Market Segment

January 29, 2025

Lagging US market hits SSAB earnings

Written by Stephanie Ritenbaugh

A weaker market in the United States and Europe and maintenance dragged down fourth-quarter results for Swedish steelmaker SSAB.

Still, premium products helped bolster earnings.

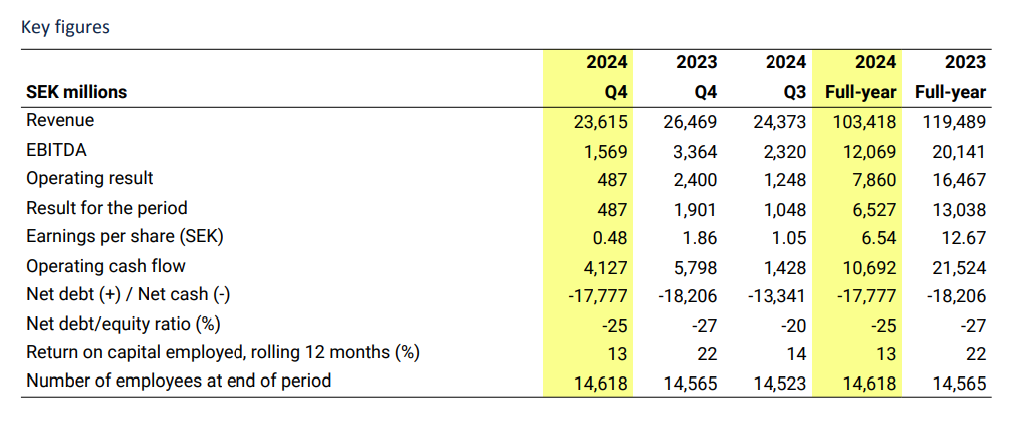

For Q4’24, SSAB reported an operating result of SEK 487 million ($44.25 million), or 0.48 per share, down from SEK 2.4 billion ($218 million), or 1.86 per share, last year.

“The markets in Europe and North America were generally weak, whereas SSAB’s high-strength steel and other premium products were more resilient,” SSAB President and CEO Johnny Sjostrom said.

He said that compared to a year earlier, prices in the US were significantly lower and the weak market in Europe impacted SSAB Special Steels and SSAB Europe.

Fourth-quarter revenue slipped by 11% year over year to SEK 23.6 billion ($214 million).

Here are some key figures the company disclosed in its report:

For the company’s Americas division, headquartered in Mobile, Ala., overall, Sjostrom said volumes are stable.

“The American market is very, very sensitive to supply and demand and prices can drop very, very fast, but it can also increase very, very fast,” he said on an earnings call on Wednesday.

“So now prices have been going down in United States for quite some time,” he continued. “And that also, of course, has a negative impact on our financial performance. And clearly, that’s the main reason why our Q4 was lower than it was in 2023.”

Looking ahead, SSAB said its order book is showing higher shipments in both special steels and Europe and the Americas.

Outlook on plate

Sjostrom said the plate market in the US had been soaring due to the Inflation Reduction Act (IRA), as well as some other infrastructure subsidies a couple of years before that.

Should tariffs be implemented for Canada, SSAB stands to benefit.

“We look at it if there are 25% import taxes to Canada, then Algoma will not be able to supply material into the United States. That’s going to have a big benefit for us. Then our price is going to go up very, very fast. The demand is going to go up very, very fast,” Sjostrom said.

“Even though there is some new capacity invested in the American market, they are still struggling,” Sjostrom noted. “And we are now trying to push up prices. I think that there is a likelihood that we were able to do this.

He added that the company is “quite optimistic that we’re going to get back on track in the USA market. Up to what level, that’s really hard to say because there are so many variables right now.”