Prices

January 8, 2014

November Imports Drop to 2.59 Million Tons

Written by Brett Linton

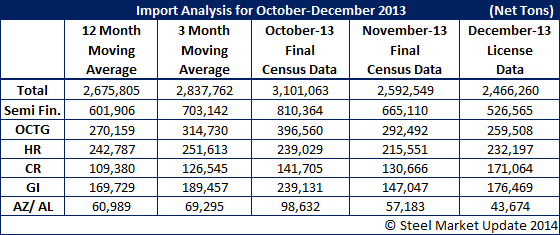

Final November trade data shows that the United States received a total of 2,592,549 net tons of steel for the month. This is a decrease of 16.4 percent compared to the 3,101,063 NT imported in October. It is also a decrease from November 2012 tonnage by 4.8 percent. December license data figures are estimated at 2,466,260 tons, down 4.9 percent compared to November.

Semi-finished imports (blooms, billets, and slabs) were 665,110 NT in November, down 17.9 percent from October but up 2.8 percent from November 2012. December tonnage is estimated at 526,565 NT, down 20.8 percent compared to November. The primary countries that semi-finished products were received from in November were Brazil and Russia.

Oil country tubular good (OCTG) imports were 292,492 NT in November, down 26.2 percent from October but up 16.1 percent from November of last year. December license data estimates imports at 259,508, a decrease of 11.3 percent from November figures. Korea, Canada, and Argentina led November OCTG imports.

Imports of hot rolled products were 215,551 NT in November, down 9.8 percent compared to October tonnage but up 14.4 percent compared to November 2012. December tonnage is currently estimated at 232,197 NT for December, up 7.7 percent from November tonnage. The primary countries that hot rolled products were received from in November were Canada, Korea, Japan, and The Netherlands.

Cold rolled imports were 130,666 in November, a decrease of 7.8 percent over October and a decrease of 13.0 percent from November last year. December license data estimates imports at 171,064, a 30.9 percent increase over November. Top countries in which November cold rolled imports were received from were China, Canada, and Mexico.

Galvanized imports decreased 38.5 percent in November over the previous month at 147,047 NT, and they were also down 29.8 percent compared to tonnage from one year prior. December tonnage is estimated to be 176,469 NT, a 20.0 percent increase. The primary countries that galvanized products were received from in November were Canada, China, and Korea.

All other metallic coated products, primarily consisting of Galvalume and aluminized products, were 57,183 NT in November, a decrease of 42.0 percent compared to October tonnage. In comparison to last year, November imports are up 9.2 percent. December license data has import estimates of 43,674 NT, down 23.6 percent compared to November tonnage. Top countries in which November other metallic coated imports were received from were Taiwan, Korea, and Mexico. (Source: US Department of Commerce)

Below is an interactive graphic which can only be viewed when logged into our website. If you have any issues with logging in, need help with navigation or how to find the article once logged in please contact our office: info@SteelMarketUpdate.com or 800-432-3475.

{amchart id=”105″ Steel Imports}