Market Data

October 17, 2022

Energy Market Analysis Through October

Written by Brett Linton

The Energy Information Administration’s (EIA) October Short-Term Energy Outlook was released earlier this month, forecasting spot prices and production for crude oil and natural gas. Crude oil prices are forecast to remain near current levels for the remainder of this year and to slightly increase in 2023. Natural gas prices are expected to rise slighly through the remainder of the year, then ease into 2023 as production levels increase. The EIA continues to note a level of uncertainty in its forecasts, explaining, “Potential petroleum supply disruptions and slower-than-expected crude oil production growth could lead to higher oil prices, while the possibility of slower-than-forecast economic growth may contribute to lower prices.”

The EIA also released it’s Winter Fuels Outlook which forecasts household expenditures for various heating fuels. It expects spending to increase across the board this winter, due to both rising fuel costs and higher consumption versus last year. Estimated heating cost increases for natural gas are 28%, heating oil 27%, electric 10%, and propane 5%.

In this Premium analysis we cover oil and natural gas prices, North American drilling rig activity, active drill rigs by state, and US crude oil stock levels.

Updated last week, you can view the latest EIA Short-Term Energy Outlook here and the Winter Fuels Outlook here.

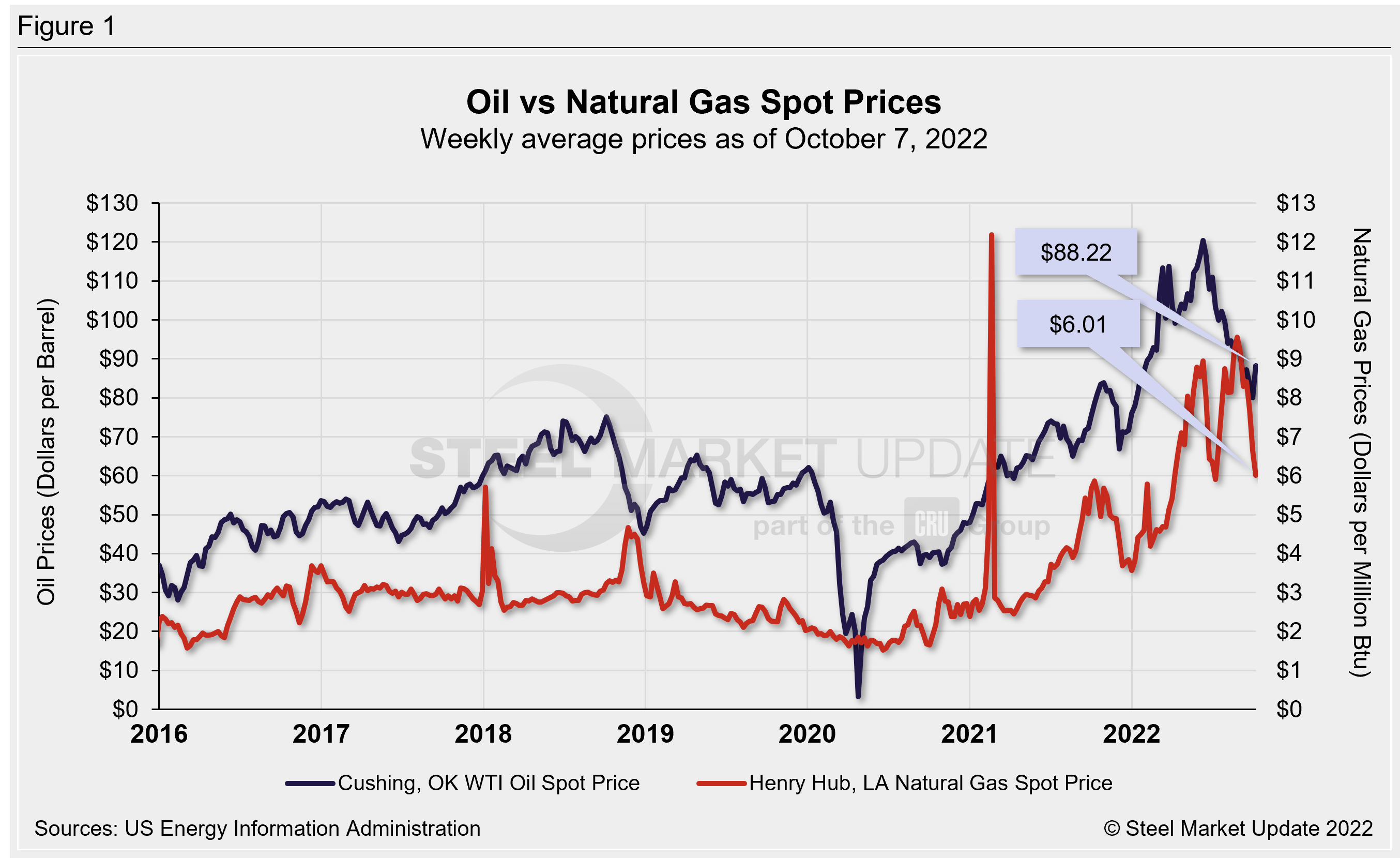

Oil and Gas Spot Prices

