Forecast to Be 3 Million Tons in February

Written by Brett Linton

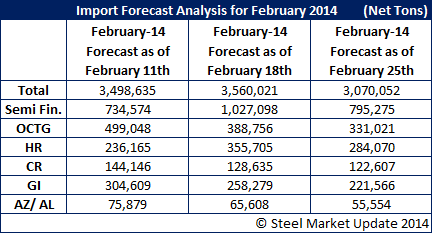

This is the fourth week in February and our third forecast regarding foreign imports into the United States. What Steel Market Update does each week (except the first week of the month) is to review the U.S. Department of Commerce import license data and then, based on the most recent numbers, project import levels by product for the month. Based on import license data through February 25th (today) we believe total imports on all steel products will be just over 3,000,000 net tons.

As you can see by the table below, the 3 million ton forecast is much lower than the 3.5 million tons being projected earlier this month based on license data available during those weeks. As we have warned our readers it is important to realize that license data can be quite volatile and the actual final census numbers can be much different than what was being indicated by the licenses. We encourage you to read an article by David Phelps on the subject which was published by Steel Market Update earlier this year.

All of the flat rolled steel items as well as OCTG (oil country tubular goods) saw their projected import numbers decline compared to what we saw in the license data earlier this month.

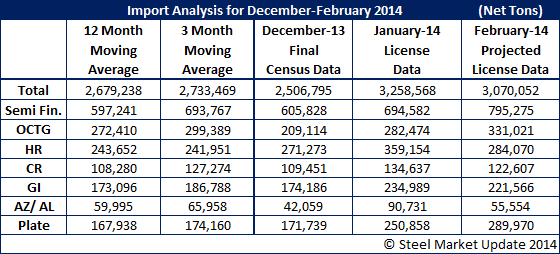

As you can see by the table below the 3,000,000 tons projected for February (total steel products) is still way above both the 3 month moving average as well as the 12 month moving average. The same situation exists for semi-finished (slabs), OCTG, hot rolled and galvanized. Cold rolled is slightly higher than the 12MMA and within normal for the 3MMA. Galvalume is slightly lower than both the 3MMA and 12MMA.