Sheet

March 26, 2025

SMU Steel Demand Index momentum slows

Written by David Schollaert

Steel Market Update is pleased to share this Premium content with Executive members. Contact info@steelmarketupdate.com for information on how to upgrade to a Premium-level subscription.

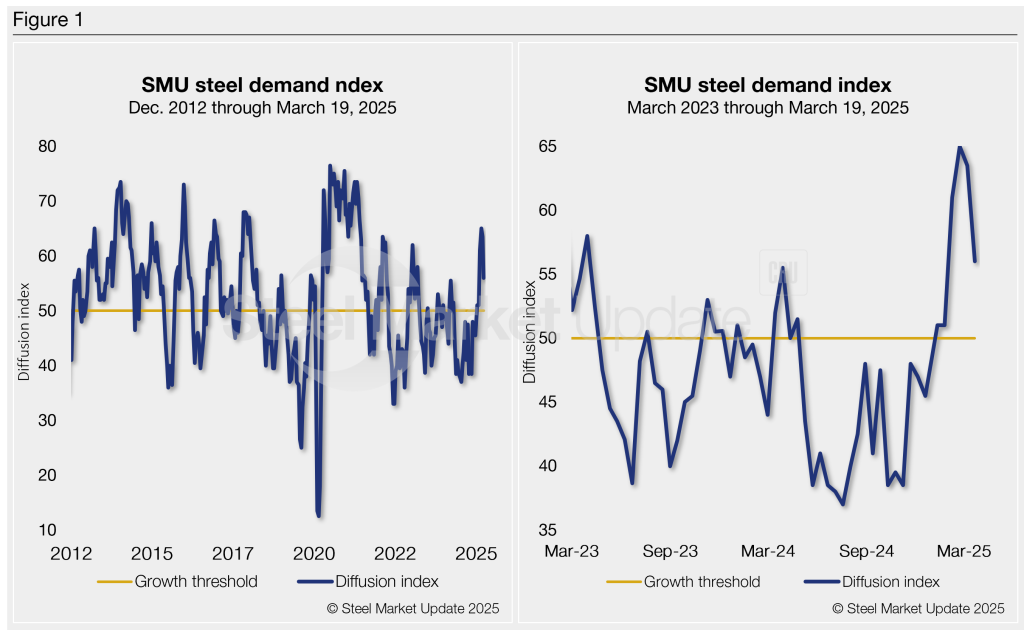

Growth in SMU’s Steel Demand Index eased in March after reaching a four-year high in late February. Despite a moderate gain, the index remains in expansion territory.

The Steel Demand Index, compiled from our weekly survey data, now stands at 56.0, down from 63.5 at the beginning of March and off from a four-year high of 65.0 in late February.

Momentum turned at the start of the year. An added bounce in February, likely backed by the threat of tariffs and higher mill prices, spilled over into March, padded by a frenzy of buying orders pulled forward.

But with a lot hanging in the balance ahead of April 2 – Trump’s self-proclaimed “Liberation Day” – demand momentum has eased some.

Methodology

Derived from the market surveys SMU conducts every two weeks, the index compares lead times and demand to create a diffusion index. This index has historically preceded lead times, which is notable given that lead times are often seen as a leading indicator of steel price moves. An index score above 50 indicates rising demand and a score below 50 suggests declining demand.

Figure 1 shows the nearly 13-year history of the index on the left and provides a closer look at the Steel Demand Index readings of the past two years on the right.

Some background

The flat-rolled market had some bright spots last year, but overall demand struggled, and prices ground lower, turning the index into contraction for the better part of 2024. Trend shifts came only on the backs of some short-lived impetus from mill price hikes.

But the index revealed there wasn’t much underlying demand for steady growth. And 2024 was marked by large-volume buyers finding discounted steel, most working through elevated inventories and weak end-market demand.

State of play

The arrival of a new administration and the renewed threat of tariffs ignited demand in late 2024, especially in Q1’25. Mills were unified in their pricing stance, and buyers were keen to get in ahead of the increases. Contract and spot buys were pulled forward, mills nearly stopped negotiating, and lead times moved out.

