Prices

December 10, 2013

Prepainted Flat Rolled Imports Up in October

Written by Brett Linton

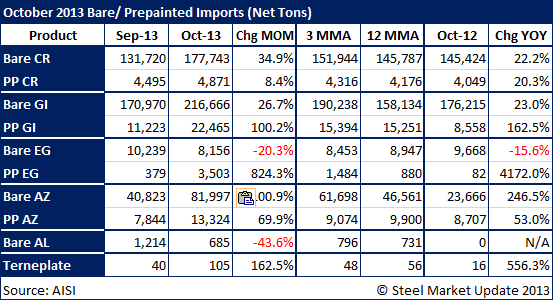

Prepainted flat rolled imports increased in October over August for all products followed by SMU, especially for galvanized and electro-galvanized. Compared to the same month one year ago, prepainted imports in October significantly increased for all products.

As you can see by our table below – prepainted cold rolled (CR) imports increased by 376 NT or 8.4 percent from August to October and remained above both the 3-month and 12-month moving averages calculated through October. Compared to levels one year ago, prepainted CR imports were up 822 NT or 20.3 percent.

Prepainted galvanized (GI) imports increased by 11,242 NT or 100.2 percent month-over-month. They are now above both the 3-month and 12-month moving averages. Compared to one year ago, prepainted GI imports were up 13,907 NT or 162.5 percent.

Prepainted electro-galvanized (EG) imports increased by 3,124 NT or 824.3 percent month-over-month. They were above both the 3-month and 12-month moving averages. Compared to one year ago, prepainted EG imports were up 3,421 NT or 4172.0 percent. Note that prepainted EG imports are much smaller than the other products in this comparison, and fluctuations in imports from China tend to skew the figures from month to month.

Prepainted Galvalume (AZ) imports increased by 5,480 NT or 69.9 percent over last month. They were above both the 3-month and 12-month moving averages. Tonnage imported in October was up 4,617 NT or 53.0 percent over the same month one year ago.