Prices

November 3, 2013

Apparent Steel Supply Up in August

Written by Brett Linton

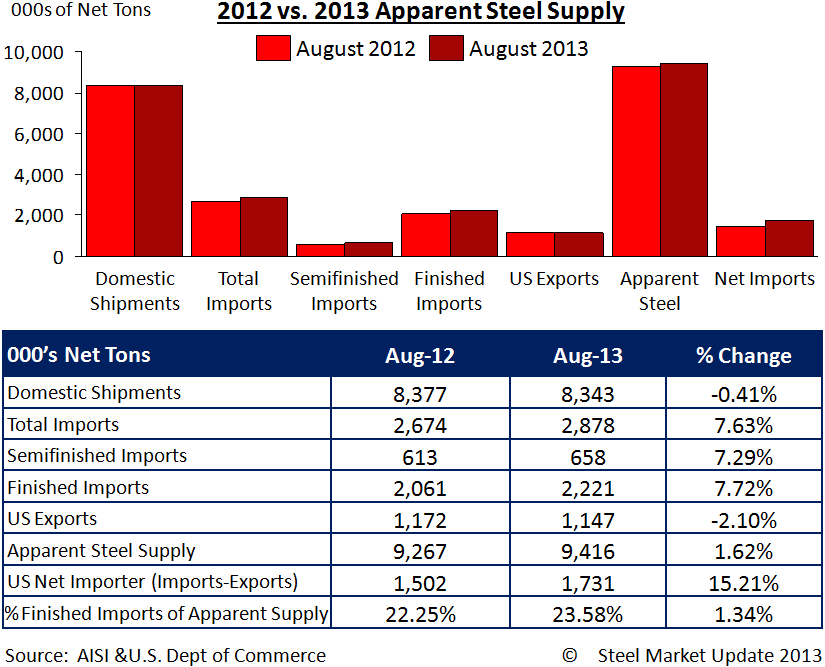

Apparent steel supply for August 2013 was up 1.62 percent compared to the same month one year ago. This is primarily due to higher total steel imports and higher semi-finished steel imports for this year. The net trade surplus from imports versus exports was 1,730,960 net tons in August of this year, up from 1,502,420 NT in the prior year.

When compared to July, August apparent steel supply is moderately higher by 211,723 net tons or 2.30 percent. Domestic shipments remained relatively stable from July to August, while total imports increased by 357,862 NT or 14.20 percent. The net amount of trade from imports and exports also increased by 297,760 NT in August, a 20.78 percent increase over July.

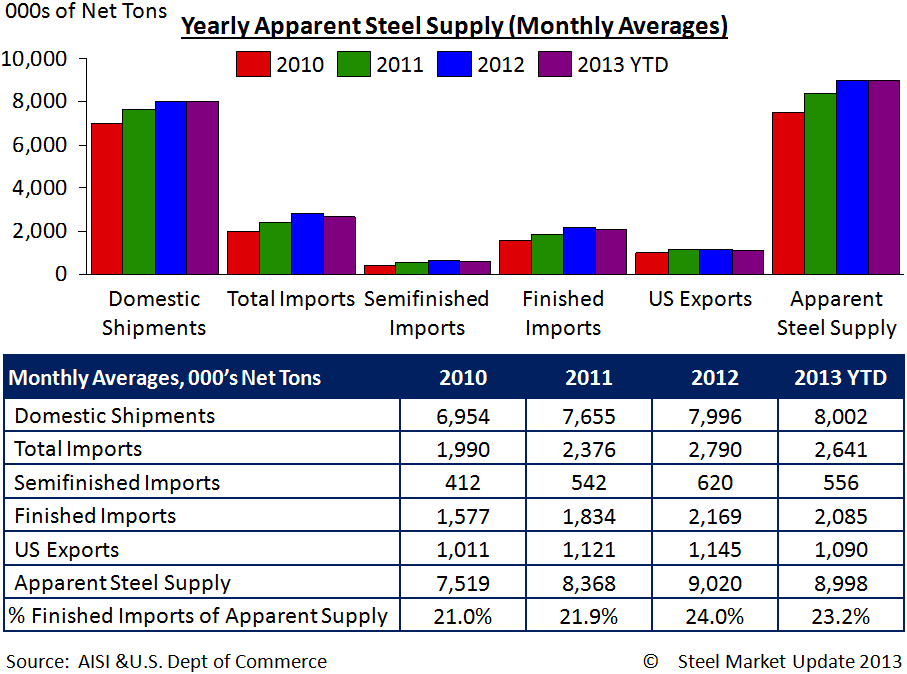

On a year to date basis, the 2013 YTD monthly averages for the items below are essentially at the same levels from what we saw during 2012. The averages are all above 2010 and 2011 levels with the exception of total U.S. exports.