The weekly West Texas Intermediate oil spot market price was $88.22 per barrel as of the week ending Oct. 7 (Figure 1). One week prior prices were $80.08 per barrel, the lowest weekly figure seen since the first week of the year. Oil spot prices have been gradually easing from the 13+ year high of $120.43/b seen in early June. For comparison, the record high in the EIA’s 36-year data history occurred in July 2008 at $142.52/b. The EIA expects oil spot prices to average $93/b in Q4 2022 and forecasts an average price of $95/b across 2023 (down from $97 in its previous estimate).

Natural gas spot prices have bounced around in recent weeks: In the last week of August prices climbed to a 14-year record of $9.56 per Metric Million British Thermal Units (MMBTU). (Note that we are excluding high spot prices in Feb. 2021 resulting from winter storms and supply scarcity). The spot price as of Oct. 7 has eased to $6.01/MMBTU, the lowest level seen since early July. The record high in the EIA’s 36-year history was $14.49/MMBTU the week of Dec. 16, 2005. The EIA expects natural gas prices to average $7.40/MMBTU in Q4 2022 (down from its previous estimate of $9.00) and forecasts 2023 to average $6.00/MMBTU (unchanged).

Rig Counts

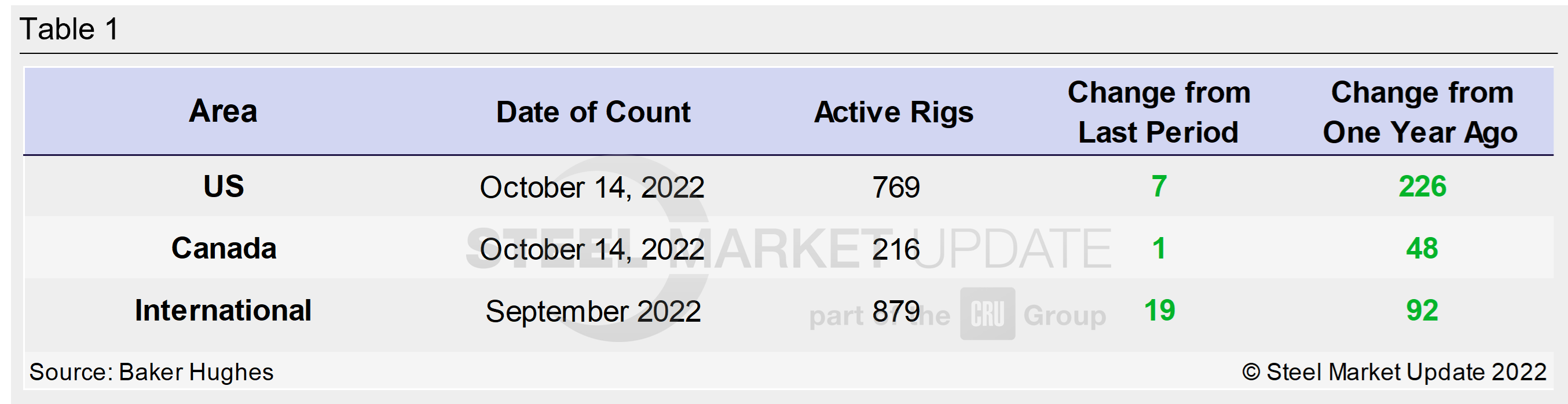

The number of active US oil and gas drill rigs continues to recover from mid-2020 lows, but has flattened out in the past few months. The latest US count was 769 active drill rigs as of the end of last week, comprised of 610 oil rigs, 157 gas rigs, and two miscellaneous rigs, according to Baker Hughes (Figure 2). Active rig counts are up 42% versus this time last year, and down just 2% compared to pre-Covid shutdowns in March 2020.

