Prices

April 17, 2025

HR Futures: Market at crossroads after turbulent run

Written by Gaby Ain

After a volatile end to Q1, the hot-rolled (HR) coil futures market appears to be stabilizing, though not without notable shifts in positioning and pricing structure. The physical market continues to resist deeper downside moves, while futures attempt to recalibrate amid a dynamic macro and supply backdrop.

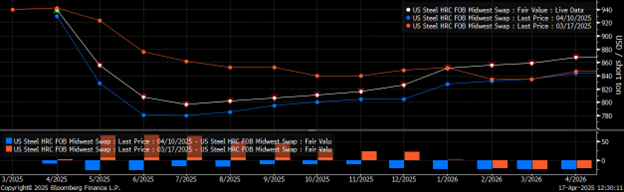

After the sharp correction into late March, the HR futures curve has shown signs of modest recovery. As illustrated in the chart below, the curve from one month ago (March 17, orange) and one week ago (April 10, blue) reflected a market under pressure. (Editor’s note: You can click on the charts below to expand them.)

However, the current curve (April 17, white) shows a moderate rebound — particularly in longer-dated contracts. While the curve still technically remains in backwardation, the back end has begun to slope upward.

This recent lift in Q4 2025–Q1 2026 pricing may signal that market participants still anticipate longer-term structural tightness in supply. Considering that logic, the widening spread between Q3 2025 and back months could suggest that near-term weakness may be more about sentiment recalibration than a full-fledged downturn.

CME Midwest HRC Futures Curve (4/17 in white, 4/10 in blue, 3/17 in orange)

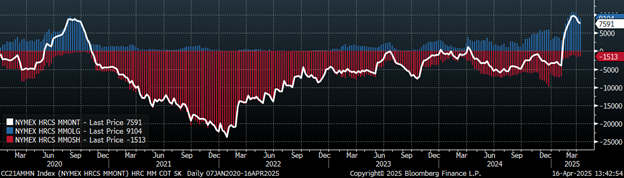

This can be seen through the step back in money-manager positioning in CME HRC futures. (See chart below.) Net length declined by 42k tons over the past three weeks. But short positions were left essentially unchanged – bringing the total net long to +125k tons. This signals that the recent pullback partially came from long liquidation, not from new bearish bets.

This behavior typically reflects profit-taking after a strong rally, a hedge against short-term uncertainty, or waning bullish conviction rather than a full reversal in outlook. In fact, net positioning remains elevated compared to much of the 2023–2024 period. That suggests managers still see potential for upside—but are preparing for near-term chop. With macro risks on the horizon (including election-linked tariff uncertainty), some trimming here seems tactical/precautionary measure.

Overall, gross shorts haven’t expanded—just gross longs have been pared back. That’s a subtle but important distinction. The market isn’t actively bearish, it’s simply catching its breath. However, the outstanding length from money managers represents a material risk to the downside – in particular should they pivot from their current bullish bets and choose to sell out of the remaining 125k of length.

CME HRC Money-Manager Positioning

The physical market has lost some momentum with lead times shortening. But mills could limit downside risk if they maintain discipline. Domestic raw steel production has not exceeded 1.7 million (m) net tons since September 2024. Recent weeks, however, have pushed close to that ceiling. Production reached 1.697m tons and 1.689m tons for the weeks ending on April 5 and April 12, respectively.

Imports have also softened. February census data showed the lowest level of total sheet imports since October 2023. Preliminary March and April estimates suggest further declines. March inventory data from SMU confirmed this tighter tone, with months on hand ticking lower.

This leaner supply setup offers a degree of downside protection. However, if demand indicators disappoint or if restocking falls short, the futures market may continue to act as a pressure valve.

The market appears to be pausing after a turbulent run. But tension remains just beneath the surface. With net long positioning still elevated, sentiment-driven selling could quickly reignite volatility. Still, supply constraints and limited imports are laying the groundwork for a resilient physical market. This moment of calm feels more like a crossroads than a conclusion.

Disclaimer

The content of this article is for informational purposes only. The views in this article do not represent financial services or advice. Any opinion expressed by Flack Global Metals or Flack Capital Markets should not be treated as a specific inducement to make a particular investment or follow a particular strategy, but only as an expression of his opinion. Views and forecasts expressed are as of date indicated, are subject to change without notice, may not come to be and do not represent a recommendation or offer of any particular security, strategy or investment. Strategies mentioned may not be suitable for you. You must make an independent decision regarding investments or strategies mentioned in this article. It is recommended you consider your own particular circumstances and seek the advice from a financial professional before taking action in financial markets.