Prices

September 8, 2013

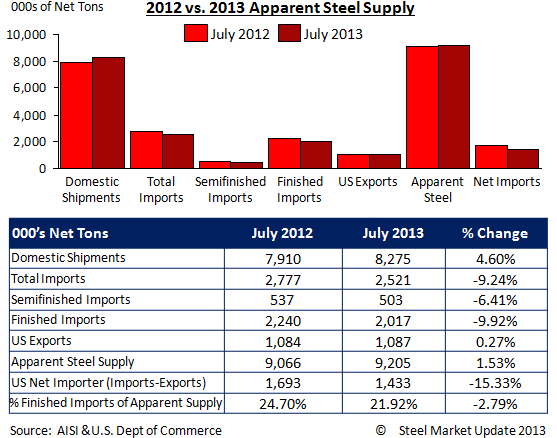

Apparent Steel Supply Higher as Domestic Shipments Improve

Written by Brett Linton

Apparent steel supply for July was up slightly compared to the same month one year ago by 1.53 percent. This is due to a 4.60 percent increase in domestic shipments, which was offset by a decrease in both total steel imports and finished steel imports, down 9.24 percent and 9.92 percent respectively. The net trade from imports versus steel exports was a surplus of 1,433,000 net tons of imports in July of this year, a decrease of 15.33 percent from one year prior.

When compared to June 2013 when apparent steel supply was at 8,727,670 NT, July supply is moderately higher by 476,980 NT or 5.46 percent. Domestic shipments showed a nice improvement in July by 468,190 NT or 6.00 percent over June. The net amount of trade from imports and exports was down 37,650 NT in July over June, a 2.68 percent increase.