Prices

December 12, 2013

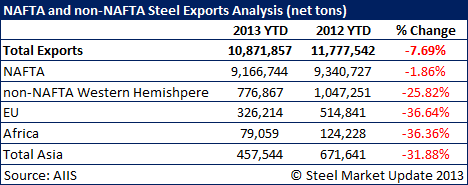

NAFTA and non-NAFTA Exports Down Across the Board

Written by Brett Linton

Total U.S. steel exports for the first 10 months of 2013 were 10,871,857 net tons (NT), a 7.69 percent decrease from the 11,777,542 NT exported for the same period in 2012. NAFTA exports decreased slightly during that time frame by 173,983 NT or 1.86 percent. U.S. exports to non-NAFTA countries within the Western Hemisphere were 776,867 NT for 2013 YTD, down 25.82 percent from the same period last year. Steel exports also decreased for EU member countries as well as Africa and Asia ranging from 31 to 37 percent.

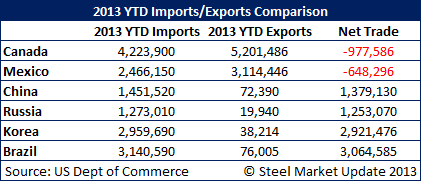

Below is a comparison of U.S. imports and exports for Canada, Mexico, China, Russia, Korea, and Brazil. Note that the net trade of imports minus exports is negative for Canada and Mexico (meaning that overall they receive more products from the U.S.), while it is a positive trade value for China, Russia, Korea, and Brazil (they export more the U.S. than they receive).