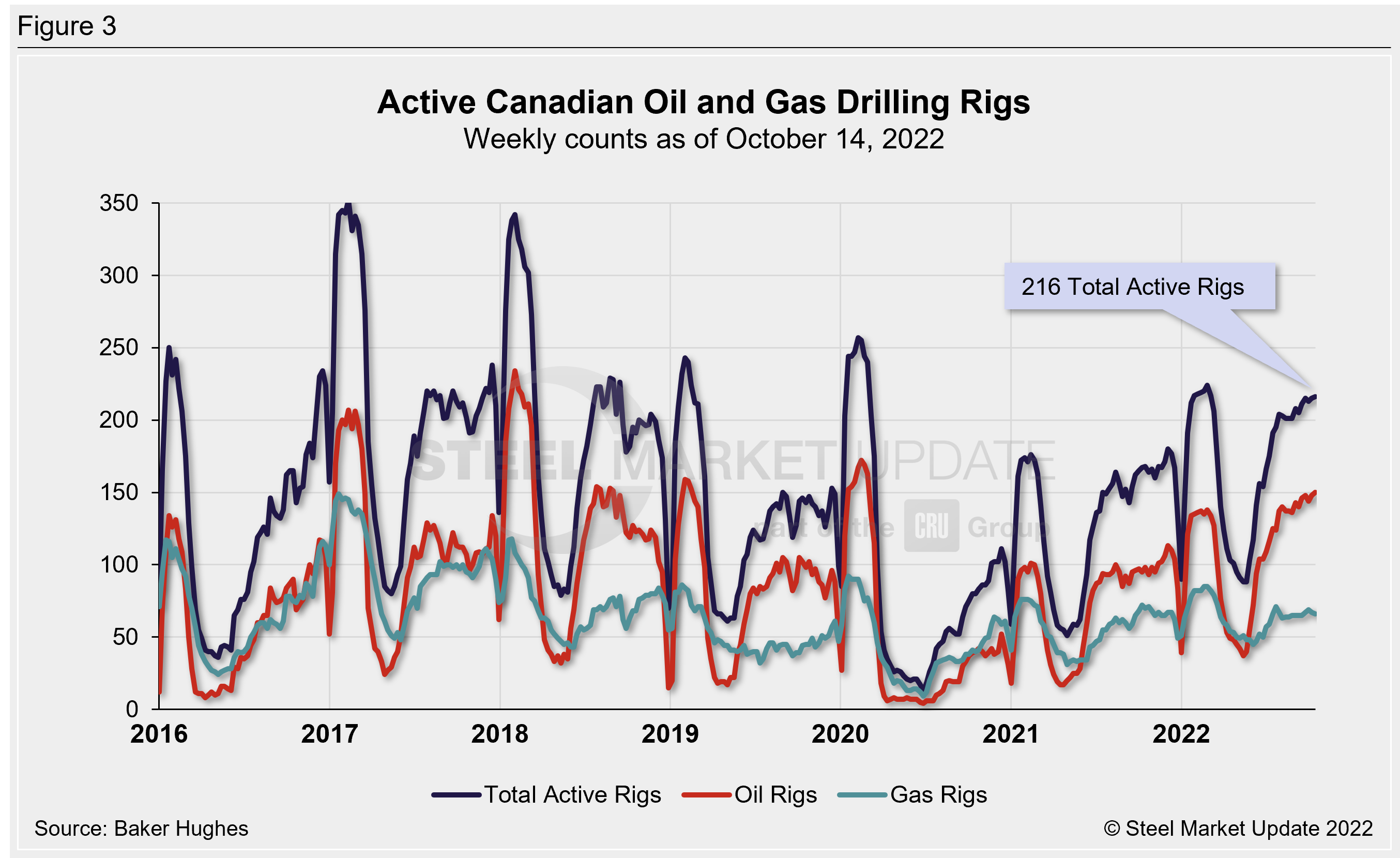

The latest Canadian rig count is 216 rigs, comprised of 150 oil rigs and 66 gas rigs. Canadian rig counts are up 29% compared to one year prior, but down 16% from pre-Covid levels (Figure 3).

Table 1 below compares the current US, Canadian and international rig counts to historical levels.

