Product

February 11, 2013

SMU Price Momentum Indicator Remains at Neutral

Written by John Packard

Written by: John Packard

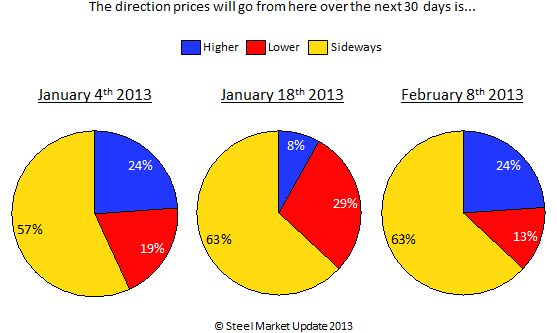

Steel Market Update did not move our Price Momentum Indicator out of Neutral where we have been “stuck” for the past 10 – now going on 11 weeks. The market lacks clear direction – or maybe a better way to view it is the market lacks personality. This is perhaps best represented with a graphic pulled from SMU surveys taken over the past couple of months where we ask buyers and sellers about the direction they believe steel prices will be headed over the coming thirty day period:

At the moment the personality of the market appears “split” between demand which appears to be decent in some industries and maybe even approaching stellar in the automotive sector. Residential construction is slowing coming back and there are signs of movement in the important non-residential construction segment (although public money has just about dried up). On the other hand scrap prices for February are down $5 to $20 per gross ton depending on the market and product. Snow is invariably going to drive prices up in the Midwest come March. We are seeing higher foreign prices and the spread between domestic and foreign has shrunk to a point where foreign buyers need to consider buying shorter lead time domestic steel. Then we have service centers that are beginning to realize that now may not be the best time to continue discounting material on their floor.

So, SMU what’s bugging you?

What is bugging Steel Market Update is the low levels of production, short lead times, sudden decrease in an acceptable spread in foreign quotes (100 percent of our trading company respondents to last week’s survey reported no increase in requests for quotes from domestic steel buyers – this after a round of price increase announcements?) and stable to improving demand levels. Service center inventories are at 2.33 months, according to our survey results, and buyers are comfortable with their inventory levels. There is no sense of panic or concern in the marketplace.

It is almost too perfect – it is almost too easy for buyers.

What gives the market focus and “personality”?

- Some form of unexpected mill interruption – blast furnace outage or something which changes the supply and demand ratios.

- Large drop in flat rolled imports (continued foreign price increases so we have an extended period of time of lower than normal import levels).

- Larger than anticipated spike in raw material costs in March – scrap goes up by $30 or $40 per gross ton (which is possible based on the storms hitting the NE and Midwest).

- A spike in orders which moves lead times further out than anticipated creating a wave of demand.

SMU Survey – Mills vs. Trading Companies

Steel Market Update has a number of trading companies and mills who participate in our surveys. We do not report their results many times since the larger numbers of participants come from the manufacturing and service center groups (which are much larger portions of the steel population). However, we have special sections of the survey for each segment of the community.

Usually, the steel mills are split in their feelings and the trading companies are fairly optimistic about their abilities to do business in the United States. This past survey we saw some changes in attitudes between the two groups.

As mentioned earlier in this article 100 percent of the trading companies reported no increase in quotes from their U.S. customers. That is the first time we have seen that percentage this high. We also found the majority of trading companies – 57 percent – felt the prices they are now quoting are at levels where the business could not be transacted. The same percentage – 57 percent – reported prices would be going higher from their suppliers over the next 30 days.

On the mill side of the ledger 83 percent believe prices will move higher over the next 30 days and only 66 percent are concerned that higher domestic mill prices will attract more foreign steel into the U.S. markets. The mill respondents also reported the booking rate to be “normal” by slightly more than 80 percent of those responding to our survey this past week.

SMU Price Momentum Indicator Neutral for Next Week or Two – After That..?

We will be watching service center spot pricing very closely over the next few weeks to see if the industry is able to fully reverse course and take spot prices higher. Higher spot prices out of the service centers could be very helpful to the psychology of the market to accept more of the announced price increases and perhaps allow for a second round of increases to follow.

SMU will also watch scrap prices – this includes Turkish buys off the east coast which will put a firm bottom to the low end product as well as how the weather will affect flows into the yards in the Midwest. The rivers appear to be rising which allows for flows of scrap from the Midwest markets into the south which takes any excess material out of the northern markets and helps support prices there.

China is now on Holiday celebrating their New Year – the Year of the Snake – which begins this weekend (February 10th) and usually lasts for two weeks. After the Chinese return from their Spring Holiday, as it is also called, we will get a better feel for the direction of iron ore spot pricing and export steel pricing. Both had been rising when the Holiday began.

We will also be curious to see if the MSCI inventory levels adjust lower in both the U.S. and Canada as the previous month’s results were not good news for the steel mills on both sides of the border.

We continue to watch mill negotiations and special “deals.” Can the mills bring the bottom end of the range up to $620 or higher and hold it there?

SMU would like to hear your opinion – you can email them to me at: John@SteelMarketUpdate.com.