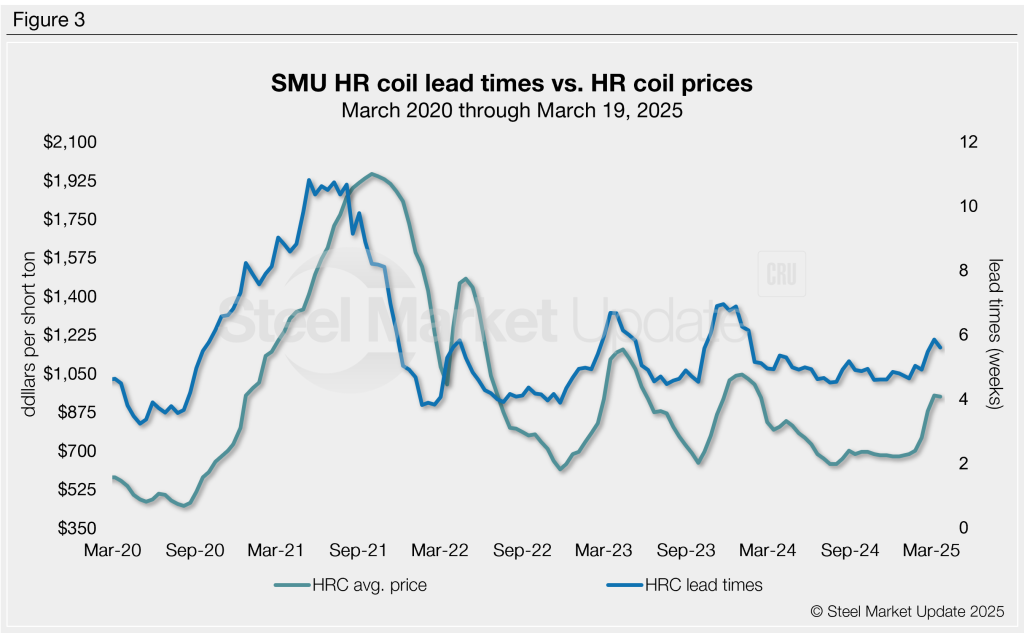

And hot-rolled (HR) coil prices responded, rising by nearly $300 per short ton (st) in just about nine weeks.

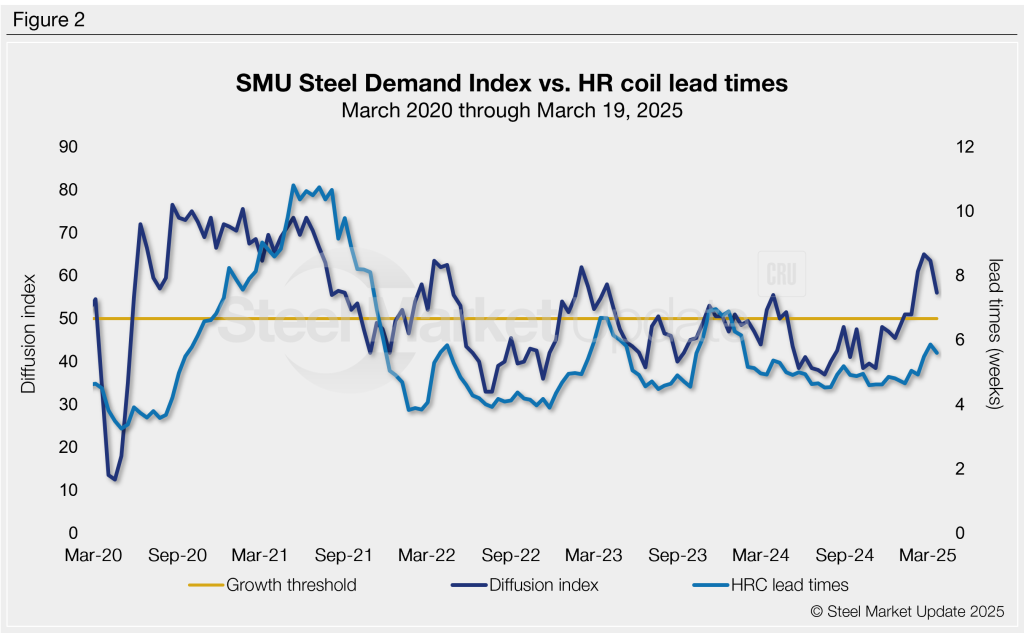

Lead times, which had been slipping and nearing 4.5 weeks, stretched out to nearly 6 weeks in early March. They have since tightened up a bit, edging down to 5.6 weeks on average in our latest assessment on March 19.

HR coil prices have seen a similar trend, reaching $950 per short ton (st) in early March, but have since ticked down on average to $945/st, according to SMU’s latest check of the market on Tuesday, March 25.

For nearly a decade, SMU’s steel demand diffusion index has preceded moves in mill lead times (Figure 2), and SMU’s lead times have also been a leading indicator of flat-rolled steel prices, particularly for HRC (Figure 3).

What to watch for

While demand is steady and still showing growth, the recent tariff-driven buying surge has slowed. Buyers seem more cautious, waiting on next week’s trade announcements.

But aside from the unknown of the latest political landscape shift, could some of the perceived curtailment in buying be a result of lead times now stretching into the slow summer months?

Time will tell if the uncertainty around tariffs has led to the apparent shift in buying, or if it’s driven largely by balanced inventories moving into the back half of H1. Nevertheless, we’ll know soon enough. Maybe as soon as next week.

Editor’s note

Demand, lead times, and prices are based on the average data from manufacturers and steel service centers participating in SMU’s market trends analysis surveys. Our demand and lead times do not predict prices but are leading indicators of overall market dynamics and potential pricing dynamics. Look to your mill rep for actual lead times and prices.