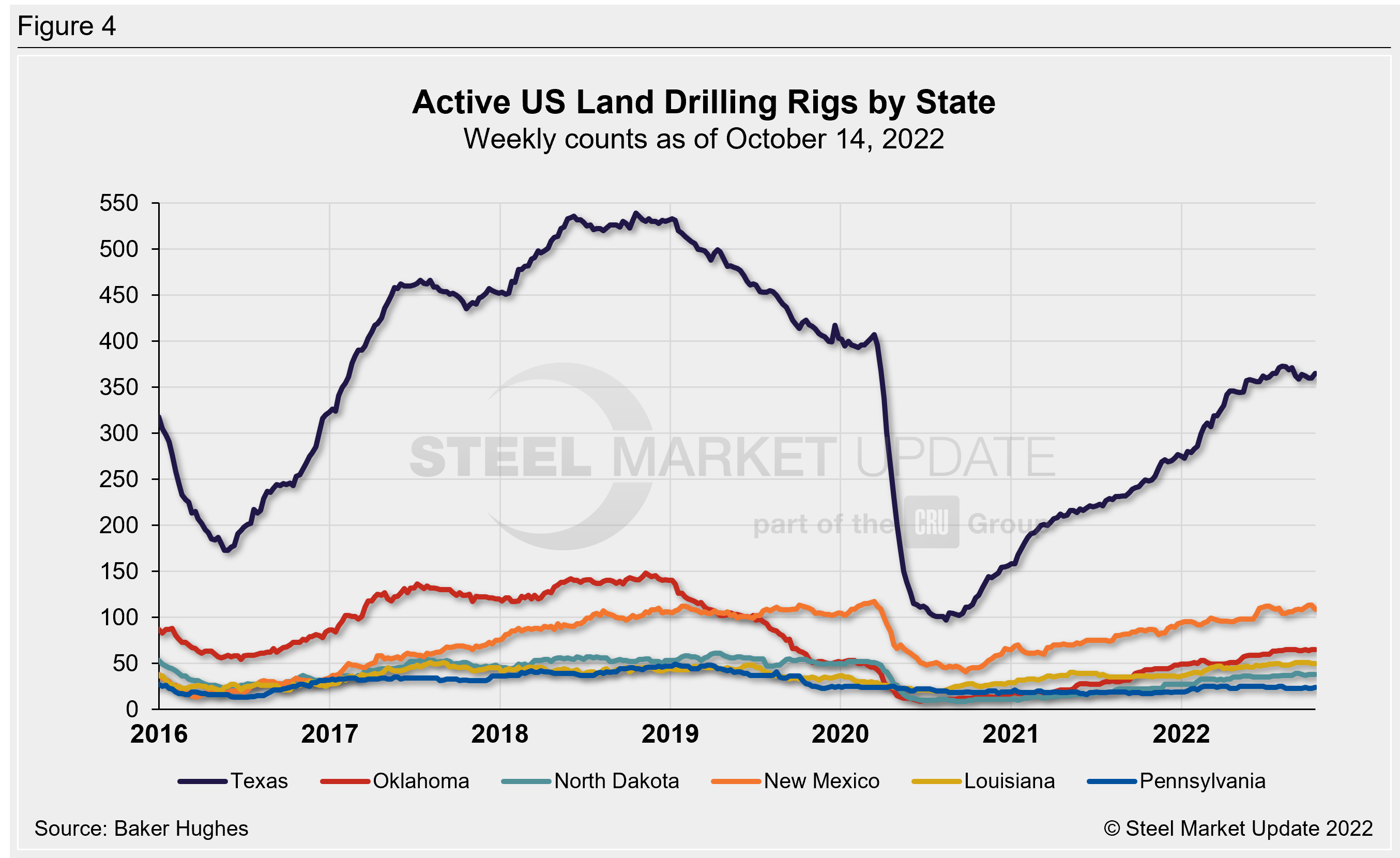

US oil and gas production is heavily concentrated in Texas, Oklahoma, North Dakota, and New Mexico. As of Oct. 14, production remains strong for each state, but has eased since July/August (Figure 4). Texas is the most active state with 365 rigs in operation and New Mexico is the second highest with 109 rigs. Recall that the number of active Texas rigs had plummeted 76% in 2020, falling from 407 in April to 97 rigs in August.

