Government/Policy

December 22, 2015

US DOC Releases Ruling on Antidumping on Corrosion Resistant Steels

Written by John Packard

Late this afternoon the US Department of Commerce released their Preliminary Determination regarding antidumping of corrosion resistant steels from China, India, Taiwan, Korea and Italy. China was smacked the hardest and received margins of 255.80 percent while India (6.64-6.92%), Korea (2.99-3.51%) and Italy (0.0-3.11%) were slapped on the wrists. Taiwan received no antidumping margin what-so-ever.

![]() From our perspective the Chinese should be eliminated from the market with Antidumping rates of 255.80 percent and countervailing duties of 26.26 percent (YP China) and all others at 235.66 percent. Chinese mills were also found to be liable for critical circumstances at the same time the CVD Preliminary Determination ruling was made back on November 3, 2015.

From our perspective the Chinese should be eliminated from the market with Antidumping rates of 255.80 percent and countervailing duties of 26.26 percent (YP China) and all others at 235.66 percent. Chinese mills were also found to be liable for critical circumstances at the same time the CVD Preliminary Determination ruling was made back on November 3, 2015.

The other mills were not necessarily eliminated from the U.S. markets as their antidumping and/or countervailing duty rates were less than 10 percent (which one trading company told us recently was the maximum expected by their Asian steel source that was not Chinese).

The Indian mills received the highest AD duties of slightly below 7 percent. The South Korean mills were next at essentially 3-3.5 percent, Italy received 3.11 percent (except Marcegaglia which received 0.0 percent) and Taiwan received nothing.

SMU spoke with trade attorney Lewis Leibowitz earlier this evening who told us that Taiwan has “dodged a bullet” but is not out of the woods yet. The petitioners will most likely mount a challenge to the AD ruling.

In the case of those who have received antidumping and countervailing duty orders Leibowitz told us “…that is where it gets complicated.” SMU will attempt to have more on that subject soon and it will be fully addressed during Lewis Leibowitz presentation at our Leadership Summit Conference in Palm Beach Gardens, Florida in March (by then we may have more announcements on cold rolled and hot rolled coil).

A steel buyer known to be an active buyer of foreign steel in the past told us after reviewing the ruling, “I think this may change some things in the market and embolden the guys that had been holding back on certain products – i.e. CR from Brazil – to come back to the market. Brazil and Korea are really hurting.”

While a trading company associated with Galvalume products out of Taiwan told us with the ruling they were wondering if they needed the Vietnamese steel they had on trial for some of their customers.

Below is a portion of the announcement received by Steel Market Update late this afternoon from the ITA Office of Public Affairs:

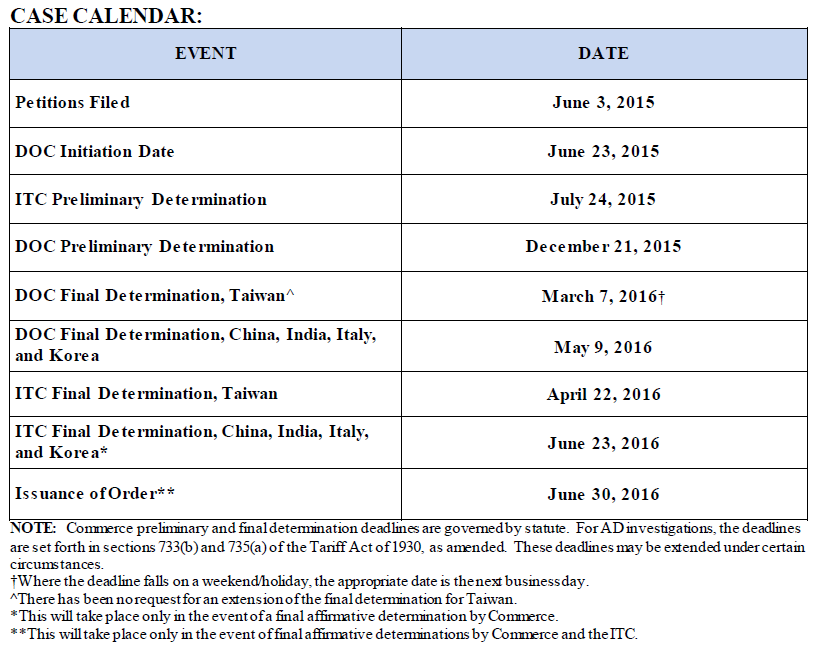

On December 22, 2015, the Department of Commerce (Commerce) announced its affirmative preliminary determinations in the antidumping duty (AD) investigations of imports of corrosion-resistant steel products from China, India, Italy, and Korea, and its negative preliminary determination in the AD investigation of imports of corrosion-resistant steel products from Taiwan.

• The AD law provides U.S. businesses and workers with a transparent and internationally accepted mechanism to seek relief from the market distorting effects caused by injurious dumping of imports into the United States, establishing an opportunity to compete on a level playing field.

• For the purpose of AD investigations, dumping occurs when a foreign company sells a product in the United States at less than its fair value.

• In the China investigation, the mandatory respondent, Yieh Phui (China) Technomaterial Co., Ltd., as well as the two parties which qualified for separate rates, all received a preliminary dumping margin of 255.80 percent. All other producers/exporters in China received the China-wide rate of 255.80 percent.

• In the India investigation, mandatory respondents JSW Steel Ltd., and Uttam Galva Steels Limited received preliminary dumping margins of 6.64 percent and 6.92 percent, respectively. All other producers/exporters in India received a preliminary dumping margin of 6.76 percent.

• In the Italy investigation, mandatory respondents Acciaieria Arvedi S.p.A. and Marcegaglia S.p.A. received preliminary dumping margins of 3.11 percent and 0.00 percent, respectively. All other producers/exporters in Italy received a preliminary dumping margin of 3.11 percent.

• In the Korea investigation, mandatory respondents Dongkuk Steel Mill Co., Ltd./Union Steel Manufacturing Co., Ltd. and Hyundai Steel Company received preliminary dumping margins of 2.99 percent and 3.51 percent, respectively. All other producers/exporters in Korea received a preliminary dumping margin of 3.25 percent.

• In the Taiwan investigation, mandatory respondents Yieh Phui Enterprise Co., Ltd. and Prosperity Tieh Enterprise Co., Ltd. received preliminary dumping margins of 0.00 percent. Commerce did not calculate a preliminary dumping margin for all other producers/exporters in Taiwan because it has not made an affirmative preliminary determination.

• As a result of the preliminary affirmative determinations, Commerce will instruct U.S. Customs and Border Protection (CBP) to require cash deposits based on these preliminary rates.