Prices

January 5, 2014

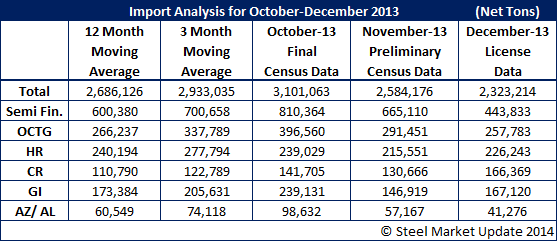

November Preliminary Imports Down 16.7 Percent from October

Written by Brett Linton

The U.S. Department of Commerce recently released revised import statistics for the month of November and December. Total preliminary imports for November are 2,584,176 net tons (NT), down 16.7 percent compared to October import figures. November imports are below both the 3 month-moving-average (3MMA) and 12 month-moving-average (12MMA) calculated through October. December imports, based on collected license data, are currently reported to be 2,323,214 NT.

Semi-finished preliminary imports (blooms, billets, and slabs) were reported at 665,110 NT for November down 17.9 percent from October imports. November levels are below the 3MMA but above the 12MMA. December imports are estimated to be 443,833 NT. If the December number is correct, this would be lower than any month during the past calendar year. The largest drop in tonnage is Brazil at 204,447 net tons – well below the 380,646 net tons shipped to the U.S. during November.

Preliminary imports of oil country tubular goods (OCTG) for November were reported at 291,451 NT, down 26.5 percent from October tonnage. November imports are below the 3MMA but above the 12MMA. December import estimates for OCTG products are 257,783 NT. South Korean exports of OCTG are increasing compared to November as well as the average for the past 11 months. A number of producers of OCTG have filed anti-dumping suit against South Korean products.

Hot rolled preliminary imports are 215,551 NT for November, down 9.8 percent from levels in the previous month. November imports are below both the 12MMA and 3MMA. December imports are estimated to be 226,243 NT which is below both the 3MMA and 12MMA for the product. Australia shipped in 15,866 net tons in November. This is the first Australian hot rolled since July 2013. South Korean hot rolled exports to the U.S. are doubling from November to December with December forecast to reach 102,967 net tons (remember South Korea is a 50/50 joint venture partner with USS at USS/POSCO and they supply half of the hot bands at UPI).

Preliminary imports of cold rolled products are 130,666 NT for November, down 7.8 percent from imports in October. However, November imports are above both the 3MMA and 12MMA calculated through October. December cold rolled imports are estimated to be 166,369 NT, well above both the 3MMA and 12MMA. China will be by far the largest exporter of cold rolled to the U.S. in December. China is project to have exported almost half of the December total with 76,420 net tons coming from the country. India cold rolled shipments are also increasing as their December shipments will be four times that of November at 9,192 net tons.

Galvanized preliminary imports in November are at 146,919 NT, down 38.6 percent compared to October. They are also below the 3MMA and 12MMA. December galvanized imports estimates are at 167,120 NT which is below both the 12 month and 3 month moving averages. In December, after Canada the two largest exporting countries will be India and South Korea.

Other metallic coated preliminary imports, primarily of Galvalume products, are 57, 167 NT for the month of November, down 42.0 percent from October levels. They are also below the 3MMA and 12MMA. December imports of other metallic coated products are estimated to be 41,276 NT. If the December total ends up being correct it will be the fewest tons of Galvalume imported into the U.S. since October 2012.

Not in the table above are plate imports in coil and sheet form. Coiled plate imports totaled 98,160 net tons during the month of November 2013. The two largest exporting countries were Canada (37,500 net tons) and Germany (22,863 net tons). December coiled imports of plate are forecast to be 94,493 net tons with Germany replacing Canada as the top exporter.

Imports of plates in cut lengths totaled 73,636 net tons during November and are forecast to be 56,069 net tons in December. The three largest exporters of cut length plate are France, Canada and Germany for the month of November. In December France and Germany drop down dramatically as Canada once again will lead the way.