Stock Levels

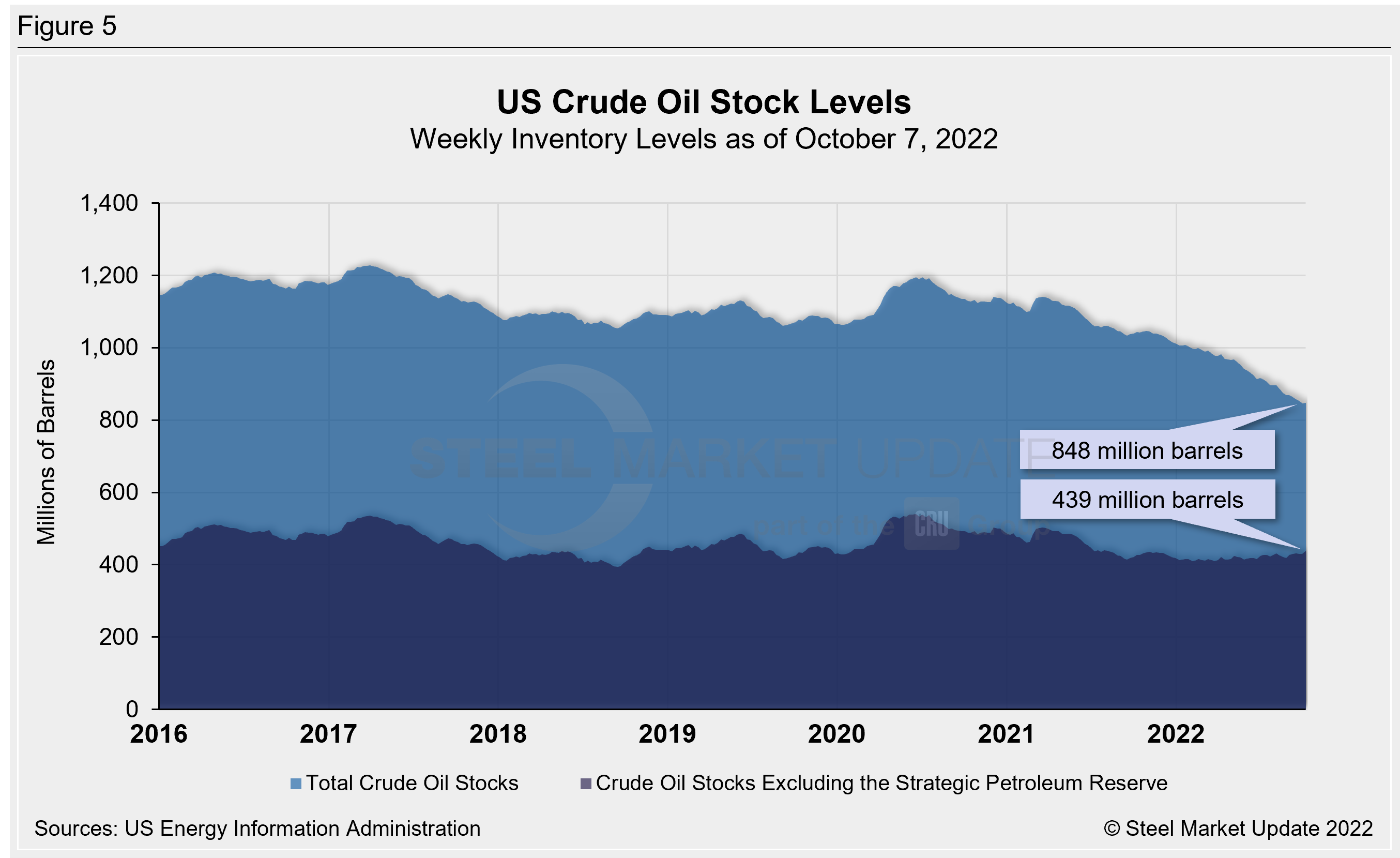

US total crude oil stocks continue to decline from mid-2020 highs, reaching a 20-year low of 846 million barrels the week of Sept. 30. Stock levels through last week were up slightly to 848 million barrels. For comparison, the record low in the EIA’s 40-year history was 608 million barrels in October 1982. Last week’s stock level is down 19% from 1.044 billion barrels one year ago (Figure 5).

Trends in energy prices and rig counts are an advanced indicator of demand for oil country tubular goods (OCTG), line pipe and other steel products.

By Brett Linton, Brett@SteelMarketUpdate.com