Prices

October 31, 2013

Hot Rolled Futures: MONSTER Month

Written by John Packard

In my last ditty, I mentioned we were likely headed to the 1775-1800 area on the S&P 500. Well yesterday we reached 1775. However, the Fed statement from their October meeting yesterday had just enough language changes from the September meeting that some felt nervous and got out of some of their positions and the market retraced back down to the 1755 area. I still think we are headed higher solidly into the 1775-1800 zone before any real correction can occur. Heck, what am I talking about? This market hasn’t seen a real correction since October 2012! It is Not going to start now. Not while their foot is still on the peddle. Buy em! Despite some traders worries that they may start to taper in December, this market is headed higher until that becomes a reality.

This exuberance does not translate to commodities. Crude has been the clearest manifestation of this. As I mentioned last time, we needed to hold $100/bbl or else we were headed to $90-92/bbl area. Well, we closed today just below $96/bbl, and are likely headed at least to the $94/bbl mark where there should be some support. The monthly crude chart is not pretty. This rally we had end summer during the Syria crisis failed to produce a higher high from the May 2011 high. This leaves crude still in the upper quadrant with deteriorating fundamentals making it look expensive. Inventories are building in various locations in the world basis the latest data. Looking more likely that crude will test low 80’s before this chapter is closed sometime in the early part of 2014 if not sooner, unless we see improving global demand in the immediate term.

Copper also has to make up its mind. It either has to break resistance about 15 cents above our current $3.3035/lb, or it is headed a lot lower as it has tested $3.00/lb a couple of times already, and markets rarely can withstand a third test. Breaking resistance is looking less likely as macro players are selling into rallies consistently.

Volatility likely on its way in commodities. Brace yourself!

Steel:

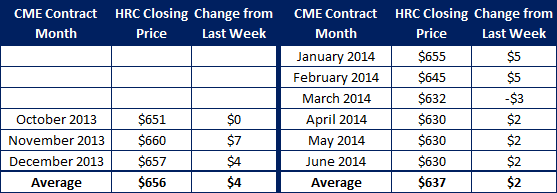

Holy Mackerel! What a MONSTER month in steel. We traded 155,200 short tons (net tons) in October. This makes up a for a slower August and September and puts us right back on track to having a big growth year. We are already over 1 million tons vs. approximately 850K tons which traded through all of last year.

For the week we traded a respectable 780 lots or 15,600 ST. This is almost considered small now in a market where we have seen 25-30K ST trade in one day.

Price wise the market has gyrated a bit, down a few dollars on nearby months one day and up a few dollars another. We have not changed much on a week on week basis (about a $1-$2 here or there). The buyers are still reticent to pay offer and offers reticent to hit bids on the back end of the curve. We have been as close as a $5/ST spread on far forward deals and not gotten trades. A bit of a stalemate in futures just like in spot market.

Iron Ore:

Iron has relaxed down to just below $132/MT. Everyone watching carefully to see whether there is any follow through on the first two months of better growth to see if could actually be a trend. Until then Iron Ore waits as inventory replenishment getting nearing its end. Forecasts and the forward curve suggest lower levels in the future. Let call Nov ’13 either side of 130/MT, Dec ’13 either side of $129/MT, Q1 ’14 either side of $127/MT, and Cal ’14 either side of $119/MT.

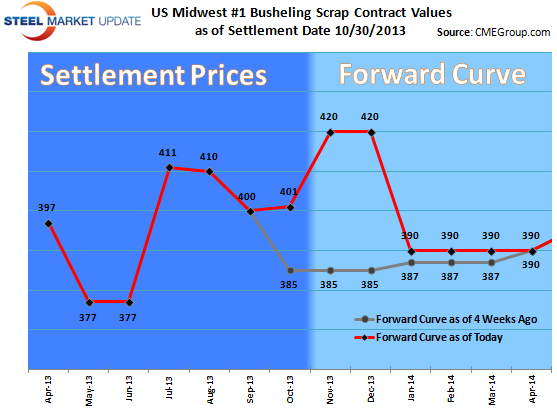

Scrap:

I just got back from the AMM Scrap conference. The mood was one of tight margins, modest flows with an expectation that flows will improve quickly on any decent price rises. The Market feels $15-20/GT (gross ton) increase brewing, but there is a difference of opinion as to how much gets collected and how quickly. With so many steel buyers maxing out existing CRU deals in this uncertain environment, the expectation is the buyers’ appetite should continue to be decent from the mills through November. Certainty wanes a bit for December, and, shockingly, some not very confident about traditional bullish 1st quarter months, maybe due to concern over real demand, steel imports factor, and the effect of Nucor’s DRI facility. As one party put it, any harsh winter months crimp both supply and demand.

CFR Turkey meanwhile has risen to $392/MT zone on back of further Turkish buys building inventory ahead of the Baltic winter season. Also Europe’s flows clearly have been tepid due to lack of activity there. It has probably made the move it is going to make, having already climbed $30/MT in 6 weeks. Futures in CFR and BUS have been quiet. Interest from conference participants in scrap futures still quite high.