Product

March 1, 2013

HR Matters!

Written by John Packard

Written by: Andre Marshall, Crunchrisk LLC

So far on the SP we have made it as high as 1532 on Feb 19th only to have retrace back to 1490 area before rebounding the last two days to 1515-1520 area. The market is becoming a bit more volatile. Poor fundamentals and money chasing returns will provide for a bullish market like we have seen. However, when uncertainty arise over news like Italian elections potentially putting into doubt the existence of the Euro then the markets get nervous. It almost doesn’t matter what the headline is, if the longs get nervous and sell on any such news then they are not that convicted. And herein lies the reality, the market is already in precarious territory after a 128% 4 year rally. It is not unusual to see volatility right before the change in direction trend of a market. We are likely headed to that 1546 target area we have been looking for, maybe a bit higher, but once there, we should expect a 10-15% drop in the SP, likely to June’s low near 1300. Timeline should be about a month out. From there we likely rally again, but to what level is still up for great debate.

In Copper and Crude we have seen different activity. After the Mid Feb highs we’ve been headed lower. Crude on Feb 13 th hit $98.65/bbl whereas we are currently $91.83/bbl and Copper on Feb 19th was at $3.76/lb whereas we are currently $3.567/lb. The fundamentals in these commodity markets are poor, with some of the widest contangos seen in some time and with very high inventories.

For now, money keeps the financial markets elevated. Time will likely wear on them if not worse.

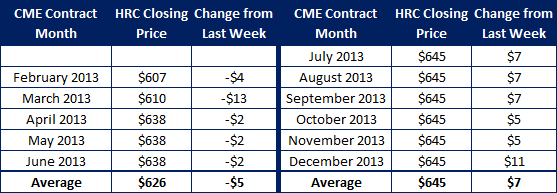

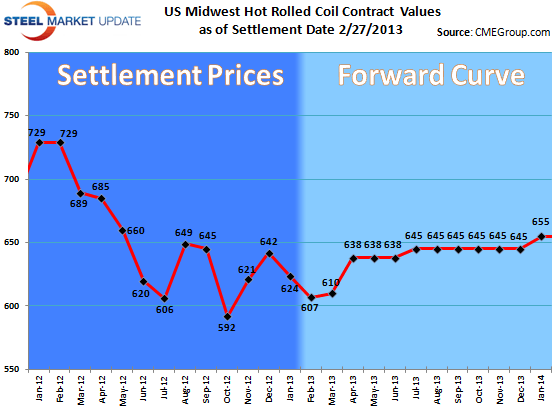

NYMEX HRC:

After 11 years flogging steel derivatives I can finally make the statement “HR matters”. I think it has mattered form some time, but HR futures made a statement on Tuesday, it traded 50K ST in one day! With weekly tonnages ranging from 12K-22K, that is quite some volume. For the week in total we have traded 2980 lots or 59,600 ST. Due primarily to some forward hedging there was also some very good trade flow on March, which traded 6K ST at $610. Q2 was bid and traded $640 and then some selling came in below. The range has been $635 to $640 there. Q3 and Q4 have surprised and traded $645/ST and Q1 also traded some nice size @ $655/ST. A nice combination of players, some buying forward, some selling against inventory (cash and carry) and some covering shorts. Bravo HR! More and more players managing their price risk on the forward curve, so it shouldn’t really be a surprise to see some nice growth in volumes.

Scrap:

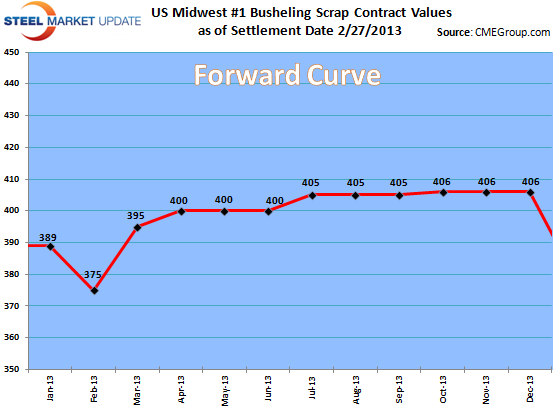

On the BUS, we had another quiet week of trading, but the forward buyers have continued to be bid in the market. We have had buying interest across the curve through October between $397/GT and $402/GT. Sellers continue to withhold interest although levels are getting to a more interesting zone which should draw out some trades.

Turkish Cargos have lifted the East Coast CFR price by about $10/GT, with cargos trading between $401 and $406/GT. The spot index also rose in conjunction with spot index now $402/GT v. the $392 level we had about a week plus ago. Hard to determine if this buying from Turkey will continue. Those close to the situation feel that inventories have been replenished and then some so they may be out for a while. On the domestic busheling front this East coast increase certainly will help dealers in their efforts to gain back levels lost in February. The range of that increase up for debate but looks like it will come in somewhere between $10 and $25, which would put us back to $390-395 zone. The cheap sales in steel of late have likely improved lead times a bit and thus appetite. Weather has helped crimp flows, but it has also affected steel shipments equally. Time will tell.

Iron Ore:

I have talked about this market before in terms of its 88% four month rally as being either a huge anomaly or a leading indicator. I think I will go with huge anomaly. Steel inventories in China are climbing to heady levels and the downstream economy is not robust enough to absorb these traders exuberance. The typhoon worries have stalled what looks inevitably to be a bubble where the question is not so much whether it will drop significantly but when. Let’s call Q2 either side $138/MT, Q3 either side of $130/GT, Q4 either side of $125/GT and Q1’14 either side of $117/GT. Nicely backwardated as it should basis fundamentals. All that said, never say never, as the Chinese have been known to keep markets distorted far longer than anyone has ever deemed imaginable. They have done it in Real Estate and Equities and can do it again here in Iron Ore. One thing looks clear is a lot of metal that needs to find homes.